Price Action Trading PDF Guide For Beginners

Price action trading is arguably the most traditional form of trading, especially for traders who make use of charts, as it involves the study of historical price movement and market behavioural patterns in predicting and speculating future price movement of the market instruments.

As talked about in my previous article, I was able to properly explain the basic concepts and guides involved in price action trading, which mostly involves the interpretation of price movement without the assistance or help of modern trading indicators. This, therefore, means that the trader must have a deep understanding of chart patterns, candlestick patterns, market trends, and support and resistance levels in relation to buying and selling pressure, as these are the basic concepts involved in price action trading.

Having a basic knowledge of these is also not enough to become a profitable price action trader, as you also need to know how to use these concepts mentioned above to create a very profitable price action trading strategy. Therefore, in this article, I will be showing you one of the most profitable price action trading strategies you will never regret knowing.

So, as I will always say, tuck yourself into your seat, grab a cup of coffee, and get your notepad as we embark on this enlightening journey. See you at the end of this article, and I hope by then, I will be getting your amazing feedback.

Price Action Trading Strategy Concepts

When you talk about price action trading, the following are some of the key concepts that every trader must master and understand to be able to make profitable trades using the price action strategy. Now, here is a list of the basic concepts:

- Candlestick Patterns

- Price/Chart Patterns

- Trends and Channels

- Support and Resistance Levels (Supply & Demand Levels)

- Risk Management (To improve profitability ratio)

The above trading concepts sum up all you need to know and apply as a price action trader. You can read my article on price action trading by following the link below to get a better understanding of these concepts.

Read Also: A Step-By-Step Guide to Price Action Trading For Beginners

Profitable Price Action Trading Strategy

I was able to become a profitable trader after mastering Price Action Trading, and In this article, I’m going to show you a three-step process that turned Price Action Trading from something so difficult and so complicated to something very easy and understandable for my readers.

So, what is price action trading strategy? Price Action Trading strategy is basically trading without any modern indicator but focusing on Price movement and patterns on the chart. It involves the usage of Price Action in finding profitable trade setups based on the price action concepts mentioned above. So, we use a combination of all these concepts or tools, as some might want to call it, to help us determine where to take a buy position and where to take a sell position.

Trading Price Action Strategy Using Three-Step Process

1st Step (Identify the Trend & Market Structure)

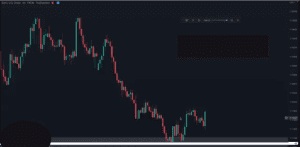

The first step in this price action trading strategy is identifying the trend and structure of the market. We will be using the AUDUSD in our first illustration.

Looking at the chart above, you can see that the price of AUDUSD is in a downtrend because Price is making your lower highs and lower lows. Now, one of my basic rules in trading is to never go against the trend, as it can be very costly.

Therefore, Since the Price is in a downtrend, we should only be looking to sell; it’s that simple because we always want to make sure that we trade with the trend rather than against the trend, as you never know when the Price is going to wipe you out if you trade against the trend.

After you have identified the trend, you also have to identify the structure. Now, from the chart above, we can draw a key level in the area circled red because that is the previous low in this downtrend, and if you look toward the left, you will discover it is also a support level. After that, the price broke through this little support level and came back up to retest this support level, as indicated in the chart above with the rectangular line.

So far, we have been able to identify the trend and also determine the structure of the AUDUSD market, which means our first step is complete. Let’s move on to our next step using the price action trading strategy.

See Also: Smart Money Concept Trading PDF

2nd Step (Prepare & Predict)

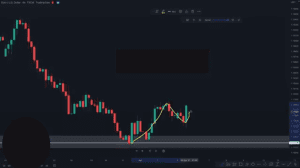

The second step of the price action trading strategy is to prepare and predict. Looking at the chart right now, we see that Price has come up to retest this previous key support level. But we cannot enter here yet as we don’t know whether we should go in for a buy or go for a sell because right now, Price can do two things: Price can continue going back down after it’s retested this level, or it can reverse and head back up.

In this case, which scenario do you think is much more possible? Which scenario has a higher probability of occurring? Obviously, we want to assume that the scenario where the Price retests the previous support zone and continues going down because right now, Price is in a very, very strong downtrend.

But even though that is true, we cannot enter the sell position right here yet because you need to wait for some sort of confirmation that tells you that Price is going to reverse and head back down and continue this downtrend. If you have read my previous articles, you will discover that I am a fan of confluences, that is, multiple strategies confirmations, as this gives you a lot more confidence in your trades.

Our confirmation could be in the form of some candlestick patterns or chart patterns, and right now, looking at the chart, Price has not shown us that yet. So we’ll continue waiting for some sort of sign that tells us to enter for a sale. This is why this stage is called prepare and predict because we are literally just preparing for the big move.

Okay, so now you can see that Price has come up to retest this key level right here officially, and you can see it formed a doji. For those of you who do not know what the doji is, the doji is this candlestick right there circled in the diagram above, and it basically means that the market is indecisive, which in turn means there is currently a struggle between the buyers and sellers, for who will dominate the market.

To explain this further, we can see from the chart above that the Price has been in a mini retracement, which means the buyers were trying to get the price back up. The doji, therefore appearing in a key level or zone, which is also highlighted in the diagram above with the long rectangular line, means the sellers or the bears, who are currently in control of the market since it is a downtrend market, have reacted strongly causing the market indecision.

It becomes very valid since it is also within the previous support zone that the bears have now turned into their own resistance level. So yeah, chances are when you see a doji at a key level like what is shown in the diagram above, that means that the market is about to reverse, and it’s about to change direction.

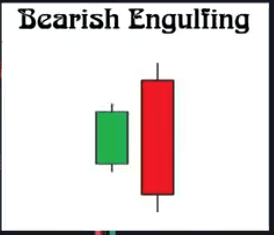

But we still cannot enter a sell position here yet because what we really want to see is some bearish engulfing candlestick, that is a big red candlestick that tells us that Price is actually rejecting this area, as the sellers are reacting strongly and it’s going to head back down. That is when we can confidently enter for the trade.

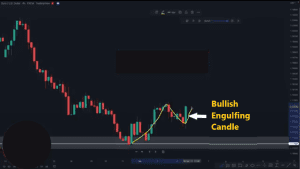

So we still need to wait. Now, what we have been waiting for has finally appeared. You see this big bearish engulfing candlestick in the diagram above, this big fat red candlestick at this key level. It is a clear signal to enter for a sell. You can decide to enter your sell position right now, but before that, we should know that we are currently in the four-hour time frame on the chart.

If we are to get our entry position for this trade, we would go to the 1-hour time frame. So, let us just go to the 1-hour time frame right now. Once you have gone down to the 1-hour time frame, you can clearly see from the above chart that Price has actually rejected this level not just one time but three times. Once here, second time here, and third time right here in the circled area of the above chart, making it a very solid key level.

The third time, Price failed to break past the key level and go back up like this, as you could see from the chart. That means what? That means the sellers/bears have held their positions strongly, and the buyers have been unable to push past the resistance that the sellers have set up. This level was tested three times, after which the buying pressure that was trying to grow was totally exhausted, resulting in the market collapse we saw on the 4-hour chart.

So right now, over here, we saw that Price gave us a bearish engulfing candlestick at this key level right in the circled area shown in the diagram above. That means Price is just rejecting this level, and this shows us that there is a lot of selling pressure that has accumulated over time. Looking at this big fat candlestick, big red candlestick in the chart above, it basically just tells us that there are a lot of sellers in these markets. So this is where we will enter a sell position right now, which basically brings us to the third step of the price action trading strategy.

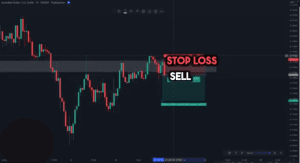

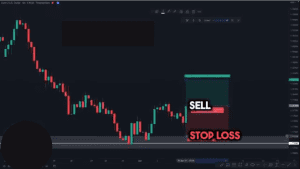

Step 3 (Enter the Trade)

Step three is to enter the trade. Take action, don’t hesitate, and enter the trade with confidence. We’ll enter for a sell position right here, and I’ll place my stop loss above this key level, as shown in the diagram above. The reason I placed my Stop Loss at the position I did was due to market structure rules. You guys must understand some market structure rules. If Price is going to reverse and break through the key level zone, it means Price is no longer going back down because there has been a change in the market structure.

It’s just going to go up and go back to the Moon. So, in that case, if you place your stop loss above the key level, you are limiting or reducing your loss. As you should know, we are not in control of the market; therefore, we can only speculate. So, if this trade does not go as planned, you only lose a tiny amount of money. You know what I’m saying?

Also, make sure that you don’t make your stop loss super tight, as shown in the above diagram because if you put your stop loss like that, the Price can easily go back up and retest this level one more time before collapsing or going towards the direction we have speculated.

But by then, you will definitely have been stopped out of the trade. If you place your Stop Loss very tight, you are just asking for it.

So the best thing to do is to give our Stop Loss a little bit of room. Just a little bit of breathing room because, again, if we look towards the left on the chart above, Price was all the way up here before it reversed. All the bit up here before it reversed. So, of course, we are going to give our stop loss a little bit of breathing room because the Price can easily come back up to retest this same exact area circled in the diagram above.

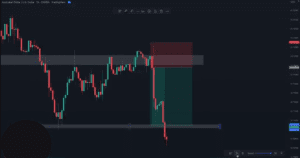

Next, we will place our take profit at the most recent low. So, where is the most recent low? If you look towards the left, remember, at the beginning, when we were trying to identify the trend and structure of this instrument, we identified the Lower highs and Lower lows on the 4-hour timeframe, so we just have to identify our lower low and lower high, lower low and lower high, on the 1-hour timeframe.

So looking at the above chart, we are able to identify the lower highs and lower lows. Also, we can see the new or most recent lower low. Now, we’ll place our take profit all the way down to the most recent lower low, as already illustrated in the chart above. If you don’t know where to place your take profit, always make sure you look towards the left. Once you look towards the left, look at where the price last stopped. That is where you place your take profit. You place it at a level where the price last stopped before retracing.

Let’s see how this trade plays out. We can see from the chart above we just smash our take profit. It is as simple as that.

Before we move on to the next trade, I want you to look at this chart above, and you can see Price literally formed this super long wick right here. So what does this mean? This means that at some point in time, buyers come into the market and push the Price all the way up to where the wick stopped in the chart above before the sellers start to come back in and push the Price all the way down.

So if you place your stop loss just like displayed in the above diagram, a few pips above the key level, placing it super tight like this, you will have gotten stopped out right there. And you will have lost the money and also the profit that was to be made, making it a double jeopardy. Seeing the trade go in your way, go in your plan. That is why you must learn how to place your stop loss properly. Make sure you always give it a little bit of breathing room.

See Also: How to Trade Like a Pro Using SMC Trading Strategy

You can download the price action trading pdf guide for beginners in pdf format by clicking any of the download buttons found in the article. This makes it easier for offline reading and proper study of the article.

.

.

Price Action Trading Strategy (Example 2)

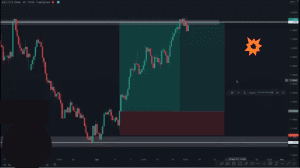

Here’s another example. Looking at the chart above, we can see right now that Price is at a major key level. Why did I mark up this key level?

I marked the key level because, if you look towards the left of the chart, right around this area here, Price always reverses when it’s around the area circled white on the chart above, which makes this area a very, very strong support area that Price has failed to break past multiple times.

So right now, looking at the above diagram, Price is at this exact area. Now using the price action trading strategy we used in the first illustration, what’s the first step?

Identifying the Trend

The first step is to identify the trend. So right now, as you can see in the chart above, the Price has been making lower highs and lower lows, lower highs and lower lows, which means that the Price has been in a downtrend once again. Also, right now, we are at a key support level, a very strong support level, because, as I already said, it has been tested three times, and there’s a very good chance that Price is going to reverse and hit back up as this is a very strong support level.

I want you to notice this also. One thing you can see right now is that the price has been making your lower highs and lower lows and lower highs and lower lows. Then where is the recent lower low? From the diagram above, you can see that there is no lower low.

Looking at the diagram above, Price actually reverses and comes back down and creates a new higher low rather than a lower low. If Price wanted to continue going down, here’s what you would do. Instead.

Looking at the diagram above, Price would have broken past the support level, come back up to retest the area represented with the white line, and then continued going back down like shown in the diagram to form your new lower low.

But that is not what Price did. Price actually reversed at the area shown on the diagram above and came back down to create your new higher low. You can see this new higher low is in a higher position than the previous lower low shown in the chart.

So, right now, this is the first sign that indicates a possible market reversal from a downtrend to an uptrend. We might therefore be looking for a buy right now. This brings us to the second step, as we have been able to identify the trend and also the market structure.

Remember what I said earlier in this article, trading against trends might be a lot riskier than following the trend. In this scenario, we very likely spotted a trend reversal, which is why I am willing to continue with the trade. Let’s move to the second step.

Prepare & Predict

Looking at the chart above, Price has created your new higher low right here. So that’s the first sign that tells us that Price is going to reverse.

The second sign is this bullish, engulfing candlestick right here. Look at this bullish engulfing candlestick. This tells us that there is a lot of buying pressure in the market and a lot of bias in the market because it’s literally a big fat green candlestick.

Enter the Trade

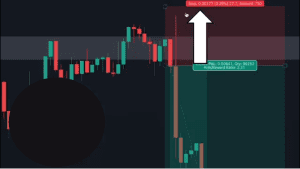

So we can enter for a buy position. We’ll place our stop loss a few pips below the last higher low. This is the last higher low shown in the above diagram. So, place it a few pips below the last higher low.

And for my take profit, let’s look towards the left side of the chart to see where the Price last stops. So if looking towards the left now, you can see that right at the area circled in the diagram above, there is actually a very strong resistance area right there because whenever Price goes up to that point, it always reverses. This is what makes it like a very strong resistance area. Therefore, we’ll place our take profit all the way up there at the resistance level. And you can see that it is a great risk-to-reward ratio. It is a ratio of 1:3.69, which means your profit is three times your loss.

One important risk management technique I would also like to mention is you should not take trades that have like one-to-one risk-to-reward ratio because that’s just not worth it. If the best take profit point is almost or equal to the distance of the Stop Loss point, making the risk-to-reward ratio almost equal, you might as well just wait for another better trade opportunity.

So it is advisable to not take the trade if it’s one is to one. I am always going to make sure there’s at least a three-to-one profit-to-loss ratio. So, for this particular trade, our risk-to-reward ratio is 1: 3.69. Now, let’s look at how this beautiful trade played out.

As you can see in the diagram above, Price goes up, creating a new higher low, and ultimately, It went up there and smashed our take profit. You can see that this was a very, very successful trade. This shows that the price action trading strategy is also very effective as long as we follow the steps.

See Also: 7 Candlestick Patterns Every Trader Should Know

Conclusion

From the above illustrations and examples, I have been able to simplify the price action trading strategy using a step-by-step approach and, at the same time, adopting most of the price action trading concepts into my price action strategy. So you can see that we didn’t make use of any modern indicator, and even the traditional indicators like the moving averages and RSI oscillator were not used in the price action strategy.

This is because I wanted to portray and explain the price action trading strategy in a very easy and less complicated manner so that even a forex beginner can easily understand the strategy. One other important concept that should not be overlooked when using the price action strategy is the use of risk management techniques. I talked about one of them and also applied it to my price action strategy. in this article, so in case you missed it, try to read through the article carefully again. It is related to the risk and reward ratio.

If you have gained value from this article, kindly drop a like and comment. If you have any questions regarding the price action trading strategy, you can drop them in the comment section. Kindly subscribe to this website to get updated each time I drop a new article on trading. See you in the next article.

You can download the price action trading pdf guide for beginners in pdf format for proper offline study and discover the secrets of a winning price action trading strategy. Learn to read market trends, make informed decisions, and maximize profits,

.

« Price Action Trading PDF Download »

We Hope you’ve learned a lot from this article!! We’re glad you did.

Join our telegram community to get up-to-date news, educational materials, free online classes, market analysis, and crypto futures trade signals that will help you grow and become profitable.