The metaverse is a rapidly growing and evolving space, with new opportunities emerging all the time.

As a result, it can be difficult to keep up with the latest developments and identify the most promising investment opportunities.

That’s where our guide to the 6 best metaverse ETFs comes in.

We’ve carefully curated this list to include ETFs that offer exposure to a wide range of metaverse-related companies and technologies.

The Metaverse

In the simplest terms possible, the metaverse is a combined virtual reality world. It’s all on a computer and it’s all virtual.

Neal Stephenson described the Metaverse as a shared, immersive virtual reality that people could enter through a computer or other device.

See Also: The Best NFT Development Companies Available in 2023

What are ETFs?

ETFs, or Exchange Traded Funds, are a type of investment fund that tracks an index of assets, such as stocks or commodities. ETFs are traded on an exchange like stocks, and they offer diversification and low costs.

ETFs are a relatively new investment product, but they have quickly become popular among investors. ETFs offer a number of advantages over traditional mutual funds, including diversification, low costs, tax efficiency, transparency, liquidity etc.

If you are looking for a low-cost, diversified, and tax-efficient way to invest, ETFs may be a good option for you.

The Top Metaverse ETFs

Here are the 6 best metaverse ETFs to invest in 2023: Ranked according to an extensive report assisted by JustETF.

- Franklin Metaverse UCITS ETF

- L&G Metaverse ESG Exclusions UCITS ETF USD Accumulating

- Roundhill Ball Metaverse UCITS ETF A USD

- iShares Metaverse UCITS ETF USD (Acc)

- HANetf ETC Group Global Metaverse UCITS ETF

- Fidelity Metaverse UCITS ETF ACC-USD

- Franklin Metaverse UCITS ETF –

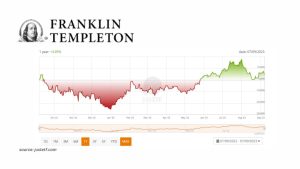

franklin templeton metaverse etf The Franklin Metaverse UCITS ETF is a passively managed exchange-traded fund that seeks to track the performance of the Solactive Metaverse Index.

The index is designed to measure the performance of companies that are involved in the development, production, or distribution of products or services related to the metaverse. The ETF has a total expense ratio of 0.30% and was listed on 6th September 2022 on the London Stock Exchange.

2023: +4.89% increase recorded

The top 10 holdings of this ETF make up 38.02% of its total assets, out of a total of 60 holdings. Here are the top 10 holdings and their respective weights within the ETF:

META PLATFORMS INC A: 4.69%

NVIDIA CORP: 4.61%

APPLE INC: 4.16%

BLOCK INC A: 4.10%

ALPHABET INC C: 3.68%

COINBASE GLOBAL INC: 3.66%

PAYPAL HLDGS. INC: 3.53%

ELECTRONIC ARTS: 3.20%

STMICROELECTRONICS NV: 3.20%

QUALCOMM ORD: 3.19%

- L&G Metaverse ESG Exclusions UCITS ETF USD Accumulating –

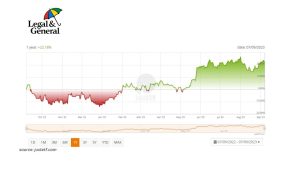

legal and general metaverse etf L&G Metaverse ESG Exclusions UCITS ETF USD Accumulating is an exchange-traded fund that tracks the performance of the Solactive Metaverse ESG Screened Index. The index is designed to provide exposure to companies that are involved in the development and operation of the metaverse, while also excluding companies that are involved in activities that are considered to be harmful to the environment, society, or governance.

The fund is accumulating, which means that dividends are reinvested in the fund, rather than being paid out to shareholders.

It is specially designed for investors who are looking for exposure to the metaverse while also wanting to invest in companies that have a positive environmental, social, and governance (ESG) profile. The fund is relatively new, having been launched in January 2023, but it has already attracted a significant amount of assets under management.

The Metaverse ETF fund also has a number of risks associated with it, including the risk of the metaverse not being as successful as expected, the risk of the fund’s underlying index not being representative of the metaverse sector, and the risk of the fund’s expenses being high.

2023: 22.18% recordedThe L&G Metaverse ESG Exclusion ETF comprises a diversified portfolio of assets, with its top 10 holdings collectively accounting for 54.69% of its total assets. Here are the top 10 holdings within the ETF and their respective weightings:

NVIDIA CORP: 8.41%

META PLATFORMS INC A: 7.22%

BROADCOM LIMITED ORD: 6.07%

ADOBE INC: 5.82%

ADVANCED MICRO DEVICES INC: 5.51%

MICROSOFT CORP: 5.09%

SAMSUNG ELECTR ORD: 4.40%

QUALCOMM ORD: 4.07%

MICRON TECHNOLOGY INC: 4.06%

TWN SEMICONT MAN ORD: 4.04%

- Roundhill Ball Metaverse UCITS ETF A USD

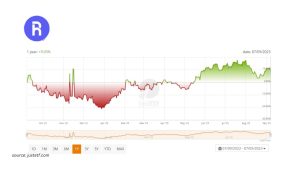

roundhillball metaverse etf The Roundhill ball metaverse ETF is a system developed by Roundhill Investments to check and track the equities and performance of companies and firms that engage in the metaverse. These ETFs allow investors to gain exposure to a diversified portfolio of metaverse companies, reducing the risk associated with individual stock picking.

The ETF tracks the Roundhill Ball Metaverse Index, which is composed of companies from a variety of industries, including technology, gaming, and retail.

The ETF is a passively managed fund, which means that it does not try to beat the market. Instead, it simply tracks the performance of the index. This makes it a good option for investors who are looking for a low-cost way to gain exposure to the metaverse.

Here are the top 10 holdings within the Roundhill Ball Metaverse ETF and their respective weightings:

NVIDIA CORPORATION NVDA (9.40%)

APPLE INC AAPL (8.57%)

META PLATFORMS INC META (6.80%)

ROBLOX CORP RBLX (6.37%)

MICROSOFT CORP MSFT (4.59%)

QUALCOMM INC QCOM (3.52%)

TENCENT HLDGS LTD 700 HK (3.49%)

SONY GROUP CORPORA 6758 JP (3.34%)

ALPHABET INC GOOGL (3.29%)

AMAZON COM INC AMZN (3.28%)

2023: +9.03

See also: The Roundhill Ball Metaverse ETF and How You Can Invest in it

- iShares Metaverse UCITS ETF USD (Acc)

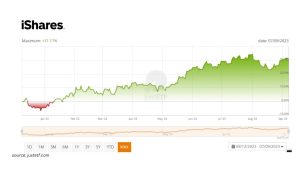

iShares metaverse etf The iShares Metaverse UCITS ETF USD (Acc) is a metaverse ETF that tracks the performance of the MSCI Global Metaverse Index.

It aims to mirror the performance of the STOXX Global Metaverse index.

Notably, the stocks included in this index are subject to screening based on ESG criteria, which assesses their adherence to environmental, social, and corporate governance standards. The iShares Metaverse UCITS ETF USD (Acc) is relatively small in size, with assets under management totaling 18 million Euros.

This ETF made its debut on December 7, 2022, and is domiciled in Ireland.

Here are the top 10 holdings of the iShares Metaverse ETF:

NVIDIA CORP: 8.75%

META PLATFORMS INC A: 7.72%ACTIVISION BLIZZARD INC: 6.20%

LOWE’S COMPANIES INC: 6.05%

AUTODESK INC: 4.67%

ELECTRONIC ARTS: 4.26%

ADOBE INC: 3.90%

TAKE-TWO INTERACTIVE SOFTWARE INC: 3.88%

INTEL CORP: 3.57%

ROBLOX CL A ORD: 3.45%

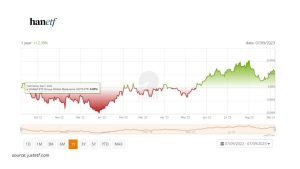

- HANetf ETC Group Global Metaverse UCITS ETF

The HANetf ETC Group Global Metaverse UCITS ETF is an exchange-traded fund that tracks the Solactive ETC Group Global Metaverse index.The ETF has a TER (total expense ratio) of 0.65% p.a. and is domiciled in Ireland. It was launched on 15 March 2022 and has 7m Euro assets under management. It is a very small ETF with a relatively high expense ratio. It is also a relatively new ETF, so it is not yet clear how it will perform over the long term.Here are the top 10 holdings:

The HANetf ETC Group Global Metaverse UCITS ETF is an exchange-traded fund that tracks the Solactive ETC Group Global Metaverse index.The ETF has a TER (total expense ratio) of 0.65% p.a. and is domiciled in Ireland. It was launched on 15 March 2022 and has 7m Euro assets under management. It is a very small ETF with a relatively high expense ratio. It is also a relatively new ETF, so it is not yet clear how it will perform over the long term.Here are the top 10 holdings:

- NVIDIA CORP: 6.22%

- UNITY SOFTWARE ORD SHS: 5.87%

- META PLATFORMS INC A: 5.17%

- SNAP INC: 5.02%

- QUALCOMM ORD: 4.81%

- APPLE INC: 4.29%

- ROBLOX CL A ORD: 3.78%

- COINBASE GLOBAL INC: 2.18%

- ADOBE INC: 2.04%

- ROBINHOOD MARKETS INC: 1.86%

- Fidelity Metaverse UCITS ETF ACC-USD

fidelity metaverse ETF The Fidelity Metaverse UCITS ETF ACC-USD is an exchange-traded fund that seeks to track the performance of the Fidelity Metaverse ESG Tilted index.

The stocks included in the index are filtered according to ESG criteria, which means that they must meet certain standards in terms of environmental, social, and corporate governance.

The ETF’s TER (total expense ratio) is 0.50% per annum. This means that for every €100 invested in the ETF, the investor will pay €0.50 in fees each year.The Fidelity Metaverse UCITS ETF ACC-USD is the only ETF that tracks the Fidelity Metaverse ESG Tilted index.

It replicates the performance of the underlying index by full replication, which means that it buys all of the stocks in the index.The ETF was launched on 24 August 2022 and is domiciled in Ireland and regulated by the Irish Financial Services Regulatory Authority (IFSRA).

Here are the top 10 holdings in the Fidelity Metaverse ETF:

- ADOBE INC: 5.25%

- NVIDIA CORP: 4.98%

- ALPHABET INC A: 4.39%

- SAMSUNG ELECTR ORD: 4.17%

- NETEASE INC ORD: 3.84%

- DIGITAL REALTY REIT: 3.57%

- ELECTRONIC ARTS: 3.40%

- NINTENDO CO LTD: 3.30%

- NAVER CORP: 3.12%

- SUPER MICRO COMPUTER ORD: 3.11%

How To Invest in Metaverse ETFs

- Open a brokerage account that offers Metaverse ETFs. You can open an account with a traditional brokerage firm or an online brokerage firm.

- Fund your account with the amount you want to invest. You can fund your account with a deposit from your bank account or by transferring money from another brokerage account.

- Choose a Metaverse ETF to invest in. There are a number of Metaverse ETFs available, so you’ll need to do some research to find one that’s right for you.

- Place your order and buy shares of the ETF. You can place your order online or by calling your brokerage firm.

- Hold your shares for the long term and wait for them to appreciate in value. Metaverse ETFs are a long-term investment, so you should be prepared to hold your shares for several years.