Have you ever thought about investing in something that will be big before it becomes popular?

Just like the early days of the internet, the Metaverse is a new technology that has the potential to be very successful. Some experts have also predicted that the Metaverse could be worth hundreds of billions of dollars by the end of 2024.

The Metaverse is a virtual world where people can connect with each other, play games, and do other activities. It’s still being developed, but it has the potential to change the way we live and work.

The Betashares Metaverse ETF is one way to invest in the Metaverse. It’s a fund that owns shares in companies that are working on the Metaverse. If you invest in the ETF, you’ll own a small piece of all of these companies.

Investing in the Metaverse is a risky move, but it could also be very rewarding. If you’re interested in investing in the future, the Metaverse is a good place to start.

About Betashares

Betashares is an Australian-based investment company that offers a wide range of exchange-traded funds (ETFs). The company was founded in 2009 and has since grown to become one of the largest ETF providers in Australia.

Betashares offers ETFs that track a variety of asset classes, including equities, fixed income, and commodities. The company also offers a number of thematic ETFs, which focus on specific sectors or trends.

Betashares is committed to providing investors with low-cost, transparent, and easy-to-access investment products.

The company’s ETFs are listed on the Australian Securities Exchange (ASX) and are available to investors through a variety of brokers and financial institutions.

As of June 2023, Betashares has over $150 billion in assets under management. The company serves thousands of advisers and over 900,000 investors

Concept Of Metaverse ETFs

To understand the concept of Metaverse ETFs, we must first divide it into two words – Metaverse and ETFs.

Metaverse ETFs are a type of exchange-traded fund that tracks the performance of companies involved in the metaverse. They offer investors a way to gain exposure to the metaverse without having to invest in individual companies.

Furthermore, the metaverse can be defined as a virtual world that is completely immersive and uses virtual reality and augmented reality headsets.

There are several benefits to investing in ETFs.

First, ETFs offer diversification, which means that investors are not putting all of their eggs in one basket.

Secondly, ETFs are relatively low-cost, which makes them a good option for investors who are looking to save money on fees. ETFs typically have expense ratios of less than 0.50%, which is much lower than the expense ratios of mutual funds, which can be as high as 2%. This means that ETFs can save investors a lot of money over time.

Third, ETFs are easy to trade, which makes them a good option for investors who want to be able to buy and sell shares quickly and easily. They can be traded easily just like stocks, and be sold through online brokers.

Some of the most popular ETFs that are being traded right now include:

- The S&P 500 ETF (SPY)

- The Nasdaq 100 ETF (QQQ)

- XLP Consumer Staples SelecT (SPDR) fund and,

- The Vanguard Total Stock Market (VTI)

For the sake of this blog post, we’ll only be digging into the Betashares Metaverse ETF, price chart and other details.

Betashares Metaverse ETF

The Betashares Metaverse ETF is an exchange-traded fund that invests in companies involved in the development of the metaverse. It was launched in late November of 2021 and is listed on the Australia Securities Exchange.

The ETF’s underlying index is the Bloomberg Metaverse Select Index, which tracks the performance of companies that are involved in the development of the metaverse, including companies that develop virtual reality (VR) and augmented reality (AR) technologies, as well as companies that develop blockchain-based applications for the metaverse.

Other performances that are being tracked include:

- 3D Modelling: companies that create the computer graphics that users will see in the Metaverse.

- Artificial Intelligence (AI) Servers: companies that offer AI services needed to enhance experiences in the Metaverse.

- Advertising Revenue: companies that sell advertising located in the Metaverse.

- Blockchain: companies involved in digital currencies and other digital assets used or located in the Metaverse.

- Infrastructure-as-a-Service: companies that build and own important infrastructure required to enable the operation of the Metaverse.

- Live Entertainment and Licensing

- Token-Based Gaming: companies that create games, or digital assets designed to be used inside games.

- VR/AR Hardware: companies that design or manufacture the hardware that enables users to ‘plug in’ to the Metaverse.

Price Chart of Betashares Metaverse ETF

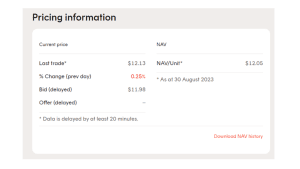

The ETF’s price chart is shown below.

As of 30 August 2023, the price chart is as follows:

As you can see, the ETF’s price has been on a steady upward trend since its launch. This is likely due to the growing interest in the metaverse, as well as the increasing number of companies that are investing in the development of the metaverse

Betashares Metaverse ETF Holdings

These are the top 10 holdings of the Metaverse ETF offered by Betashares:

* As at 31 August 2023. Excludes cash

Name Weight (%)

NVIDIA CORP 8.4%

META PLATFORMS INC 6.2%

ADOBE INC 5.3%

NETEASE INC 4.3%

AMAZON.COM INC 4.1%

AUTODESK INC 3.9%

ALPHABET INC 3.9%

APPLE INC 3.8%

MICROSOFT CORP 3.6%

QUALCOMM INC 3.5%

These companies are all leaders in the development of the metaverse, VR, and AR. The ETF provides investors with exposure to this rapidly growing sector of the economy.

How To Invest in Betashares Metaverse ETF

You can buy or sell units just like any share on the ASX (Australian Security Exchange).

Also, trading ETFs is the same as trading shares. To invest in Betashares Metaverse ETF, follow these steps accordingly.

Fund requires no minimum investment.

- Choose a Broker:

To begin trading Betashares Metaverse ETF, you need to have an account with a brokerage firm that offers access to ASX (Australian Securities Exchange) where the ETF is listed.

- Research and Analysis:

Before making any trade, conduct thorough research on the Betashares Metaverse ETF and the Metaverse sector as a whole. Understand its holdings, performance history, and the underlying companies it represents.

- Place an Order:

Orders for buying and selling Betashares Metaverse ETF are placed during ASX trading hours through your broker. You can use market orders or limit orders, depending on your strategy.

- Pay Brokerage:

Keep in mind that you will incur brokerage fees when buying or selling Betashares Metaverse ETF, similar to trading ordinary shares. Ensure you are aware of the brokerage costs associated with your chosen broker.

- Confirmation with Statement:

Once the trade is executed, your broker will provide you with a confirmation note detailing the transaction. You will also receive a CHESS holding statement, similar to what you receive when trading ordinary shares.

Please note that there are fees associated with trading ETFs, so be sure to factor these into your investment decision.

Other Considerations

Other Factors to be considered when trading metaverse ETFs include, but are not exclusive to:

Market Maker Arrangements

It’s important to be aware of the role of market makers in ETF trading. Market makers are professional traders who provide liquidity by quoting buy and sell prices for the ETF throughout the trading day. They help ensure that ETF prices closely align with the underlying asset values.

ETF Price Information

Prices and other relevant information for Betashares Metaverse ETF can be found on the ASX website or your broker’s platform.

Net Asset Value (NAV) and iNAV

The NAV (Net Asset Value) represents the value of the ETF’s assets minus liabilities. It’s a crucial reference point to consider before buying or selling ETF units.

iNAV (Indicative Net Asset Value) is an estimate of the ETF’s intraday value based on underlying net asset values. It helps investors assess whether they are trading at or close to the NAV per unit.

Advanced Charting Tool

To make informed trading decisions, you can use advanced charting tools such as those provided by your broker. These tools allow you to perform technical analysis, create custom charts, and use various indicators for analysis.

Examples include esignal, stockcharts, Metastock, etc.

Other Metaverse ETFs To Invest In

- Roundhill Ball Metaverse (METV)

- ProShares Metaverse ETF (VERS)

- Fount Metaverse ETF (MTVR)

See also: The Roundhill Ball Metaverse ETF and How You Can Invest in it

Summary

Although some analysts have classified the Betashares Metaverse ETF to just be another fancy NASDAQ with a .69 per annum fee on the top, it will be useful to note that the ETF is only designed to track the performance of companies involved in the development and operation of the metaverse.

This means that investors who buy shares in the ETF are basically betting on the success of the metaverse.

If the metaverse indeed becomes a success, then the ETF could be a very lucrative investment. However, if the metaverse fails to live up to its hype, then the ETF could lose a lot of money.