Web3 is the latest buzzword in the world of technology and finance, and it represents a new era in the evolution of the internet.

With its promise of decentralization and transparency, Web3 is poised to disrupt many industries and change the way we live our lives.

In this context, investors are looking for the best Web3 stocks to capitalize on this emerging trend.

In this article, we will explore some of the best Web3 stocks that investors should be paying attention to in order to take advantage of this exciting market opportunity.

The Web3 ecosystem includes decentralized applications (dApps), non-fungible tokens (NFTs), decentralized finance (DeFi) platforms, and more.

These technologies are disrupting traditional industries such as finance, healthcare, and gaming, and creating new opportunities for investors.

Investing in Web3 stocks can be challenging as this market is still in its early stages. However, some companies are leading the way in this field and have the potential for significant growth.

Some of the areas of focus for Web3 companies include providing infrastructure for decentralized systems, developing dApps and games, and creating decentralized finance platforms.

Investors can also consider investing in companies that are not exclusively focused on Web3 but have exposure to this market through strategic investments or partnerships with Web3 startups.

It’s important to note that like any investment, investing in Web3 stocks comes with risks. Investors should conduct proper due diligence and consult with a licensed financial advisor before making any investment decisions.

See also: What Is Web3 (Web 3.0) and How Can One Invest in it?

Why Web3 Companies are Poised for Growth in a Digital World

One of the major advantages of Web3 companies is Decentralization.

This means that their systems are not centralized and therefore have fewer limitations in terms of security, transparency, and privacy.

Decentralized systems built on blockchain technology offer a higher level of security, immutability, transparency, and privacy, which makes them attractive to users who want more control over their data and privacy.

Another factor contributing to the growth of Web3 companies is the increasing adoption of blockchain technology.

As more businesses and individuals learn about the benefits of blockchain, they are more likely to seek out Web3 solutions for their needs. This increased demand will drive the growth of Web3 companies in the coming years.

Smart contracts are another factor that makes Web3 companies more attractive to users. These self-executing contracts with terms of agreement written into lines of code allow for the automation of processes and reduce the need for intermediaries.

It also makes it easier for Web3 companies to build and run decentralized applications that offer more automated and efficient processes.

The next factor is Tokenization.

Tokenization is also a significant trend that is driving the growth of Web3 companies. Tokenization involves issuing and trading digital tokens that represent assets or rights.

This process enables businesses and individuals to monetize their assets and create new marketplaces. Web3 companies that use tokens are positioned to benefit from this trend because tokens have the potential to increase in value over time.

See Also: How To Start Investing in Web3 in 2023

From Blockchain to Metaverse: Top Web3 Stocks to Watch

Facebook(FB)

Facebook is working on a metaverse project, which aims to create a fully immersive virtual world where users can interact with each other in real time.

The project is still in its early stages, but it could have significant implications for the future of the Internet.

Facebook has been investing heavily in the web3 and metaverse space in recent years, with CEO Mark Zuckerberg stating that he sees the metaverse as the next generation of the internet.

Last year, in October 2021, the company announced its name change to Meta, indicating its focus on the metaverse. Meta plans to invest $10 billion over the next few years to develop the metaverse, where people can interact and engage in a range of activities.

Meta has also acquired several companies in the space, including virtual reality headset maker Oculus and blockchain-based startup Chainspace. The company has also launched an NFT platform called MetaVerse, which allows users to create, buy, and sell NFTs.

Meta has been building its own virtual world called Horizon Workrooms, which allows remote teams to collaborate in a virtual office space. The company has also launched a beta version of Horizon Workrooms for Oculus Quest 2 users.

In addition to its own developments, Meta has been working with partners to develop the metaverse.

The company has partnered with several game developers, including Ubisoft and Roblox, to create metaverse experiences. Meta has also partnered with several universities to develop educational experiences in the metaverse.

See also: What Happened to the Mark Zuckerberg Metaverse?

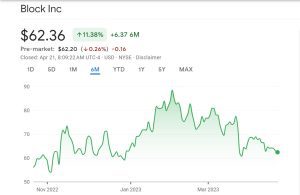

Block Inc.

Block is a payment processing company that allows merchants to accept credit card payments. It has also invested heavily in Bitcoin, and its Cash App allows users to buy and sell Bitcoin.

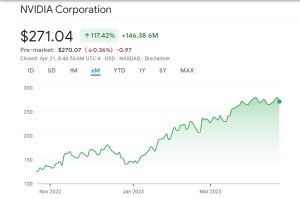

Nvidia (NVDA)

Nvidia is a semiconductor company that produces GPUs used in gaming and cryptocurrency mining. Its GPUs are used to power blockchain networks and process cryptocurrency transactions.

Nvidia has been developing graphically-intensive processing units (GPUs) that are necessary for running blockchain networks and decentralized applications (dApps), which are key components of the web3 ecosystem.

It has also been partnering with blockchain companies and startups to provide hardware and software solutions for the decentralized web.

They are a market leader in the semiconductor industry, providing high-performance processing units for a wide range of applications, including gaming, data centers, artificial intelligence, and autonomous vehicles.

Nvidia has built a strong competitive advantage through its cutting-edge technology, industry partnerships, and innovative product development. This could help it maintain its leadership position and sustain growth in the long term.

And as with any investment, there are risks involved in buying Nvidia stocks, including its dependence on the gaming industry, exposure to global macroeconomic conditions, and potential competition from other semiconductor companies.

Microsoft (MSFT)

Microsoft has been investing in blockchain technology and has launched several blockchain-related products, including Azure Blockchain Service, which allows companies to build blockchain applications on the Microsoft Azure cloud platform.

Microsoft is one of the technology giants that has been investing in the Web3 and metaverse space in various ways.

Microsoft has partnered with OpenSea, the largest NFT marketplace, to enable the discovery and trading of NFTs directly within the Microsoft Teams collaboration platform.

They’ve also been investing in Virtual Reality Technologies such as HoloLens and Windows Mixed Reality technologies.

It is important to do your own research, understand your investment goals, and consult with a financial advisor before making any investment decisions. Consider factors such as your risk tolerance, investment horizon, and financial situation before investing in any stock, especially Microsoft.

How to Diversify Your Portfolio with Web3 Stocks

Diversifying your portfolio with web3 stocks can be a great way to expose yourself to the potential of blockchain and cryptocurrency technology while also minimizing risk. Here are a few ways to diversify your portfolio with web3 stocks:

- Invest in a mix of companies: Don’t just focus on one type of web3 stock – spread your investments across a few different companies. This might include cryptocurrency exchanges, blockchain technology providers, or companies focused on creating virtual worlds or metaverses.

- Consider market capitalization: When selecting web3 stocks, consider the market capitalization of the company. Smaller companies may be more volatile, while larger companies may be more stable but may also have less growth potential.

- Look at financials and management: Like with any investment, it’s important to evaluate a company’s financials and management. Look at revenue growth, profitability, and debt levels, as well as the track record of the company’s management team.

- Monitor industry trends: Stay up to date on industry trends and news related to web3 stocks. This will help you make informed decisions about your investments and adjust your portfolio as needed.

- Consider a diversified fund: Another option is to invest in an exchange-traded fund (ETF) or a mutual fund that focuses on web3 stocks. This can offer exposure to a variety of companies within the space and help you diversify your portfolio without having to select individual stocks.

Overall, diversifying your portfolio with web3 stocks can be a great way to take advantage of the potential of blockchain and cryptocurrency technology while also minimizing risk.

Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

See also: The Roundhill Ball Metaverse ETF and How You Can Invest in it

The Investing Trend You Can’t Ignore

Different companies involved in the decentralization of the internet have already started to gain traction in the market, with several companies such as Coinbase, Chainlink, and Polkadot leading the way.

These companies are at the forefront of the revolution, with their innovative technologies and effective adoption strategies.

Investing in such companies is therefore an excellent opportunity for investors looking to tap into the potential of the promising web3 ecosystem.

Web3 stocks offer several benefits to investors, such as high returns on investment, diversification, and long-term growth prospect since it is already considered one of the most significant technological advancements of the 21st century, and early investors stand to reap the benefits of the ongoing web3 revolution.

See also: How To Make Money With Web3 in 2023

Investing in the Future

In 2021, the market cap of the cryptocurrency market reached over USD 2 trillion for the first time, indicating a significant increase in demand for blockchain-based solutions and cryptocurrencies.

This market cap includes both established cryptocurrencies such as Bitcoin and Ethereum, as well as newer tokens associated with web3 projects.

Web3 stocks have gained a lot of interest from investors due to the significant benefits they offer.

Here are some of the reasons why you should start investing in the future with web3 stocks:

- High Growth Potential: Since this new technology is still in its early stages, the potential for growth is enormous. As more companies and individuals adopt blockchain technology, the demand for web3 services will continue to increase, leading to higher stock prices for the companies.

- Disruptive Potential: Web3 technology has the potential to disrupt several industries, including finance, healthcare, supply chain, and more. Investors who identify the right web3 stocks can benefit from investments in companies that are disrupting entire industries.

- Trustless Systems: Blockchain technology used in web3 systems allows for transparent and trustless operations, reducing the risk of fraud, corruption, and other unethical practices. This added layer of security can provide you as an investor/shareholder with confidence in your investments.

- Long-term Growth: Web3 technology is still in the early stages of development, and the potential for growth in the coming years is enormous by investing in web3 stocks, investors can benefit from long-term growth prospects.

See also: How to Invest in Web3: Navigating Success in the Evolving Landscape

Why Web3 Stocks Should be Part of Your Long-Term Investment Strategy

Here are some reasons why web3 stocks of the decentralized internet should be part of your long-term investment strategy:

- Web3 technologies are expected to revolutionize the way we use the internet and interact with each other online. This global shift towards decentralized systems and blockchain-based solutions is predicted to create new business models, disrupt traditional industries, and provide opportunities for innovation.

- Investing in Web3 stocks can offer exposure to a diverse range of companies and projects that are at the forefront of this technological transformation. These may include blockchain infrastructure providers, decentralized finance (DeFi) protocols, social networks, gaming platforms, and more.

- Web3 stocks have the potential for high growth and returns, as the market for these technologies continues to expand. For example, the global blockchain market size is expected to grow from $3 billion in 2020 to $94 billion by 2027, according to MarketsandMarkets.

- Some Web3 stocks may offer investors exposure to cryptocurrency as well, which has shown to have high returns in the past. Though it’s important to note that cryptocurrency investments come with high volatility and risk.

- Including Web3 stocks in a diversified investment portfolio can help reduce risk and increase potential returns by offsetting losses in other sectors or asset classes.