Spread, Pip, Lot size, and Leverage in Forex Trading

Spreads, Pips, Lot size, and leverage are important terms in forex trading that every beginner forex trader needs to know and understand in other to navigate the Forex market properly and profitably. In this article, we would be giving explaining these terms.

Meaning of Leverage in Forex Trading

Leverage In forex trading is using a smaller deposit to control a much larger total contract value. In layman’s terms, leverage gives forex traders who have very little capital the ability to navigate the forex market by helping them supplement their initial capital through Leverage provided by the broker. Leverage gives the trader the ability to make nice profits, and at the same time keep risk capital to a minimum.

For example, a forex broker may offer 50-to-1 leverage, which means that a $50 dollar margin deposit would enable a trader to buy or sell $2,500 worth of currencies. Similarly, with $500 dollars, one could trade with $25,000 dollars, and so on. While this is all gravy, let’s remember that leverage is a double-edged sword. Without proper risk management, this high degree of leverage can lead to large losses as well as gains.

Leverage is an investment strategy of using borrowed funds from the broker to increase the potential returns of an investment. Leverage allows you to enter a position or trade that is larger than your capital. Leverage in Forex can be in the forms 1:100 1:200 1:300 1:400 1:500, and 1:1000.

The trader’s forex account is established to allow trading on margin or borrowed funds. Brokers regulate or limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire. However, the broker will require a percentage of the trade’s notional amount to be held in the account as cash, which is called the initial margin. Looking at the initial margin, this is the amount of cash or collateral a trader must have in his/her account before they are able to enter into a trade while borrowing funds from the broker which as explained already is called leverage.

Another question that may be in your mind right now is, why is there a need to borrow cash funds from a forex broker? Now to explain this, the forex is arguably the largest financial market in the world and also the most liquid as it tends to see transactions of over 5 trillion dollars on a daily basis.

Therefore, participating in the forex market traditionally is highly expensive as an independent trader would need a large amount of cash fund or capital before they are able to take effective trades or positions in the market and we are talking about thousands to tens of thousands of dollars which is largely not affordable for most beginner traders.

Therefore, the need for leverage to provide cash support for traders to enable them to trade with whatever little amount they have. This leverage is always given by the forex broker to the forex trader and the amount of leverage a trader can get also varies from each broker.

For instance, if a broker gives a trader leverage of 1:100 and the trader has a personal cash fund of $100, it means although the original cash deposited into his broker trading account is still at $100, he has the ability to take trades in markets which would need a financial commitment of $10,000.

As his cash funds would be multiplied a hundred times i.e., 100x making him have a trading power of $100 X 100 (leverage) = $10,000. Therefore, if the trader decides to take his/her trade in a commodity/stock that needs the trader to have at least $100,000 to be able to make trades, the trader would automatically be unable to trade such commodities or stocks. The leverage also has a lot to do with the margin and lot size.

See Also: 7 Simple Profitable Forex trading strategies for Traders

Meaning of Spread in Forex Trading

Spread is the difference between the bid and ask. It represents brokerage service costs and replaces transaction fees. Spreads are traditionally denoted in pips – a percentage in point, meaning fourth decimal place in currency quotation. Types of Spreads in Forex Fixed spread – the difference between ASK and BID is kept constant and does not depend on market conditions.

Fixed spreads are set by dealing companies for automatically traded accounts. Fixed spreads with an extension – a certain part of a spread is predetermined and another part may be adjusted by a dealer according to the market. Variable spreads – fluctuate in correlation with market conditions.

Generally, variable spreads are low during times of market inactivity (approximately 1-2 pips), but during a volatile market, they can actually widen to as much as 40-50 pips. This type of spread is closer to the real market but brings higher uncertainty to trade and makes the creation of an effective strategy more difficult.

A trader needs to cover spreads in winning trades before making a profit. For example, let’s take EUR/USD, the price of 1.4652 which is the bid, and 1.4650 which is the asking price. This means that the spread charge is 2 pips. Therefore, in the case of selling USD, if the price moves to 1.4552,

There is a successful pull of 100 pips. However, a spread of 2 pips will be deducted, making the investor basket 98 pips.

WHAT IS A PIP?

PIP stands for Price Interest Points. There is a Standard lot ($100,000), Mini Lot ($10,000), and a Micro lot ($1000). In the standard lot, a pip is worth $10. A mini lot is $1 and it is worth $0.1 in micro lots. However, each currency has its own pips value.

PIP VALUE

The pips value depends on the lot size you enter a trade with. Let’s take the EURUSD example again. At the price of 1.4652 and leverage of 1:100, if an investor sells with a lot size of 0.01, which means each Pips movement either gives you a profit of $0.10 or a loss of the same amount. When it moved to 1.4552 from 1.4652, that means the EURUSD made a bearish movement losing 100 pips in the process, the 100 pips would produce $10. A Micro lot size of 0.01 was used which equates to having $0.10 on each PIPS movement. i.e., 100 pips X $0.10 = $10

Calculating Pips Value Trading EURUSD, with an account in USD, one pip = 0.001 Let’s say your trade account is $10,000 0.001*10,000 =10

If the exchange rate is 1.13798 10/1.13798=8.7875007 therefore a pip of EURUSD at a value of 1.13798 is worth $8.79 for metal, you calculate thick value instead of pips value. Tick value=tick in decimal (0.01) Number of trading lot of 100oz =0.01100 =1 each tick is worth $1

WHAT’S A LOT SIZE

The lot size is used to determine the value of each pip that you can earn.

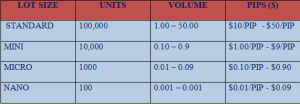

The standard size for a lot refers to 100,000 units of a currency, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units of a currency. Below is the table that shows the Lot size calculation.

Dipprofit is a platform where we provide you with the latest news, events, and insights on Cryptocurrency, and Forex trading we also give quality educational content to our readers. Click the bell icon on the article page to subscribe and get first-hand updates that would also help your Crypto, Forex Trading & financial journey.