Forex Risk Management Tips for Profitable Forex Trading.

In our previous article, we already mentioned the importance of risk management in a forex trader’s journey. In this article, we shall continue by giving more risk management tips that are very important for profitable forex trading.

Setting Your Profit & Loss Daily Target

As you embark on your trading journey you must and should know that the road is not always a smooth sailing one, there will be ups and downs, as there will be profits as well as losses sometimes. The losses you incur don’t make you a less successful trader if you have a proper trading plan.

One thing I practice is the Risk-reward Ratio formula, this is the process of rationing your profit against your losses. Some persons use the 1:2 i.e, one ratio two formula which means your profit target should be twice your loss target. While some use the 1:3 formula i.e, one ratio three, this means your profit target in on each trade should be thrice your loss target.

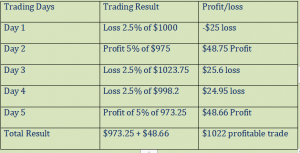

For example, let’s assume you have a trading fund of $1000 and are looking to trade profitably you would need to know your profit percentage on the trade as well as your loss percentage in case the trade suddenly goes against your speculation. This would help you manage your losses well.

So, you decide your profit on each trade to be 5% of your trading funds your maximum loss possible on each trade would be 2.5% which is 1:2. This means assuming you took 5 trades in a week and only hit your profit target twice that week, while the rest of the week you hit your loss target, you would have still had a profitable week.

See the table below.

We can see from the above table that this trader used the 1:2 trading plan and at the end of the week, he still made some profit despite the fact that he didn’t really have a lot of profitable trades. $22 after 5 trades with an equity of $1000 may look very little, but for forex veterans who have been into trading for years, they would tell you, you have made great success. If this trader keeps up this trading plan at the end of 6 months, he would still have his starting equity and also 30% – 40% profit on his capital.

Therefore, we can see that Forex Trading can be very profitable if the forex trader makes use of a trading plan and also sticks to it with strict discipline.

See Also: Smart Money Concept Trading for Beginners: Learn How the Banks Trade

Discovering a Trading Strategy

Another forex risk management strategy is to create a trading strategy that works for you. As a trader is very important and this is something you must put into consideration when drawing up your Trading Plan, as it would help you maximize your profit opportunities and also make your trading journey much more successful, we would be talking about creating a Forex Trading Strategy to ensure Trading success next. Successful trading is all about having a trading plan, a plan for success

Strategy Based Trading

Having a trading strategy is very important, as it gives you better control over the market and helps you gain more in-depth experience while analyzing the market. Furthermore, strategy-based trading helps traders make better decisions while trading.

Trading strategies involve the trader, choosing the instruments they are willing to stick to, the instrument they are willing to analyze often, and the instrument they are willing to research consistently.

It also includes the indicators the traders make use of, the time the trader takes as the best time in which they get into the Forex market to take their trades, the lot sizes the trader uses, the duration of the trade, the confirmation the trader must see before taking a particular trade. All these and many more are encompassed in Strategy Based Trading.

We will look at a few forex risk management strategies mentioned in the paragraph above.

Choosing Specific Trading Instruments

Most times, many traders enter into trades without understanding the instruments in which they are trading, they don’t understand the time when the instrument is highly volatile, and when the instrument makes little to no market movement. They also don’t know the indicator that works best with the particular instrument and the economic indicators that directly affect the instruments.

This ought not to be so, as a trader the first thing you are supposed to understand is the market in which you are carrying out your trade.

That’s why professional traders have very few instruments they trade on, some have just three (3) instruments, and some have four (4). This helps the trader narrow down his/her research scope helping them put in more time and effort in studying the few instruments they are trading and over time they are able to tell when it’s the best time to enter trades in those instruments and make good profit from them.

The traders would also be able to understand the behavioral pattern of the instruments. Therefore, to be much more effective in your trades it is advisable you narrow down the instruments you trade in the Forex market so it would be easier to study and understand them well.

Confirmation Strategy

This is simply the process of having a pattern which each time you see it in a chart, makes you enter into a trade because you have tested that pattern over and over again and it has proven to be reliable.

Confirmation patterns are mostly spotted by traders who narrow down their trading instruments to just a very few instruments. Since they are able to focus their time and effort on very few instruments, they tend to discover patterns while trading those instruments over and over again using various technical or fundamental forms of analysis.

After discovering these patterns, the trader still goes further to test them and after some testing period, if the confirmation pattern proves to be reliable, the trader then adapts it, making trading easier and more profitable.

See Also: 8 Chart Patterns Every Beginner Trader Must Know to Succeed in Trading

Keep track of your trading activity in a journal

In Forex trading, you never stop learning. With every mistake you make along the way, you will learn valuable lessons especially when it comes to forex risk management. In a journal, take note of all your trading activity. If you suffer a loss, read back on what you did so you can correct it. If you made a large profit, also read back to see which strategies you can repeat in the future. Also using a journal helps you keep track record of your trading growth and the effectiveness of your strategy. Nowadays, due to continuous technological advancement, tools such as applications have been created that can serve as trading journals. An example is myfxbook.

See Also: 3 Simple Forex Risk Management Strategies that Improve Profitable Trading

Hold back on the leverage

It’s been said too many times that leverage is a two-edged sword. Leverage does promise magnified profits in case of a favorable trade. However, it will also increase your losses considerably if the trade takes a bad turn.

Large leverage looks enticing but it is very dangerous. You can figure out the leverage ratio that is perfect for you based on the following: the size of your trading account, your average stop-loss distance, and your risk per trade. You will understand more about these things as you learn further about Forex trading. To learn more about leverage you can look at our trading education articles.

Conclusion

In conclusion, it’s not just the technical aspects of Forex trading that you have to learn in order to be successful. You also need to keep your funds in check at all times. If you follow these risk management tips carefully, you will be able to increase your profits and minimize losses on future trades.

Forex Risk management is as important as any other aspect of Forex trading and as I have emphasized in this chapter, is also instrumental to how profitable a trader can be in the market. Therefore, as you also learn technical and fundamental analysis you should also know how to keep your profit steady and consistent, have a trading plan and employ a high level of discipline keeping your emotions in check.

We Hope you’ve learned a lot from this article!! We’re glad you did.

Join our telegram community to get up-to-date news, educational materials, free online classes, market analysis, and crypto futures trade signals that will help you grow and become profitable.