Cryptocurrency trading can be fast-paced and challenging, but using the right tools and crypto trading strategy can help traders make better decisions.

The Best 3 Profitable Crypto Trading Strategy

Here are three of the best crypto trading strategies that can help improve your trading profitability:

- SMC Order Blocks

- Fibonacci Retracement Strategy

- Chart Patterns Strategy

1. SMC Order Blocks

One of the best crypto trading strategy is SMC (Supply, Demand, and Market Control) aka Smart money concept order blocks, which can help traders predict market movements and enter trades more effectively.

We will explain what SMC order blocks are, how to identify them, and how to use them in your trading strategy.

SMC order blocks are important levels on a price chart that show potential areas where the balance between supply and demand has shifted.

These levels are based on the idea that large institutional traders, known as “smart money,” leave clues in the market through their buy and sell orders. These clues can be seen as order blocks on a price chart.

Bullish Order Blocks

Bullish order blocks occur when there is a strong imbalance between supply and demand, leading to a rapid increase in price.

These blocks indicate areas where smart money has entered the market with significant buying activity. Traders can spot bullish order blocks as areas where the price has surged after a period of consolidation or pullback.

Bearish Order Block

On the other hand, bearish order block indicate areas of strong supply and weak demand, resulting in a rapid price decline.

These blocks show where smart money has entered the market with significant selling activity. Bearish order blocks are often seen as areas where the price has dropped sharply after a period of consolidation or rally.

How to Identify SMC Order Blocks

Identifying SMC order blocks requires paying attention to market structure and price action. Traders can follow these steps to identify and mark SMC order blocks on their charts:

- Spot Strong Moves: Look for strong, clear price movements that suggest smart money activity.

- Find Consolidation or Pullback Zones: After a strong price movement, the price often consolidates or pulls back before continuing in the same direction. These zones are potential SMC order blocks.

- Mark Highs and Lows: Once a consolidation or pullback zone is identified, mark the highest high (for bullish order blocks) or lowest low (for bearish order blocks) within that zone.

- Confirm with Volume: Volume can provide additional confirmation of an SMC order block. Look for high volume during the strong price movement and decreasing volume during the consolidation or pullback.

Entering Trades Using SMC Order Blocks

Traders can use SMC order blocks to enter trades with a higher chance of success. Here’s how to enter long and short trades using bullish and bearish order blocks:

Long Trades (Bullish Order Blocks)

- Identify a Bullish Order Block: Look for a strong bullish price movement followed by consolidation or a pullback.

- Wait for Price Retracement: Enter a long trade when the price retraces back to the bullish order block.

- Place Stop-Loss Below the Order Block: To manage risk, set a stop-loss order below the low of the bullish order block.

- Set Take-Profit Targets: Set multiple take-profit targets based on key support and resistance levels or use a trailing stop to maximize profits.

Short Trades (Bearish Order Blocks)

- Identify a Bearish Order Block: Look for a strong bearish price movement followed by consolidation or a pullback.

- Wait for Price Retracement: Enter a short trade when the price retraces back to the bearish order block.

- Place Stop-Loss Above the Order Block: To manage risk, set a stop-loss order above the high of the bearish order block.

- Set Take-Profit Targets: Set multiple take-profit targets based on key support and resistance levels or use a trailing stop to maximize profits.

SMC order blocks are valuable tools for cryptocurrency traders to have a better crypto trading strategy.

SMC is one of the best crypto trading strategy and by understanding how to identify and use these bullish and bearish order blocks, traders would improve their chances of winning trades.

Remember to always use proper risk management techniques and combine SMC order blocks with other technical analysis tools for the best results.

See Also: Smart Money Concept Trading for Beginners: Learn How the Banks Trade

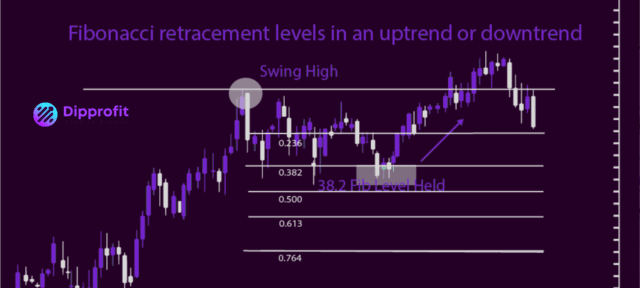

2. Fibonacci Retracement in Crypto Trading

Fibonacci retracement is a useful crypto trading strategy for traders. It helps identify potential reversal levels after a price movement.

This strategy is based on a sequence of numbers called the Fibonacci sequence, discovered by an Italian mathematician named Leonardo Fibonacci.

Fibonacci retracement levels include 23.6%, 38.2%, 50%, 61.8%, and 100%, which are used to find possible support and resistance levels.

Fibonacci retracement is based on the idea that after a price goes up or down, it often retraces or moves back before continuing in the original direction. Traders use Fibonacci retracement to find potential entry and exit points in the market.

How to Use Fibonacci Retracement

To use Fibonacci retracement in crypto trading, follow these steps:

- Find the Trend: First, determine if the market is going up or down. Fibonacci retracement works best in markets with a clear trend.

- Identify Swing Points: Look for the most recent highest and lowest points in the trend. These points will be used to draw the Fibonacci retracement levels.

- Draw Fibonacci Levels: Use a charting tool to draw the Fibonacci retracement levels from the lowest to the highest point in an uptrend, or from the highest to the lowest point in a downtrend.

- Spot Potential Entry Points: Watch for the price to retrace to one of the Fibonacci levels. These levels can act as support or resistance, depending on the direction of the trend.

- Confirm with Indicators: Use other indicators, like moving averages or the Relative Strength Index (RSI), to confirm the trade setup before entering a trade.

How to Enter Positions Using Fibonacci Retracement

Long Positions:

In an uptrend, traders look to buy near the Fibonacci retracement levels. They enter a long position when the price is expected to bounce off these levels and continue higher.

The entry point is usually near the 38.2% or 50% retracement level, with a stop-loss below the lowest point and a target at the previous highest point or the next Fibonacci extension level.

Short Positions:

In a downtrend, traders look to sell near the Fibonacci retracement levels. They enter a short position when the price is expected to retrace to these levels before continuing lower.

The entry point is typically near the 38.2% or 50% retracement level, with a stop-loss above the highest point and a target at the previous lowest point or the next Fibonacci extension level.

Fibonacci retracement is a helpful tool for crypto traders. It can help them identify potential entry and exit points based on the market’s natural movements.

However, traders should remember that Fibonacci retracement crypto trading strategy is not a foolproof crypto trading strategy and should be used in conjunction with other analysis methods and risk management techniques.

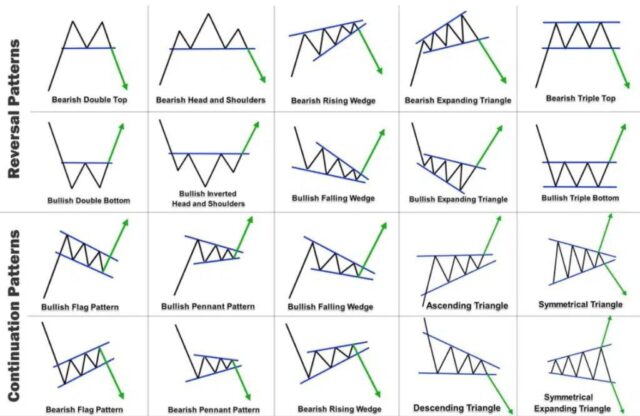

3. Chart Patterns

Chart patterns are like maps that show where the price of a cryptocurrency might go next.

By studying these patterns, traders can make decisions about when to buy or sell. We’ll show you how you can make use of this trading strategy in this subheading.

What Are Chart Patterns?

Chart patterns are shapes that form on price charts. They show how the price of a cryptocurrency has moved in the past and can help predict future price movements. Traders use these patterns to decide when to enter or exit trades.

Common Chart Patterns in Cryptocurrency Trading

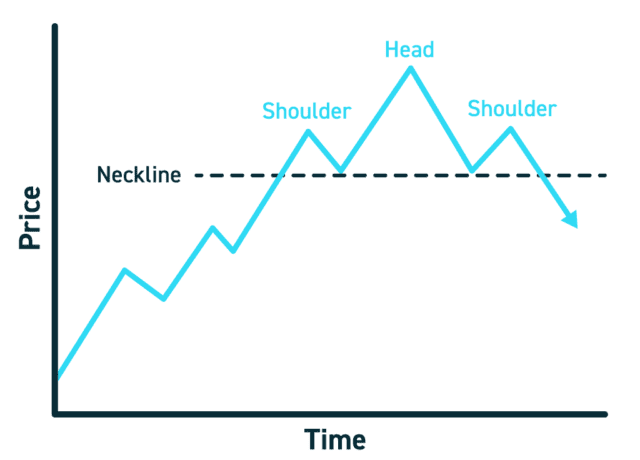

1. Head and Shoulders Pattern

The head and shoulders pattern looks like a person’s head and shoulders. It shows that a trend is about to reverse. When the price breaks below the “neckline” of the pattern, traders might sell to make a profit.

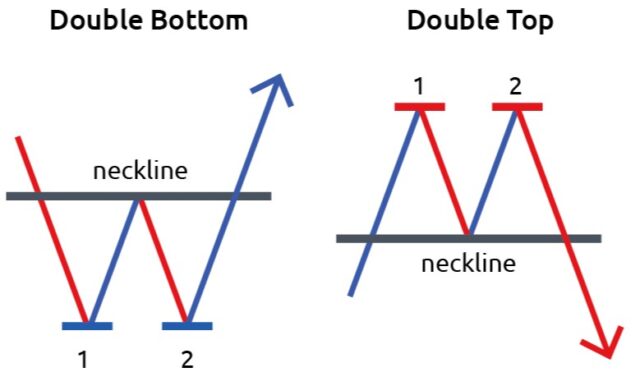

2. Double Top and Double Bottom

The double top pattern happens when the price hits a high, drops, then tries to go up again but fails to reach the previous high. This can signal a trend reversal. The double bottom pattern is the opposite and can indicate a trend change from down to up.

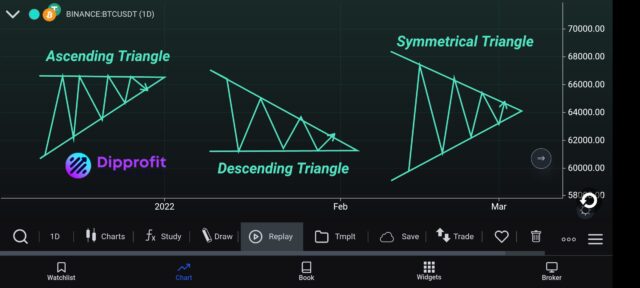

3. Triangle Patterns (Symmetrical, Ascending, Descending)

Triangle patterns show a period of consolidation before the price breaks out in a new direction. Traders can look for breakouts from these patterns to enter trades in the direction of the breakout.

4. Flags and Pennants

Flags and pennants are short-term patterns that show a brief pause in the price movement before the trend continues. Traders can use these patterns to enter trades in the direction of the trend.

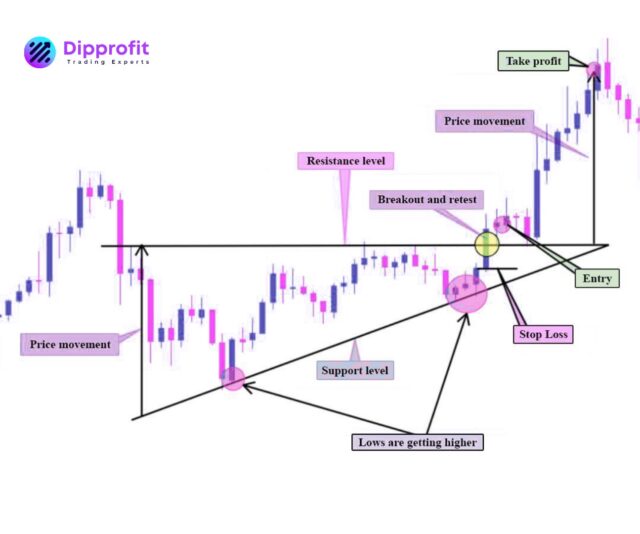

How to Spot Chart Patterns

- Study the Chart: Look at the price chart of the cryptocurrency you’re interested in. Try to spot patterns that repeat themselves.

- Identify Highs and Lows: Mark the highest and lowest points on the chart. These points are important for identifying chart patterns.

- Draw Trendlines: Connect the highs and lows with lines to see if they form a pattern. The way these lines slope can give you clues about the pattern.

- Confirm the Pattern: Wait for the price to break out of the pattern before making a trade. This breakout confirms that the pattern is valid.

Setting Long or Short Positions Based on Chart Patterns

- Long Position: If you see a bullish pattern, like a double bottom or an ascending triangle, you might want to buy. Place a stop-loss order below the breakout level to limit your losses if the trade goes against you.

- Short Position: If you see a bearish pattern, like a head and shoulders or a double top, you might want to sell. Place a stop-loss order above the breakout level to protect yourself from losing too much money.

Chart patterns is beneficial crypto trading strategy. Practice looking for chart patterns on different charts to become more comfortable with using them in your trading strategy.

See Also: Taking Profitable Trades Using Trading Chart Patterns PDF Guide

Risk Management

Crypto trading can be a good way to make money, but it also comes with risks. If you’re not careful, you could lose all your money.

To do well in cryptocurrency trading, it’s important to have good strategies to manage these risks, no matter your crypto trading strategy

Risk Management Strategies

Let’s talk about some simple but effective ways to manage risk when trading cryptocurrency.

1. Use Stop-loss Orders

One way to manage risk is to use stop-loss orders. A stop-loss order is like a safety net for your trades.

It’s an instruction you give to the trading platform to sell your cryptocurrency if its price falls to a certain level.

This helps you limit your losses if the market goes against you. It’s a good way to avoid making emotional decisions and to make sure you don’t lose too much money on a single trade.

2. Decide How Much to Trade

Another important thing to think about is how much of your money to risk on each trade. This is called position sizing. It’s a good idea to risk only a small percentage of your total trading capital on each trade.

Many traders suggest risking no more than 1-2% of your capital on a single trade. This helps you avoid losing too much money if a trade doesn’t go well.

3. Be Careful with Leverage

Leverage can help you make bigger profits, but it can also increase your losses. It’s important to use leverage carefully and only trade with money you can afford to lose.

Many experts recommend using low leverage, like 2x or 3x, to reduce the risk of losing all your money.

4. Spread Your Risk

Diversification is a good way to reduce risk. Instead of putting all your money into one cryptocurrency, you can spread it out across different cryptocurrencies or even other types of investments. This way, if one investment doesn’t do well, you won’t lose all your money.

5. Look at the Risk and Reward

Before you make a trade, it’s a good idea to think about the potential reward compared to the potential risk.

This is called the risk-reward ratio. A common rule is to aim for a risk-reward ratio of at least 1:2.

This means that for every dollar you risk, you should aim to make at least two dollars in profit. This way, even if you’re not right all the time, you can still make money overall.

6. Stay Informed and Adapt

Finally, it’s important to stay up-to-date with what’s happening in the market and be willing to change your strategy if the market changes.

Cryptocurrency prices can change quickly, so it’s important to be able to adjust your strategy accordingly.

This might mean changing your stop-loss levels, adjusting how much you trade, or even closing a trade if the market isn’t going your way.

Managing risk is an important part of cryptocurrency trading. By using strategies like stop-loss orders, position sizing, leverage, diversification, risk-reward ratios, alongside your crypto trading strategy, you can protect your money and increase your chances of making a profit in the cryptocurrency market.

See Also: The Ultimate Risk Management PDF Guide

Developing a Winning Trading Mindset

Crypto trading can be very rewarding but also quite tough.

While analyzing markets and doing research, and using the right trading strategy is important, another important aspect of successful trading is your mindset.

Developing a winning trading mindset is key for handling the ups and downs of the market and making smart decisions.

Emotions like fear, greed, and hope can really impact your trading decisions, often leading to bad choices.

Developing a winning trading mindset means learning to control these emotions and making decisions based on logic and analysis instead of feelings.

Some Winning Mindsets

1. Staying Calm and Collected

A big part of successful trading is staying calm and not letting your emotions get the best of you.

Fear of missing out can make you trade impulsively, while fear of losing can stop you from taking necessary risks. Greed can also be a problem, leading you to trade too much and take on too much risk.

By staying disciplined and sticking to your trading plan, you can avoid these pitfalls and make smarter decisions.

2. Having a Plan

Having a trading plan is important. This is a set of rules that guides your trading, including your goals, how much risk you’re comfortable with, when to enter and exit trades, and how to manage your money.

A good trading plan can help you stay focused and avoid making decisions based on emotions. Stick to your plan even when things get tough, as this will help you stay consistent in your approach.

3. Learning from Mistakes

No trader is perfect, and everyone makes mistakes. The important thing is to learn from them.

Instead of beating yourself up over losses, try to understand what went wrong and how you can do better next time. This mindset can help you grow as a trader and stay positive even when things aren’t going well.

4. Being Realistic

While it’s good to have big goals, it’s also important to be realistic. Set achievable goals based on your skills and experience, and don’t compare yourself to others.

Trading takes time and practice, so be patient and focus on improving slowly rather than trying to get rich quickly.

5. Taking Care of Yourself

Trading can be stressful, so it’s important to take care of yourself. Get enough sleep, eat well, and exercise regularly to keep your mind clear and reduce stress.

Practices like mindfulness and meditation can also help you stay focused and calm during trading.

Developing a winning trading mindset is important for success in the cryptocurrency market.

Suppose traders can understand the impact of emotions on their trading decisions, stay disciplined, ensure they have a plan, manage their risk, learn from mistakes, be realistic, and take care of themselves. Then they can develop a strong mindset that will be of help.

See Also: Swing Trading Strategy PDF

You can also join our Telegram community where you can learn all you want to know about the cryptocurrency space, defi, web3, and airdrop opportunities and also have access to live AMA sessions from time to time, then click the button below to join Dipprofit Telegram Community For Free Now