RISK MANAGEMENT PDF GUIDE

One of the greatest setbacks for forex traders, and investors is losing all their funds to the market, unfortunately, this seems to be the case almost all the time, as over 90% of traders and investors end up blowing their funds.

One of the major reasons for this is the fact that most of these people lack the proper risk management skills and strategies needed to carefully manage and grow their financial portfolios.

For some of these traders, after being asked why they ended up losing all their funds to the market, the complaint you hear doesn’t spring up from their lack of the forex trading technical or fundamental skill, but mainly from the fact that they never got good risk management tips or knowledge that would have saved their portfolio.

It is no news that forex trading is fundamentally a risk. You go in, investing your funds and hoping that your trades and speculations are favourable. In the process, you will probably use advanced tools to predict price patterns and monitor financial news to stay updated on market movements.

Even if you mastered your trading strategy, another very important skill you need to learn to succeed as a forex trader is risk management skill. Unfortunately, risk management is something that many novices and beginner traders often neglect. Perhaps they think it is something so natural that they do not need to learn more about it.

They are probably thinking, I already know how to take care of my money, why would I need risk management tips? The fact is when it comes to trading with your money, with the aim of earning some good profit from it, risk management is a major skill you must learn. One of the most important secrets of profitable forex traders and investors is the fact that they have mastered the art of risk management, therefore they can properly minimize their losses and maximize their profits.

It is as simple as this, if you are not careful with your trading money, you will inevitably end up losing all your trading funds, which is a disaster we have seen happen severally. Therefore, to keep this from happening to readers on our platform and members of our community, I have decided to prepare a detailed risk management pdf guide containing tips and strategies that will help you properly manage and reduce your trading risks and at the same time improve profitable forex trading.

[ez-toc]

RISK MANAGEMENT STRATEGIES THAT MINIMIZE LOSSES

In this Risk management PDF guide, I will be simplifying things by giving simple but effective risk management strategies that can help minimize loss of money and liquidity in trading.

Below are some of the major risk management strategies:

- Money management,

- Psychological management,

- Creating a trading plan and

- Strategizing

- Timing

- Keeping Proper Trade Records

- Understanding how to use your leverage

All these are very necessary keys needed in managing risk for every individual, from forex traders to investors. Now that I have mentioned these risk management strategies the next step is to examine them individually for proper understanding.

Kindly note that I will be using forex trading as the case study in explaining the various risk management strategies, but these strategies are not limited to only forex trading but are also very useful for financial investments of all kinds.

Having established that fact, let’s look at how as a trader, you can employ these risk management skills and increase your chances of making progressive profits in your trades.

The first on our list of risk management strategies is called ‘The Art of Money Management”.

MONEY MANAGEMENT

The aim of every trader is to be profitable in their trades and make loads of money to live a better and fulfilling life therefore, the motivation to burn through the nights and days carrying out research and understanding your market to better gain insights and ideas on how to explore your advantages, enabling you to make that money you desire at the end.

This is where a lot of beginner traders and novice traders get it wrong, they come into the trading industry for the money but fail to understand that it takes time and effort to kick-start a profitable forex career.

A lot of traders see Forex Trading as a Get Rich Quick Scheme where they can just rush in, get some months of training, with no knowledge of risk management, and instantly start making lots of money. This is a very wrong notion, as I also emphasize to my students, ‘Forex Trading is an art, and its beauty is in the process, it takes a lot of time, work, and dedication to even start understanding the art while mastering the art of Forex trading is a journey which we all must enjoy.

Let’s examine it from this perspective, imagine forex trading to be like your business, of which I totally agree with that notion as it involves transactions, buying, and selling to make profit. You won’t expect to open up your business with a Capital of $10,000 and then under a month or two make back your capital and also your profit. Although there might be underlying differences between forex trading and your traditional businesses, the fact still remains that both of them involve transactions and also aim at making profit.

Some businesses take up to 2 to 3 years before they break even, then another 1 to 2 years before they start making profit which totals a minimum of 5 years, and as the business owner, you would have to be patient enough to attain or achieve this goal within this period.

In the case of Forex, it might not take as long as that and would even take a shorter time if you have access to materials and also experienced traders as mentors, it would still take some time before you can start making profit in Forex trading.

In essence, the first thing you need to know when coming into forex trading is that you can’t start making loads of cash as soon as you start. Always use the business mindset to approach forex trading and it will help you to a large extent limit the greedy thoughts that consume most investors or traders.

It’s not a get-rich scheme, except you decide to use shortcuts such as signal channels and robots, but these have their serious downsides as you would spend lots of money to get any of these shortcuts and most importantly, you would not be in control of your trades rather you would be at the mercy of others; the Signal provider or the robot and in lots of cases I have seen this method lead to disastrous trades.

To have good money management skills, you must have a good and healthy mindset towards making money, know how to gradually grow your financial portfolio, and also make sure you are using Capital you can afford to leave for a long time without being overly bothered about how quickly you would double the capital and be able to withdraw the profit. By so doing you enjoy the trading process more as you are not so eager to withdraw your proceeds.

See also: The Best Trading Indicators for Beginner Traders in 2023

PSYCHOLOGICAL MANAGEMENT

Psychological management is one of the most important risk management strategies we can think of, as it has to do with having the right mindset when trading, and being able to train yourself to overcome some of the overwhelming mental & emotional barriers or challenges most traders are likely to face when they start trading.

The 3 main contributors to emotional buying and selling in the market:

- Hope

- Fear

- Greed

These three (3) emotions are most likely going to affect you as a trader if you don’t have the proper mindset when you start trading. We would be looking at how they can affect and influence your decision as a trader and also how to control these emotions.

HOPE

As stated earlier, most traders tend to have the wrong mentality of making lots of money easily as soon as they kickstart their forex journey which causes more harm than good as they go along.

It is not wrong to be a very positive-minded trader but it is disastrous when you base your results on HOPE as it would affect your decision-making.

For example, let’s assume Chris, entered a BUY trade for EURUSD with $1000 equity in the trade and hopes to make some good profit with no target in mind, Chris also decided to set a STOP LOSS because he was told its necessary, after some hours he comes back to check the trade and finds out he is losing on the trade and has currently lost about $50 which is about 5% of his total equity.

Chris looks at the market and maybe decides to still hold on and shift the position of his STOP LOSS further instead of exiting the trade seeing that the trend of the market has been reversed or the pattern he saw entering the market is no longer in play, He still keeps his hope high.

Chris comes back to check the trade again in an hour’s time and sees the trade has further gone against his speculation his loss now running to $80 showing all indications of still going further against his speculation, he is reluctant to exit the market and still has some hope that the market would reverse in his favor after a while.

He, therefore, leaves the trade running till the next day removing His STOP LOSS position totally he comes back the next day to check only to see that he has incurred a loss of about $200 which is a whopping 20% of his whole equity, due to the fact that he refused to face the reality that his market speculation was not accurate at that time and he should have exited the trade earlier rather than hoping it would move in his direction.

You should also know that even when the trader puts a STOP LOSS as a precaution and even has a trading plan, many times the trader would go against this plan if they are unable to keep these emotions in check.

Therefore, while trading forex, emotions should be out of the picture and kept in check with strict rules and disciplinary measures.

Download Risk Management PDF Guide

GREED

This is also a very huge emotional challenge lots of traders face in their trading process and journey, as every individual is thrilled with making more money, and as we say in economics, ‘Man’s needs are insatiable.

As a trader it is very important to be very disciplined, this is a very important character every successful trader must imbibe before they make good success, it is not enough to just understand the market dynamics, it is also important to know how to navigate the market without involving emotions.

Greed is a trader’s killer because it keeps pushing the trader to take unreasonable trades just to make an unreasonable amount of money in a short period of time. This might work out well sometimes but when it backfires it is always very disastrous.

Traders are expected to take calculated risks and not totally absurd or unreasonable ones as it always spells disaster.

Let’s also illustrate using another example: Williams is an upcoming trader who has had some good success in the market and is looking to further increase his portfolio with more profitable trades.

He started his trading journey with an equity of $10,000 and has grown it to 100% profit bringing his current equity to $20,000 in just 4 months which means Williams makes about 25% profit monthly, a very steady and commendable growth.

Now he starts targeting $100,000 in the next 2 months due to his growing lifestyle. This already shows that Williams is getting greedy which is not a good sign.

Now Williams on a particular occasion takes a trade where he uses 75% of his equity i.e., $15,000 for the trade, his TAKE PROFIT is set at 25% profit which is $3,750 dollars in profit for the trade.

After a while Williams comes to check his trade and finds out the 25% profit is almost attained, he looks at the market and feels that the market would still keep on moving in his favor for a long time and then readjusts his TAKE PROFIT position to 50% ignoring the 25% he set earlier.

He leaves his trade and when he comes back he discovers that the market has reversed and gone against him, taking him into a loss of over 30% already, he becomes disappointed and eventually leaves the market with a loss.

In this scenario, William’s greed has cost him to lose some of his equity in a trade when he was supposed to make a very good profit.

This is only one scenario where greed is illustrated, there are different ways greed affects traders’ decisions, sometimes some traders would use very unreasonably high LOT SIZES so they can quickly make great profits or use very high leverages. All these have led to several traders blowing their accounts and incurring serious losses.

What happened to Williams can also further make him lose more money if he doesn’t control his emotions and allows anger or frustration to set in, he might want to do what we call ‘REVENGE TRADE’ where he would try to recover what he lost in the market by even trying to take more unreasonable risk to make up for the losses and also make more profit.

This is not advisable at all because as a trader, your mind must and should be open, so you can understand and see the market from a broader and clearer view, if your judgment is clouded with anger, frustration, or revenge, you would end up losing more money to the market and the market definitely does not care.

You should know this, nobody is the master of the market, at least not when you have very little liquidity rather the market is the master, all you need to do is calmly face it, understand it, and then benefit from its flow.

FEAR

This is another trader’s killer which without a proper forex risk management strategy will in most cases ruin a trader. This especially applies to upcoming traders who have not yet established themselves in the FOREX market.

Fear allows traders to miss out on opportunities, and lose money from trades due to the fact that they may exit trades prematurely when they see that the trade, they entered is incurring little losses already and they are losing their funds, fear can also make traders enter a trade prematurely when they feel they would lose out of whatever opportunity they see brewing.

When this fear affects a trader over and over again, they end up blowing their equity and find it difficult to trade again because they develop a phobia for trading in general.

I have seen this happen severally in my trading journey and it’s something every trader must and should guard against. Like the previous 2 emotions, I would give an illustration of how fear can affect you as a trader and how to guard against it.

Let’s use Ese as a case study: Ese is a beginner forex trader and he has just funded his account with $100, he decides to enter into a trade after he has carefully analyzed the market, and he decided to risk 50% of his equity for this trade and also ensured that he placed his STOP LOSS & TAKE PROFIT price using his broker.

After a while Ese comes back to check his trade and sees that the market is currently going against his speculation and he is incurring a loss of about $3 already, this makes him question his skills and speculation and he decides to exit the trade because he is afraid of losing more money.

After exiting the trade, Ese came back in an hour to check the same instrument he just stopped trading and saw that the market direction of the instrument had started moving towards the direction he speculated but unfortunately, he exited the trade and even incurred a loss.

After discovering that the trade has started moving towards his previously speculated direction, Ese developing FOMO fear of missing out on the opportunity on which he has incurred a loss initially, recklessly enters into the trade again and this time goes all in, using all his equity in the trade and increasing his LOT SIZE so he can recover the money he lost in the previous trade.

After entering into the trade, Ese came back to check the trade and discovered that the position he entered the trade was a very wrong position, where the market was having a pullback, therefore he discovered he was already incurring more losses at this point and rushed out of the market to avoid further losses.

At this point due to the fact that he used a bigger LOT SIZE, and all his capital, his losses are more than before losing more than half of his equity.

From Ese’s action, you can see that FEAR is an emotion that would affect every trader if they are not disciplined.

To curb these emotions while trading it is very important you have a TRADING PLAN and use funds you can afford to lose, or equity that won’t put you under undue pressure while trading. We will be examining what it takes to have a TRADING PLAN next:

See also: How to Trade Like a Pro Using SMC Trading Strategy

.

.

.

HAVING A TRADING PLAN

Another one of the Risk management strategies is having a trading plan. Just like the popular saying, ‘if you fail to plan you are planning to fail’. Every Forex Trader must understand the fact that they need to have a working Trading Plan before they can even think of becoming successful in Forex Trading. Every Successful and professional Forex Trader has their trading plans which they have tried and tested over time till they can work with it and confirm it’s sustainable.

There are some basic factors to consider when trying to create a trading plan and I would be highlighting some of these factors.

Firstly, every trader must and should know that their emotions cannot change the trajectory of the market as they don’t have the ability to influence the market movement except if they own billions of dollars, therefore utmost discipline should be inculcated in their trading activities as this would ensure that they stick to whatever Trading Plan they have created for themselves.

The first thing you need to consider after your training process as an aspiring trader is your capital base.

CAPITAL BASE

You should ensure that the amount you would use to start your trading journey should be something that you can afford to lose or do without over a period of time.

Most individuals put in money they were supposed to channel into other important things into forex trading hoping to make some quick profit on the funds and then take back what they put in. This is a bad idea because you would be forced to trade with emotions and end up losing your funds.

Therefore, if you are ready to start trading, it is advisable you don’t put in borrowed funds as it is already the beginning of trading failure. Look for a way of getting a dedicated fund, however little it might be to fund your forex broker account so as to trade comfortably and not emotionally.

This way you are able to gradually grow your funds without anxiety over a period of time.

Download Risk Management PDF Guide

SETTING YOUR PROFIT & LOSS DAILY TARGET

The second thing you need to consider when creating a trading plan is your risk-to-reward ratio. As you embark on your trading journey you must and should know that the road is not always a smooth sailing one, there will be ups and downs, as there will be profits as well as losses sometimes. The losses you incur don’t make you a less successful trader if you have a proper trading plan.

One thing to practice is the Risk-reward Ratio formula, this is the process of rationing your profit against your losses. Some persons use the 1:2 i.e., one ratio two formula which means your profit target should be twice your loss target. While some use the 1:3 formula i.e., one ratio three, this means your profit target in on each trade should be thrice your loss target.

For example, let’s assume you have a trading fund of $1000 and are looking to trade profitably you would need to know your profit percentage on the trade as well as your loss percentage in case the trade suddenly goes against your speculation. This would help you manage your losses well.

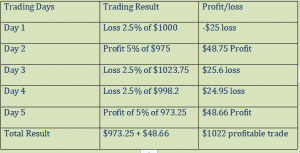

So, you decide your profit on each trade to be 5% of your trading funds your maximum loss possible on each trade would be 2.5% which is 1:2. This means assuming you took 5 trades in a week and only hit your profit target twice that week, while the rest of the week you hit your loss target, you would have still had a profitable week.

See the table below.

We can see from the above table that this trader used the 1:2 trading plan and at the end of the week, he still made some profit even though he didn’t have a lot of profitable trades. $22 after 5 trades with an equity of $1000 may look very little, but for forex veterans who have been into trading for years, they would tell you, you have made great success.

If this trader keeps up this trading plan at the end of 6 months, he would still have his starting equity and also 30% – 40% profit on his capital. Therefore, we can see that Forex Trading can be very profitable if the forex trader makes use of a trading plan and also sticks to it with strict discipline.

See Also: Smart Money Concept Trading for Beginners: Learn How the Banks Trade

DISCOVERING A TRADING STRATEGY

Another forex risk management strategy is to create a trading strategy that works for you. As a trader is very important and this is something you must put into consideration when drawing up your Trading Plan, as it would help you maximize your profit opportunities and also make your trading journey much more successful, we would be talking about creating a Forex Trading Strategy to ensure Trading success next.

Successful trading is all about having a trading plan, a plan for success

STRATEGY BASED TRADING

Having a trading strategy is very important, as it gives you better control over the market and helps you gain more in-depth experience while analyzing the market. Furthermore, strategy-based trading helps traders make better decisions while trading.

Trading strategies involve the trader, choosing the instruments they are willing to stick to, the instrument they are willing to analyze often, and the instrument they are willing to research consistently.

It also includes the indicators the traders make use of, the time the trader takes as the best time in which they get into the Forex market to take their trades, the lot sizes the trader uses, the duration of the trade, the confirmation the trader must see before taking a particular trade. All these and many more are encompassed in Strategy Based Trading.

We will look at a few forex risk management strategies mentioned in the paragraph above.

CHOOSING SPECIFIC TRADING INSTRUMENTS

Most times, many traders enter into trades without understanding the instruments in which they are trading, they don’t understand the time when the instrument is highly volatile, and when the instrument makes little to no market movement. They also don’t know the indicator that works best with the particular instrument and the economic indicators that directly affect the instruments.

This ought not to be so, as a trader the first thing you are supposed to understand is the market in which you are carrying out your trade.

That’s why professional traders have very few instruments they trade on, some have just three (3) instruments, and some have four (4). This helps the trader narrow down his/her research scope helping them put in more time and effort in studying the few instruments they are trading and over time they can tell when it’s the best time to enter trades in those instruments and make good profit from them.

The traders would also be able to understand the behavioural pattern of the instruments. Therefore, to be much more effective in your trades you should narrow down the instruments you trade in the Forex market so it would be easier to study and understand them well.

CONFIRMATION STRATEGY

This is simply the process of having a pattern which each time you see it in a chart, makes you enter into a trade because you have tested that pattern over and over again and it has proven to be reliable.

Confirmation patterns are mostly spotted by traders who narrow down their trading instruments to just a very few instruments. Since they are able to focus their time and effort on very few instruments, they tend to discover patterns while trading those instruments over and over again using various technical or fundamental forms of analysis.

After discovering these patterns, the trader still goes further to test them and after some testing period, if the confirmation pattern proves to be reliable, the trader then adapts it, making trading easier and more profitable.

See Also: 24 Powerful Candlestick Patterns PDF Guide

KEEP TRACK OF YOUR TRADING ACTIVITY IN A JOURNAL

In Forex trading, you never stop learning. With every mistake you make along the way, you will learn valuable lessons especially when it comes to forex risk management. In a journal, take note of all your trading activity. If you suffer a loss, read back on what you did so you can correct it. If you made a large profit, also read back to see which strategies you can repeat in the future.

Also using a journal helps you keep track record of your trading growth and the effectiveness of your strategy. Nowadays, due to continuous technological advancement, tools such as applications have been created that can serve as trading journals. An example is myfxbook.

HOLD BACK ON THE LEVERAGE

It’s been said too many times that leverage is a two-edged sword. Leverage does promise magnified profits in case of a favourable trade. However, it will also increase your losses considerably if the trade takes a bad turn.

Large leverage looks enticing but it is very dangerous. You can figure out the leverage ratio that is perfect for you based on the following: the size of your trading account, your average stop-loss distance, and your risk per trade. You will understand more about these things as you learn further about Forex trading. To learn more about leverage you can look at our trading education articles.

CONCLUSION

In conclusion, it’s not just the technical aspects of Forex trading that you have to learn in order to be successful. You also need to keep your funds in check at all times. If you follow these risk management tips carefully, you will be able to increase your profits and minimize losses on future trades.

Risk Management is very important to all investors that deal with money just as Forex Risk management is also important to forex traders and as I have emphasized in this PDF guide, it is also instrumental to how profitable a trader can be in the market.

Therefore, as you also learn technical and fundamental analysis you should also know how to keep your profit steady and consistent, have a trading plan and employ a high level of discipline keeping your emotions in check.

.

Download Risk Management PDF Guide

SEE OTHER DOWNLOADABLE PDF ARTICLES

Scalping Trading Strategy PDF Guide For Dummies

The Best Moving Average Strategy PDF Guide

The Best Day Trading Strategy PDF Guide in 2024

24 Powerful Candlestick Patterns PDF Guide

Taking Profitable Trades Using Trading Chart Patterns PDF Guide

Smart Money Concept Trading PDF

The Best Price Action Trading PDF Guide For Beginners

Are you interested in joining a community where you can learn all you want to know about the cryptocurrency space, defi, web3, and forex trading and also have access to live AMA sessions from time to time, then click the button below to join Dipprofit Telegram Community For Free Now.