Scalping Trading Strategy PDF Guide

One of the major reasons why most forex traders tend to make losses rather than gains/profits in their trading journey is due to the fact that they get distracted by the vast arrays of trading strategies, trying several trading strategies out without truly mastering or understanding the particular strategy they work better with.

Therefore, as I break down the scalping trading strategy in this pdf guide, I would also like to make you understand the importance of truly mastering a particular trading strategy as that would make you more efficient and profitable as a forex trader.

The scalping trading strategy is a trading strategy for individuals who like thrilling and exciting adventures, you will understand why I said that as we get to understand the meaning of scalping and how to trade using the scalping trading strategy.

In this scalping trading strategy pdf guide, I will be giving an in-depth definition of the scalping trading strategy, the techniques used in scalping for both forex, and other commodity pairs, and finally, I will show a practical example of how to apply the scalping strategy.

So, just as I would always say, sit down, relax your mind, and grab a cup of coffee, your notepads, tablets, and MT4/MT5 platforms as we get to understand the scalping trading strategy.

Firstly, let’s get to understand what scalping is

WHAT IS SCALPING?

Scalping involves making multiple trades within a short period, aiming to profit from small price movements. Now that we understand what scalping is, let’s get to understand what forex scalping is.

It is a popular day trading technique employed by traders across various markets to make swift profits by buying or selling currency pairs within a short holding period. A scalper seeks to capitalize on the frequent small price fluctuations that occur throughout the day, making numerous trades in the process.

Although the gains sought after in scalping are typically small, such as 10 to 20 pips per trade, they can be amplified by increasing the size of the position and also the number of trades taken.

In the world of forex scalping, traders often hold positions for just a few seconds or minutes before exiting and opening new ones, sometimes executing multiple trades in a single day.

Now that we know the primary meaning of scalping, let’s get a deeper understanding of the scalping trading strategy.

See Also: Supply and Demand Zones: A Profitable Trading Strategy

Download Scalping Trading Strategy PDF

UNDERSTANDING SCALPING TRADING STRATEGY

The scalping trading strategy is a strategy used by scalpers to make quick and multiple gains from the market in short periods. It involves looking for profitable opportunities while using lower time frames like 1mins, 5mins, 15mins, and 30mins while executing multiple trades within short time windows, to rake in some little pips in profit.

It is important to note that some basic principles need to be adhered to while using the Forex scalping strategy some of these principles are:

- Ensure you minimize your risk to capture small price movements for your profit. The small price movements can become significant amounts of money when you capitalize on the usage of leverage and large lot sizes.

-

- While using the scalping trading strategy, it is advisable to make use of ECN Forex accounts instead of traditional ones, as the latter may put you in a disadvantaged position, due to the large spread, ask, and bid price.

- While using the scalping trading strategy, it is important to control your Leverage, spreads, fees, and slippage as they are risks that forex scalpers need to control, manage, and account for as much as possible.

From the above-stated principles it is clear that while using the scalping strategy, scalpers commonly use leverage, which enables them to take larger positions, resulting in significant profits with even small price changes. For instance, a profit of five pips on a $20,000 position (mini lot) in the GBP/USD currency pair would amount to $10, whereas on a $200,000 position (standard lot), it would equal $100.

Furthermore, scalping strategies can be either manual or automated. A manual system requires a trader to sit in front of the computer screen, identify trading signals, and decide whether to buy or sell. On the other hand, an automated trading system employs programs to instruct the trading software when to execute trades based on pre-set parameters.

Another thing of note is the fact that scalping is particularly popular just after significant news releases, such as the announcement of interest rates or U.S. employment reports. These types of high-impact news releases often result in substantial price movements within a short time, providing an ideal opportunity for scalpers to enter and exit trades quickly.

Due to increased volatility, scalpers may reduce their position sizes to mitigate risk. While a trader may aim to achieve a 10-pip profit on a typical trade, they may be able to capture 20 pips or more in the aftermath of a major news announcement.

Now that we already understand what forex scalping strategy entails, and some of the guiding principles, for forex scalping, let’s look at some scalping trading strategies that scalpers use when scalping.

.

.

.

SCALPING TRADING STRATEGIES

There are quite a few forex scalping strategies traders make use of while engaging in their scalp trading, but we will be talking about a few of them in this article.

TREND SCALPING STRATEGY:

The trend scalping strategy requires identifying the trend direction and executing quick trades in the same direction, aiming to capture little profits as fast as possible while the trend continues.

COUNTER-TREND SCALPING STRATEGY:

In contrast, the countertrend scalping strategy is more complex, requiring the scalper to open positions and make quick trades in the opposite direction of the trend. Those using this approach are betting on a trend reversal or pullback, aiming to profit from these changes.

RANGE SCALPING STRATEGY:

Traders using the range scalping strategy identify areas of support and resistance and aim to purchase near support and sell near resistance, generating profits from oscillating price movements occurring within the range.

STATISTICAL SCALPING STRATEGY:

Finally, statistical scalping strategies involve identifying patterns or anomalies in the market. This approach looks for specific conditions that result in predictable price movements. For instance, traders can identify chart patterns that appear at particular times of the day or certain days of the week to take advantage of these patterns and generate profits.

In conclusion, traders can utilize various forex scalping strategies to profit in the Forex market. Each approach presents its own unique challenges and advantages, and traders should select the technique that best matches their trading style and risk tolerance.

So far in this scalping trading strategy pdf guide, we have been able to understand the meaning of scalping and forex scalping strategy, some basic techniques that are required while scalping, and also some scalping trading strategies that scalpers use while trading. The next step is to examine various ways in which you can increase your success rate when using the scalping trading strategy.

How to Improve Your Scalping Trading Strategy As A Trader

To become a successful scalper, here are some basic tips to follow:

Stay disciplined and focused: Maintain discipline in adhering to your trading plan and avoid emotional decision-making.

Manage risk effectively: Use stop-loss orders and position-sizing techniques to manage risk and protect capital.

Adapt to changing market conditions: Stay flexible and adapt your strategy to evolving market conditions, adjusting your approach as needed.

Avoid overtrading: Exercise restraint and avoid overtrading, as excessive trading can lead to losses and exhaustion.

Continuous learning and improvement: Stay updated on market developments, continuously learn new techniques, and seek to improve your scalping skills over time.

Download Scalping Trading Strategy PDF

Another thing to take note of is that the scalping trading strategy can be used across various markets. It can be applied across various markets, including:

Forex Market: Scalping is popular in the forex market due to its high liquidity and round-the-clock trading hours.

Stock Market: Scalping is also practised in the stock market, particularly among day traders seeking quick profits from intraday price movements.

Cryptocurrency Market: Scalping is prevalent in the cryptocurrency market, where high volatility offers ample trading opportunities for short-term traders.

Now, the next step is to examine how to take profitable trades using the scalping trading strategy I will illustrate below.

In this illustration, I would be using the trend forex scalping strategy, which is also what I mostly advise traders to use, as it is less risky than the counter-trend scalping strategy.

Smart Money Concept Trading for Beginners: Learn How the Banks Trade

HOW TO TRADE USING THIS SCALPING TRADING STRATEGY.

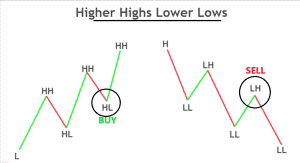

In the above chart, we can see that the price is in an uptrend with higher highs and higher lows on the chart. As I stated we are trading with the trend and not against the trend which is a countertrend scalping strategy another scalping strategy in case you missed it earlier.

In an uptrend, you are looking to start your buy scalping when price is making its higher lows which is in favor of the trend, while in a downtrend you are looking to start your sell scalping when the price is making its lower highs, as shown in the diagram above.

This strategy is based on the concept of market retracement and consolidation.

One golden rule of price action is that when the price moves in a particular direction, it would retrace, as the price cannot keep moving in a particular direction without having pullbacks and retracements.

What you, therefore, need to do as a trend scalper is to wait for the retracement to finish, wait for the end of the retracement or pullback as some traders call it before you decide to enter your trade and make some quick pips.

This strategy works well with the 5mins timeframe, remember that one of the explanations I gave at the beginning of the article is that the forex scalping strategy is most effective on lower timeframes.

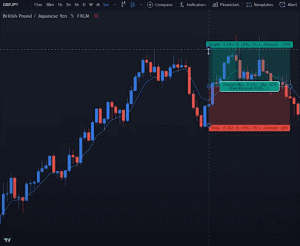

So, we would be changing our chart timeframe to 5 mins, to get a better entry and exit opportunity for this scalp trade. Note that before we go to the smaller timeframe, we need to get our trend in the higher timeframe, preferably a 1-hour timeframe which was what I did in the first diagram before entering the trades on the 5 mins timeframe.

So from the chart above we are now on the 5mins timeframe, and we can see the price movement, as price starts pumping up, before the retracement down, now all we need to do, is to be sure that price has finished its retracement, after which we can take some quick and short buys, which is the true essence of scalping.

If you are wondering how to know when price is done with its retracement and is ready to continue moving toward its prevailing trend, then there are basically two ways:

Ensure you draw your trendlines to form a diagonal support and resistance line, as soon as price hits the support trend line you have drawn, it is very likely it would continue in its trend direction, but you need to wait for confirmations which are mostly shown through the candlestick formation.

The next candle after the candle that touched the trendline, might be an engulfing candle, a hammer, doji, or a hanging man. Seeing any of this candlestick formation after price has gotten to the support trendline, means a trend continuation and you can take your scalp trades.

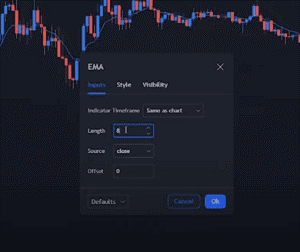

The second way to know when the retracement is over is through the use of the Exponential Moving Average (EMA). In the diagram above, you can see it around the candlesticks, it is the thin blue line that runs through the candlesticks on the chart.

To get it set up on your chart, just go to moving averages and select exponential, change the period to 8 and the source to close just as it is in the diagram above, save it, and then you can also change the color before you close the setting window and you should have the EMA on your chart now.

Now that the EMA is set, the logic behind this EMA is when it is above the candlesticks, price is going down and when it is below the candlestick, the price is going up.

You would be able to confirm any retracement in the situation when the candlestick crosses the EMA line on the chart, then you would know the retracement is over and the price is continuing its trend as shown in the above chart.

Always remember that this is mainly for scalping.

Looking at the diagram above, since we are using the forex scalping strategy, we entered a quick trade after the candlestick crossed the EMA line, and made about 20 pips profit as quickly as we could. This was a successful trade also, as illustrated in the diagram.

Another thing of note is what I had talked about earlier, looking for a confirmation, we can see from the chart above that there was a bullish engulfing at the end of the retracement before the price continued its trend, crossed the exponential moving average, further confirming our opportunity, and then we rush in as scalpers take some good pips and we are out.

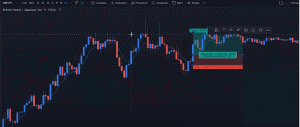

Let us take a look at the next scalping opportunity, still on the same chart and still using the 5 mins timeframe.

So another scalping opportunity appeared just some minutes after the first opportunity, and in this one the retracement ended with a long-legged doji, forming a morning star candlestick formation as shown in the chart above, after seeing this, we wait for the second confirmation which is the candlestick crossing the EMA, then after that is also confirmed, we take our trade and make a quick 20 pips profit from the trade.

Some scalpers may not even wait for the second confirmation, after seeing the morning star candlestick formation, but the candlestick crossing the EMA makes the trade less risky.

From the above illustration, we can see that it is easy to trade using the forex scalping strategy if you are someone who likes scalping, and following the above steps I have highlighted using the trend scalping strategy, would make your scalp trades a lot better hopefully.

The Best Price Action Trading PDF Guide For Beginners

RISKS IN SCALPING STRATEGY

Scalping, like any other trading style, comes with its own set of risks. While it’s true that profits can accrue rapidly by taking numerous profitable trades, the possibility of losses escalating just as quickly cannot be ignored. This is particularly true when traders lack the necessary skills or employ a flawed system.

Even when traders limit their risk exposure by staking a small amount per trade, a high volume of trades can result in a substantial drawdown if many of those trades are unsuccessful.

Leverage and position sizes that are scaled up can also be a cause for concern. Consider a trader who has $20,000 in their account but uses a position size of $200,000, equating to a leverage of 10:1.

Let’s assume the trader is willing to risk five pips on each trade and seeks to exit the trade when they gain a 10-pip profit.

While this can be a sound strategy, there are instances when the trader may be unable to exit the trade at a five-pip loss. For example, the market may gap through their stop-loss point, resulting in a 20 pip loss, which is four times the expected amount, other times, there might be a sudden spike in price movement in the opposite direction of what the trader had anticipated.

Such an event, known as slippage, is a common occurrence during major news announcements, and repeated incidents can result in significant losses that can deplete a trading account in no time.

SCALPING PERSONALITY

In one of my articles, I talked a little about traders’ personality traits, this is because, as a trader, it is important for you to understand your personality and the trading patterns and strategies that suit you, as this would help strengthen your expertise, understanding, and profitability.

Scalping is good for traders, who love exciting and thrilling adventures, they can cope with the intensity of the quick-fire trades and still keep a cool head. This set of traders must also be able to sit in front of the chart for an extended period of time, ensuring they closely monitor their trades.

If you are not able to take the heat on instant trade executions and fast-paced trade entries with almost instant exits, then you should know scalping is not for you and look for other less intense strategies.

CONCLUSION

Scalping is one of the oldest and most common trading strategies available in trading, and a lot of binary and currency traders make use of this strategy from time to time.

Like every other strategy, scalping does not guarantee any fast-paced profit for you as a trader, it takes a lot of patience, practice, planning, and understanding to be able to make use of the forex scalping strategy and benefit from the market.

Therefore, if you are still reading this at the time, I would like to congratulate you, because it means you already have one of the needed traits which is patience and every successful trader has that.

Download Scalping Trading Strategy PDF

SEE OTHER DOWNLOADABLE PDF ARTICLES

The Best Moving Average Strategy PDF Guide

The Best Day Trading Strategy PDF Guide in 2024

24 Powerful Candlestick Patterns PDF Guide

Taking Profitable Trades Using Trading Chart Patterns PDF Guide

Smart Money Concept Trading PDF

The Best Price Action Trading PDF Guide For Beginners

Are you interested in joining a community where you can learn all you want to know about the cryptocurrency space, defi, web3, and forex trading and also have access to live AMA sessions from time to time, then click the button below to join Dipprofit Telegram Community For Free Now.