Introduction To Day Trading

The end goal of trading is to make a profit and every profitable trader today started from the lowest point and honed their skills through both experience, practice and acquisition of knowledge. As a trader, I have always believed that before you attain profitability in trading one of the most important things you need in your arsenal is understanding your personality as a trader and the trading strategy that best suits that personality.

I know you would agree that it is more difficult to change your personality than looking for the best strategy that suits that personality. This is why although I have learnt, used and mastered some great trading strategies, I only truly make use of one that suits my personality as a trader. In this article, I will be explaining one of the most commonly used trading types called day trading, I will also be giving a proven day trading strategy which has been developed with some years of experience.

If you are someone who can take a high number of risks in a short time, or you enjoy the thrills of getting instant rewards and feedback from highly risky adventures, are unable to stay too long waiting or expecting something, or are eager to quickly cash in on your profits then day trading is for you. In the next paragraph, you should know why, as I will be giving an easy-to-understand definition of day trading.

What is Day Trading

Day trading is simply a financial trading strategy in which traders buy and sell one or more financial instruments within the same trading day using smaller timeframes ranging from 1 minute to 4 hours. This approach is characterized by its quick decision-making and hands-on involvement in the market. It carries a higher level of risk and also has a higher chance of loss as traders most times take their trades at the spur of the moment.

Day trading stands apart from other trading styles, notably swing trading and position trading this is because while swing traders hold positions for days or weeks to capture price swings, and position traders take a longer-term investment approach, day traders seek to capitalize on intraday market fluctuations. Day trading has its advantages as well as its disadvantages. Let’s take a look at some of the benefits of day trading.

Benefits of Day Trading

There are lots of benefits in day trading, let’s take a look at a few below:

- Fast Execution

- Patience

- Accessibility

- More Opportunities

Fast Execution:

With day trading, the trader does not need to wait for a long time before they can trade as they can trade at any point in time. They can take trades any day of the working week and at any time also, as soon as they supposedly see an opportunity.

Patience:

Day trading as compared to swing trading and position trading requires very little patience as you don’t need to look for a long-term opportunity as you can instantly execute a trade once an opportunity occurs.

Accessibility:

You can carry out day trading anywhere in the world and you don’t need to wait to get to a particular location before day trading.

More Opportunities:

Due to the fact that day trading means you can always trade every day, you also have access to more opportunities daily once you have mastered the proper day trading strategies.

Now that we have examined some of the benefits of day trading, we will proceed to look at some of the most common day trading strategies that you can use in your day-to-day trading process.

Common Day Trading Strategies

When day trading, you would need strategies that will help make your trading experience worthwhile and profitable, these strategies would then be mastered over time. Here I will mention some of the most common day trading strategies available or mostly used by day traders.

- High-Frequency Trading

- Scalping

- News Trading

- Range Trading

High-Frequency Trading:

This type of trading is mostly automated, which means it involves the use of trading robots, expert advisors (E.A) and algorithmic trading to carry out high-level trades exploiting the inefficiencies in the market within short periods. This can only be done by automation, as it is very difficult for individual traders to easily spot these short market inefficiencies.

Scalping:

Scalping is a popular day trading technique employed by traders to make swift profits by buying or selling currency pairs within a short holding period. A scalper seeks to capitalize on the frequent small price fluctuations that occur throughout the day, making numerous trades in the process. They make use of the smallest timeframes making it easy to spot very short-term opportunities. The most commonly used timeframe for scalping ranges between 1 minute to 15 minutes timeframe.

News Trading:

Another day trading strategy is news trading, but this type of strategy limits the number of times the day trader takes his trade to the news available. It is also a very useful day trading strategy as the trader waits for trade opportunity that comes from news and event updates which most times causes volatility in the market for some time during the day.

The trader capitalizes on these periods to make multiple market entries and can make either a lot of profit within the news day or incur losses.

Range Trading:

Range trading strategy is one of the most basic day trading strategies we have, as it involves pure price action. While carrying out range trading, the trader actively makes use of the support and resistance level at a particular zone and this is very effective when carrying out intraday trading. The trader waits for the price to get to a resistance level, where they instantly sell and when it gets to the support level they buy.

To confirm that a financial instrument or the financial market is currently ranging, you need to ensure that the support and resistance level within the current price zone has been tested and retested multiple times, over some time.

Later in the article, I will be giving a practical illustration of one of my best day trading strategy, which you can use to further improve your chances of profitability as a day trader.

How to Start Day Trading for Beginners

Before delving into day trading, aspiring or beginner traders should prioritize education. Understanding market dynamics, strategies, risk management, trade management and risk to reward strategy is also very crucial. Below are some of the steps to take when embarking on day trading as a trader.

- Educate yourself

- Set Realistic Goals

- Start Small

- Practice with Demo Accounts

- Create a Trading Plan

- Learn & Understand Technical Analysis

- Stay Informed (Understand Fundamental Analysis)

- Manage Risk

- Start With Liquid Assets

- Understand Trading Psychology

- Review and Learn from your Trades

- Continuous Learning from Experienced Traders (Mentors)

- Comply with Regulations

- Choose the Right Broker (Trading Platform)

Educate Yourself:

Learn the basics of trading how it operates and the various financial instruments available for trading.

Understand different trading strategies and ensure that you choose the one that aligns well with your personality, Make sure to learn and understand technical analysis and fundamental analysis. You can learn this here on dipprofit.

Set Realistic Goals:

There is a popular saying that ‘when you fail to plan then you are already planning to fail’. Many beginner traders jump into trading today without setting any goals. Their only aim is getting into the market to make a quick profit. This already sets you on the wrong path, as you eventually get carried away with the overwhelming activities involved in trading.

Therefore as a trader, it is important to define your financial goals and risk tolerance. Be realistic about what you expect to achieve daily, weekly and monthly basis and how much risk you are willing to take on each trade. Also, determine the amount of capital/liquidity you need to have before using a particular lot size and by doing this, you would be able to effectively grow as a day trader.

Start Small:

If you are just getting started with day trading, then it is important to risk small amounts first, so you get to improve on your emotional management and discipline and also understand how to make the most when using the strategy before you can go ahead to using larger sums. This helps manage risk while you’re learning the ropes.

It also helps you with proper risk management and planning.

Practice with a Demo Account:

A demo account is a practice account that has all the features available in a live account, the only difference is the fact that you don’t need to use real capital or liquidity to trade on the practice account. The broker provides you with a Virtual amount that you can use in trading. This allows you to get comfortable with the trading platform and test your strategies without risking real capital.

This is also a great way to understand a lot about the brokerage platform such as the spread/fees, the trading tools available etc.

Create a Trading Plan:

As I stated earlier, as a trader if you fail to plan, then you are already planning to fail. Your trading plan is the sum of all your trading arrangements. It includes your trading goals, trading strategy and risk management setup. All these are necessary for becoming successful as a trader and you need to have them properly documented and journaled.

The trading plan serves as your guide as a day trader and helps you make great trade decisions daily thereby minimizing your losses and maximizing your profit. Always ensure you stick to your plan and avoid impulsive decisions.

Understand Technical Analysis:

You can’t even think of making a profit as a day trader if you don’t properly understand technical analysis. Technical analysis helps you to easily interpret charts, identify trends, identify bullish and bearish movements, spot supply and demand zones and so on. It also helps you know how to use trading indicators to spot trade setups and signals.

Technical analysis is crucial for every day trader and understanding how to use it would improve your chances of profitability in trading.

Stay Informed:

Information is key, especially in trading. As a day trader, you should keep yourself updated on market news, economic indicators, and any events that may impact the assets you’re trading. The process of using news, events and economic indicators in speculating the possible market direction is known as fundamental analysis. Therefore, it is very important to learn and understand fundamental analysis as a trader because activities such as economic news and events have a great impact on the market.

Using technical analysis alongside fundamental analysis greatly increases the chances of profitability for you as a trader.

Manage Risk:

Risk management is another key aspect of trading. A trader who can master all the other trading skills and knowledge but fails in risk management would end up also failing as a trader in a short time. Risk management is the technique professional and profitable traders use to manage their capital and achieve profitability in trading. It involves proper planning, discipline, personality development and money management skills.

You can use risk management techniques such as setting stop-loss orders to limit potential losses, using a small percentage of your trading capital on a single trade, and properly managing your leverage and margin level.

Start with Liquid Assets:

In the financial market, the more liquidity an instrument has, the easier it is to trade the financial instrument and the lower the fees/spread charged by the broker. This is very good for day trading since the traders can take multiple trades in a day and each time the trades are taken, the brokers take their fees.

Therefore, Focusing on trading highly liquid assets, as they usually have narrower bid-ask spreads, would help reduce transaction costs and allow you to take more trades in a day.

Control Emotions:

Emotional discipline is key to successful day trading. Avoid letting fear or greed dictate your decisions. Stick to your strategy and remain calm under pressure.

Review and Learn from Trades:

After each trading day, review your trades to analyze what worked and what didn’t. Learn from your mistakes and successes. Then apply them to the next trading day, rinse and repeat this process till you can properly develop an airtight trading strategy.

Continuous Learning from Experienced Traders (Mentors):

The financial markets are dynamic and constantly changing. Stay committed to continuous learning and adapting your strategies based on market conditions. Getting an experienced and already successful trader as a mentor is more like a shortcut in this process. This is because with a mentor you will be able to avoid experiencing lots of errors and will have knowledge of them only through the experience of your mentor. This makes the process faster and easier.

Comply with Regulations:

Every country and region has their governing laws and regulations as regards financial trading, therefore, it is important to be aware of and comply with the regulations governing day trading in your region. This includes understanding margin requirements and the pattern day trader rule. Now you may want to learn what pattern day trading is and what the pattern day trader rule is, i will talk briefly about it later in this article.

Choose the Right Broker (Trading Platform):

A broker is the intermediary between the trader and the market. It is the trading platform which the trader uses when communicating with the financial market and it is the most important tool for day trading.

It is no longer news that there are a lot of dubious and fraudulent brokers out in the trading space and that is why you need to properly research and make your findings about a broker before you start using them to trade the financial market.

Firstly you need to ensure that the broker you are choosing aligns well with your trading strategy, for day trading strategy, almost every legitimate broker is compatible with it.

Secondly, you must determine the broker spread or the fees the broker charges as you carry out your trade, some brokers take outrageous spreads or fees on every trade leaving the trader in losses at the end of the day.

Thirdly, you need to ensure that the broker you are using or about to use in your trading is properly regulated and licensed.

To make your selection easier, I would mention some of the best and most reliable trading platforms you can easily select from in the next paragraph.

Best Day Trading Platforms Based on Country/Region

The trading platform you use for your trading activity will always vary from country to country and from region to region as you all know, different government policies and regulations for different countries. I have already compiled a list of some of the best trading platforms in the United States which you can read more about using this link. I will still list them here also.

Best Day Trading Platforms in the U.S

- FOREX.com

- IG U.S

- OANDA

- FXCM

- TD Ameritrade FX

- Coinbase

You can read more on these best forex brokers in the U.S. by following this link.

Best Day Trading Platforms in Nigeria

- Hantec Markets

- Alpari

- Hot Forex

- Exness

- FXPro

- Bybit

- Binance

Best Day Trading Platforms in India

- AvaTrade

- Exness Group

- RoboForex

- IC Markets

- IG (Pro)

Best Day Trading Platform in South Africa

- Pepperstone

- AvaTrade

- Plus500

- IG Markets

- Admiral Markets

I will be doing a more detailed article on the best trading platforms in Nigeria very soon, so stay tuned by just clicking the subscribe button on your right if you are reading this using your P.C. or clicking the subscribe button at the bottom of the page if you are using your mobile phone. Also, if you want me to do my research and include your country here, kindly drop your request in the comment section and it will be attended to.

At this point, I suppose you should have gathered quite some knowledge from the article so far to prepare you for your day trading journey. To put the icing on the cake and make this article a masterpiece for you my readers, as promised at the beginning of the article, I will be giving an illustration of one of the best day trading strategy, using pictorial guides as an aid. You can learn how to use this particular day trading strategy and if you can understand it properly also integrate it into your trading arsenal.

8 Chart Patterns Every Beginner Trader Must Know to Succeed in Trading

The Best Day Trading Strategy to Use in 2024

So, in this strategy, I will be using the 15-minute chart for my entries, and the four-hour chart to get my major areas of value you can never forget your risk management strategy which is very important to becoming a profitable trader. Therefore I will be using a positive reward-to-risk ratio.

I have been able to create a trading strategy combining the strategy with my day trading process which I am now giving to you since you are interested in using the day trading approach in your trading journey.

As I provide you with a step-by-step guide to mastering this day trading strategy, I would love for you to subscribe to our newsletter for more article updates and also do well to share the article with your friends and community if you find this useful.

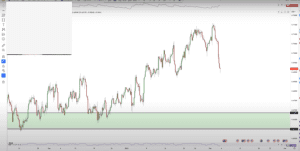

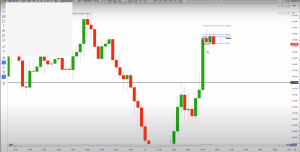

Let’s get started. Right now we’re looking at the Aussie dollar in the chart below. The first step in this strategy is going to be finding prominent and major areas of value on the four-hour chart.

Now, unfortunately, this is one of the most subjective parts of this strategy and there’s no way to have absolute set-in-stone rules for identifying areas of value and levels of structure. So for that reason, I’m going to be showing you exactly what I look for when using this day trading strategy right now.

You should also understand that just like any other strategy, you only get better at it with experience. Now for me, looking at the Australian dollar in the diagram below where price currently sits, one thing is for sure here, and that is the fact that price is going to do one of two things. Price is either going to go higher or lower.

That’s the only two things Price ever does. So with that being the case, the question you have to ask yourself is, if the price goes higher, what is the most prominent level of structure that you see? The rules for this, although they can’t be set in stone, are laid in the way the zone is drawn.

Now to identify and draw the zone, you need to look for a recent area of structure that’s been tested multiple times, and looking at the diagram below that area most obviously is the area indicated with the horizontal line.

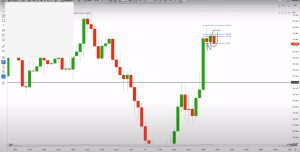

We have a level of structure that has pushed prices around multiple times as indicated in the diagram above. So if the price heads higher, I know this area and it’s not just that straight line but it’s more of an area or a zone as indicated with the rectangle, is going to be an area I will look at for possible sell trades. I hope you are still with me on this one. The other thing the price can do is that price can push down.

If price pushes down, still looking at the diagram above, where do you see as the most prominent and major area of value that price is going to hit? If you were able to point this level out, then that’s great, if you weren’t there is no need to panic, you will soon become familiar with the process.

Looking at the chart above, right here we have another level that has very obviously pushed prices around in a major way throughout the past. With that being the case, I know if the price pushes lower, I’m going to be looking in this zone again, it’s no longer a straight line but a zone as indicated in the diagram above with the rectangular shape. This zone indicates a possible buying opportunity in our day trading strategy.

So I just wanted to show you how can identify major levels of structure before we go over the full strategy. Now let’s go ahead and take a look at an example of the full strategy just in case you didn’t properly understand the previous illustration.

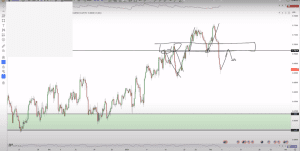

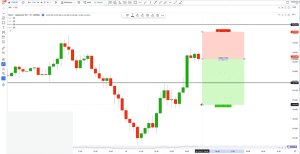

Now, looking at the diagram above you should notice we are on the euro yen (EurJpy) and we’re looking for major areas of value from where price is right now. The current price is indicated in the diagram above. Now remember what I said earlier, price can do one of two things. It’s either going up or going down. If it goes up, what’s the major area of value that you see on the chart?

Looking at the diagram above, you should see the major area of value that is highlighted on the chart above, considering that this is the area that pushed the market around the most.

Now what’s the second thing price can do? Price could go down let’s also if there is any prominent area of value to identify considering that price might go down. We do have a prominent level as you can see it identified in the diagram below.

But if we wanted to trade before that, there’s another level that can be identified and that is indicated in the diagram below. The reason the area/zone is identified as a place of value is because this also is an area of support.

The market was supported from that area multiple times and has been tested multiple times as support and as resistance. So we have three areas of value that we’re looking at indicated in the diagram below by the horizontal lines in the chart.

The next thing to do is to drop down to a lower time frame, remember we use the 4-hour timeframe to determine the area of value and the 15-minute chart for entry. So I use the 15-minute timeframe to get a good entry for my day trading.

Before we move to the 15-minute timeframe, we need to determine where our trade opportunity lies. Taking a look at the diagram below, you will see that price has broken through the support zone of our first area of value with a bearish candle and the next candle was a bullish candle that couldn’t break through the former support now turned resistance zone.

So it looks like something is going to happen in the level we have spotted on the 4-hour timeframe as indicated in the diagram above. The next step is going to the 15-minute timeframe to look for our confirmation.

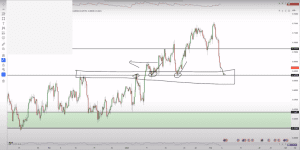

Zooming into our area of value in the 15-minute timeframe and considering the resistance level we’re looking for possible sell trades from this area of value.

The confirmation strategy I make use of is a candlestick formation which involves finding a candlestick pattern that is followed by a candlestick that closes below the candlestick pattern within the next 3 candlesticks after the candlestick pattern. You should also understand that this candlestick formation should be within the area of value we have been able to identify.

The candlestick pattern can be any of the reversal candlestick patterns and this confirmation should be looked for in the 15-minute timeframe.

So still following our illustration, and while looking at the 15-minute chart in the diagram above, you should notice that immediately after the last bullish candle, which we spotted on the 4-hour timeframe, the next is a candlestick pattern and the name of this candlestick pattern is called the shooting star candle which is also a candlestick reversal pattern.

After spotting the candlestick pattern, the next thing to look out for as I said is to look for a candlestick that closes below the I want to see for added confirmation, since we are on a lower time frame down here on the 15-minute chart, what I want to see for added confirmation is a candlestick that closes below the low of that shooting star candle within the next one, two, three candles.

Now, looking at the diagram above, you will notice that happening within the next two candles. The candle circled in the diagram above is the candlestick that we are looking for so obviously that rule is met.

So, again, to do a recap, we wait for prices to get to our area of value that we’ve pointed out on the four-hour chart, then again wait for a candlestick pattern.

In this specific case, it’s a shooting star candlestick and within three candles, we’re waiting for a candle to close below that candlestick pattern, low. Now from the chart above we have that right there, making it a perfect scenario for a possible trade in our day trading strategy.

The next step will be placing an order. Our entry point will be at the closing of the candlestick that closed below the candlestick we discovered, you can also see that in the chart above. Our Stop Loss and Entry points are closely related to our risk-to-reward ratio.

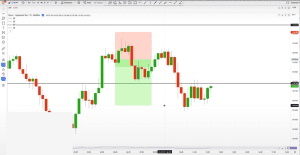

Using this day trading strategy the most compatible risk-to-reward ratio is 1:1.7, this has proven to have the most consistent result. We can’t do a 1:1 as that would not be profitable in the long term, especially for long-term day trading.

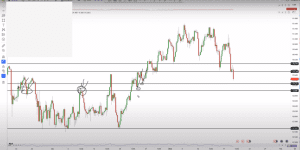

Let’s go ahead and check the result of the trade we just placed. We can see that in the chart above Prices pushed up a bit, then pushed down, and eventually, as you can see, came down enough to hit our targets.

Now before we conclude this long article, I know you might have some questions in mind, the most likely is how do you know if it will be a bullish trade you should be taking or a bearish trade? It is quite easy, price was below the area of value which we just took the trade from, making the area of value into a resistance or supply zone. Since it is a strong zone, I was already 50% sure that price is likely to bounce back from the area and keep trading downwards but as you know we can’t conclude with just 50% probability.

This is why the candlestick confirmation rule was added making it a confluence and also increasing the validity of our speculation.

Smart Money Concept Trading for Beginners: Learn How the Banks Trade

Conclusion

Finally, as with every other strategy, this strategy does not win all the time. This is why risk management and emotional management are vital for a day trader, as you can ensure that your ROI over time is in profit due to proper and strategic planning alongside discipline.

As I always say to my students, a great strategy would only make your trading easier but does not guarantee profit, applying risk management to an already great trading strategy is what can guarantee profitability in trading over time.

You can also read my article on Risk Management, to better understand what it takes to apply proper risk management principles. See you in my next article. Please do well to like, subscribe to our newsletter and share this article if you were able to find value.

Frequently Asked Questions

How Many Trading Days in a Year?

The number of trading days in a year can vary depending on the financial market and its operating hours. In the context of the stock market, which typically follows a Monday through Friday schedule, there are generally 252 trading days in a year. This calculation considers weekends, holidays, and other market closures. As for the Crypto market, it is open throughout the calendar year making it 356/366 days.

Day traders therefore have a lot of trading opportunities available to them irrespective of the financial market they are participating in.

Is Day Trading Profitable?

Day trading involves high-frequency trading done regularly and this also increases the chances of profit as well as the chances for more losses. Statistics have proven day trading to not be so profitable, as a majority of the traders using the day trading strategy are novice traders and end up consumed with greed. We are looking at about a 90% loss possibility. This doesn’t mean you can’t be profitable as a day trader but it needs a great deal of discipline, experience and understanding of the market.

Are you interested in joining a community where you can learn all you want to know about the cryptocurrency space, defi, web3, forex trading and also have access to live crypto and forex market news updates from time to time, then click the button below to join Dipprofit Telegram Community For Free Now.

Good article, thanks! Can I get it in pdf? kiskisel@yahoo.com

Hello Elena, we are glad you love it, you can download the pdf document for all our trading articles right here on our website. Just navigate to the ‘Trading Education’ Category, and select the pdf archives. You can immediately select the article you want to get the PDF file to click on the article and you will see the download pdf button right there.