USDT Tether Market Cap Hits Record $89 Billion

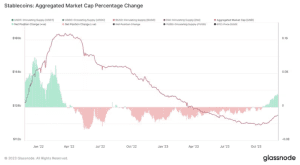

In what looks like a drastic but expected shift in the crypto market, fresh capital is now making its way into the cryptocurrency domain, marking the first expansion of the stablecoin market in over 18 months. Notably, USDT Tether Market CAP surged to an unprecedented market cap of $89 billion, as indicated by Glassnode data. The collective market capitalization of the leading stablecoins has seen a robust increase of nearly $5 billion in the past month, reaching a total of $124 billion.

This expansion signifies a substantial reversal of a prolonged downtrend that commenced around May 2022, aligning closely with the onset of the challenging period known as the crypto winter. Stablecoins, essentially digital versions of conventional currency, play a pivotal role in the crypto ecosystem by facilitating seamless transitions between traditional fiat money and blockchain-based digital asset markets. They also serve to furnish market participants with essential liquidity for trading and lending activities.

The resurgence in the size of the stablecoin market is regarded as a positive indicator for the overall well-being of the recent cryptocurrency rally. Tanay Ved, an analyst at Coin Metrics, interprets this upward trend as a leading signal of enhanced on-chain liquidity, suggesting an environment where more capital is accessible for deployment.

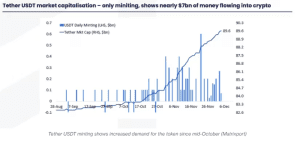

One thing of note is that a substantial portion of this growth is attributed to Tether (USDT), the foremost stablecoin by market cap, widely utilized on centralized exchanges and for transactions in emerging economies. According to a report by Matrixport, Tether’s supply has increased by $7 billion since September, with a notable acceleration in minting activities since mid-October.

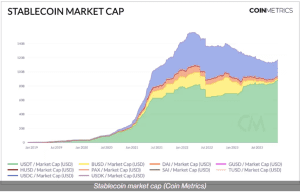

The current market cap of USDT is approaching $90 billion, surpassing its previous all-time high in 2022, as per CoinGecko data. Despite the growth of USDT, the contraction experienced by competitors like USDC and BUSD had offset its expansion until recently. Noelle Acheson, an analyst and the author of the Crypto Is Macro Now newsletter, views this trend as a positive signal for crypto assets, indicating a growing interest from investors.

However, she emphasizes that it is still early days, considering that the total stablecoin market cap remains below levels seen earlier this year when the outlook for the crypto market was arguably more challenging.

Read More News & Articles:

- The New Money Evolution: Lugano Residents Can Now Pay Taxes and Bills with Crypto

- Coinbase Wallet Unveils Crypto Transfer Features Using WhatsApp, Telegram and Others

- JPM Coin News: JPM Coin Set to Transform Interbank Transactions on Partior

- The Rise of Cryptocurrency: Bitcoin ETF Leads the Charge

Are you interested in joining a community where you can learn all you want to know about the cryptocurrency space, defi, web3, forex trading and also have access to live crypto and forex market news update from time to time, then click the button below to join Dipprofit Telegram Community For Free now.