Supply and Demand Trading Strategy PDF Guide

The basic principle of supply and demand has always been a dominant force in the market, shaping price movements. This is why the supply and demand trading strategy is highly effective for traders, as it enables them to pinpoint crucial supply and demand zones on the chart, which, in turn, inform their buy and sell decisions. According to the law of supply and demand, when demand surpasses supply, prices rise, creating a bullish market. Conversely, when there’s an excess of supply compared to demand, prices fall, resulting in a bearish market.

In essence, supply and demand denote intense buying and selling activities in the market. Supply and demand zones, on the other hand, represent specific areas where significant price shifts occur on the chart. When we identify these supply and demand levels, it signifies that major players such as banks and institutions are entering the market, driving significant price movements. This serves as a critical signal to enter either a buying or selling position, depending on the prevailing price direction at that moment.

These explanations provide a glimpse into the functionality of the supply and demand trading strategy. Now, let’s delve into what exactly supply and demand zones represent.

What are Supply and Demand Zones in Supply and demand Trading Strategy?

From the above explanation, supply and demand is basically aggressive selling and buying. While supply and demand zones are zones where the price starts making big and massive prices on the chart. When we spot these supply and demand levels, what it tells us is that the big boys like banks and institutions are entering the market and pushing the market in the direction where the major price movement is going and this should be the right time to enter a buy or sell position, depending of the price movement at the time.

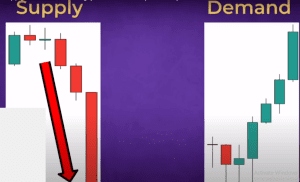

Looking at the chart above we can see at the supply side there is a serious bearish momentum, with the price falling aggressively, while on the demand side, we can see there is a great bullish momentum with the price level rising aggressively.

Putting it in simpler terms, for you to spot a supply zone using the supply and demand trading strategy, we would see it forms before a downtrend, while a demand zone forms before an uptrend. This is how you would be able to spot your demand and supply zones. Furthermore, these momentum candles shown in the diagram above tell us smart money is in the market, but if you see small candles like the one in the diagram below, it is not demand or supply at all, what it means is that we just have the retail traders trying to scrape some funds from the market, as there is no real liquidity in the market yet.

See Also: The Secret to Profitable Forex Trading: Trendlines and Channels

Why Should We Trade Supply And Demand Zones?

Why you should use the supply and demand trading strategy in your trading is because it helps you to trade when the big boys like the banks and institutions are trading with smart money, you are reacting with them as they react and you would be able to get enough liquidity from the market as a result. The best way to easily identify when the big boys like the banks and institutions are entering the market is by using the supply and demand zones trading strategy.

You might want to ask why should I want to always trade with the big boys rather than scrape the market, but you should remember that you are a retail trader, and retail traders in most cases always provide liquidity for the big boys. Why? you may ask again, we should not forget, that while you and all your trading colleagues are trying to trade with $1000 to $10,000 these big boys like banks, institutions, and hedge funds deal with hundreds of millions and billions of dollars in the market every day.

what a billion dollar looks like

Now if you are a professional trader you should already know that liquidity drives the market in whatever direction it wishes, so when these big boys come into the market with lots of cash liquidity, they more or less stare the market in a particular direction, if you are able to discover the supply and demand zones which can also be called order blocks where they enter into their trades, it is very likely you would make your profit from the market. This is why I mentioned earlier that the supply and demand trading strategyis one of the most profitable trading strategies around.

In essence, supply and demand trading strategy is the process of identifying supply and demand zones and levels while using them to determine possible buy and sell positions. In this our supply and demand trading strategy pdf guide, you will be learning how to use supply and demand zones to properly enter a buy or sell position.

Supply and Demand Trading Strategy PDF Guide Download

Trading is a complex endeavor that demands a range of techniques, experience, and expertise. Success in trading is influenced by various factors, including technical analysis, market fundamentals, trader sentiments, and economic conditions.

Traders often find themselves overwhelmed as they navigate the markets, struggling to filter out the noise that surrounds them. The constant stream of data from charts, price movements, and other sources can lead them astray, causing them to lose focus and, ultimately, equity.

Recognizing these challenges, we at Dipprofit are committed to assisting traders in their journey. We provide in-depth articles packed with valuable information and knowledge to simplify and enhance their trading experience.

Furthermore, we’ve taken a step further to ensure that our educational resources are easily accessible to our readers. Our articles are available for download, facilitating further learning and research.

You can also read the full article by clicking this link Here

Download Other Trading PDF Guides

- Smart Money Concept Trading PDF

- The Best Trading Chart Patterns PDF Guide

- 24 Powerful Candlestick Patterns PDF Guide

- The Best Guide For SMC Trading Strategy PDF

Join our telegram community to get up-to-date news, educational materials, free online classes, market analysis, and crypto futures trade signals that will help you grow and become profitable.

Subscribe to our newsletter to get more educational content, tips, and updates.