Binance Ceo Resigns

Source: Bloomberg

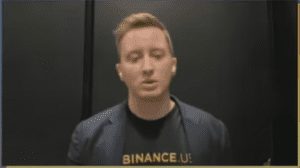

Binance.US, the American arm of the crypto trading platform, is undergoing significant changes as its CEO, Brian Shroder, steps down from his role. Shroder has been succeeded on an interim basis by Norman Reed, who previously served as the Chief Legal Officer, according to a company spokesperson.

This leadership transition comes in the midst of a challenging period for the company, which is controlled by Changpeng “CZ” Zhao, a prominent figure in the digital entrepreneur space. Binance.US is currently in the process of reducing its workforce by over one-third, which translates to more than 100 job positions. The reason behind these layoffs is a regulatory crackdown that has impacted the company’s operations.

Formally known as BAM Trading Services Inc., the exchange was established in 2019 specifically for US users, who are restricted from using Binance Holdings, the parent company.

Staffs Layoffs

This round of job cuts is the second one this year for the Miami-based firm. It is facing a slew of legal and operational challenges, including accusations from the US Securities and Exchange Commission (SEC) of mishandling customer funds, misleading investors, and violating securities rules. These allegations have been denied by Zhao and the associated companies.

In addition to the SEC’s action, the US Commodity Futures Trading Commission charged Binance and Zhao with “willful evasion of federal law” in March. The Justice Department is also conducting an investigation into Binance, though it hasn’t levied any accusations of wrongdoing against the company yet.

The regulatory pressure had immediate consequences for Binance.US users, who found themselves unable to deposit or withdraw dollars as several banking partners severed ties with the platform. The company had to resort to an alternative method for its US users to convert dollars into cryptocurrencies.

The market share of Binance.US has dwindled significantly, dropping to approximately 0.6% from the 2.39% it held in April, according to Jacob Joseph, an analyst at researcher CCData. Monthly trading volumes have also fallen below levels seen in early 2020.

A company spokesperson stated, “The actions we are taking today provide Binance.US with more than seven years of financial runway and enable us to continue to serve our customers while we operate as a crypto-only exchange. The SEC’s aggressive attempts to cripple our industry and the resulting impacts on our business have real-world consequences for American jobs and innovation, and this is an unfortunate example of that.”

Prior to this departure, Binance.US had already laid off an unspecified number of workers following the SEC’s actions, as reported by Bloomberg in June.

See Also: 11,196 Years Prison Sentence for the Ceo of Collapsed Crypto Exchange Thodex

News Snippet

It’s worth noting that Binance Holdings, the parent company, has also been witnessing the departure of executives and employees in recent months. This includes the departure of two executives responsible for regions including Eastern Europe and Russia this month. In August, Binance lost its head for the Asia-Pacific region, and in July, several executives, including its Chief Strategy Officer, left the company.

Brian Shroder joined Binance.US two years ago after holding positions such as Head of Business Development, Global Partnerships, at Ant Group, and Head of Strategy and Business Development in the Asia Pacific for Uber. His tenure followed the brief term of the prior CEO, Brian Brooks, who left the position after only four months.

We Hope you’ve learned a lot from this article!! We’re glad you did.

Join our telegram community to get up-to-date news, educational materials, free online classes, market analysis, and crypto futures trade signals that will help you grow and become profitable.