Introduction

Since the pandemic in 2020, NFTs have emerged as a groundbreaking asset class within the digital realm.

These digital assets have captured the attention of many investors worldwide by offering different opportunities for growth and innovation.

This article will explain seven ways to invest in NFT, covering various investment avenues and strategies to maximize your potential returns.

Why Invest in NFT?

Investing in NFT can be an attractive opportunity for several reasons.

Firstly, the NFT market has experienced rapid growth, with high-profile sales grabbing headlines and attracting attention worldwide.

Additionally, investing in NFT allows you to participate in the growth of the broader NFT ecosystem, including digital art, gaming, virtual real estate, and more.

7 Ways To Invest in NFT

These are 7 of the best way to invest in NFT :

- Investing in NFT marketplaces

- Investing in NFT marketplace tokens

- Investing in NFT marketplace stocks

- Investing in Blockchain technology

- Investing in Blockchain scaling companies

- Investing in NFTs with Cryptocurrencies

- Investing in NFT Metaverse land

Investing in NFT Marketplaces

NFT marketplaces are a good head start if you want to begin investing in NFT companies.

NFT marketplaces serve as online stores or platforms where creators can mint, buy, and sell NFTs in return for a fee.

By investing in NFT marketplaces, individuals can benefit from the overall growth of the NFT ecosystem.

Some popular marketplaces that you can start are Opensea, Rarible, and Mintable. There are also other marketplaces grouped according to what they offer.

Some are grouped according to the blockchains that the NFTs are hosted, others are grouped according to the quality and price of NFTs that are being traded on the platforms.

But, before investing in NFT marketplaces, it is vital to research and identify reputable and established marketplaces that showcase strong user adoption and a diverse range of high-quality NFT offerings.

See also: 7 Best NFT Marketplaces to Buy and Sell in 2023

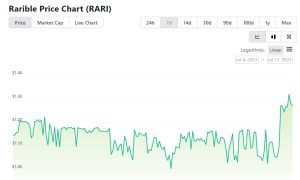

Investing in NFT Marketplace Tokens

NFT marketplace tokens are cryptocurrencies specific to certain NFT platforms. These tokens often hold utility within their respective ecosystems, granting holders various benefits or privileges.

To invest in NFT marketplace tokens, you should consider acquiring NFT marketplace tokens as they may appreciate value alongside the growth and success of the underlying NFT platform.

The tokens that have been created by these NFT marketplaces are usually on the same blockchains as their marketplaces and a good reason why most of them depreciate in value when the tokens are having lesser circulation than usual.

Currently, the most popular NFT marketplace tokens being traded are Rarible ($RARI) and Binance ($BNB) due to their high trading activities. So, investing in these marketplace tokens is a good way to invest in NFT companies.

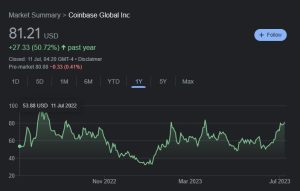

Investing in NFT Marketplace Stocks

Another great way to invest in NFT companies is by investing in NFT marketplace stocks.

Several publicly traded companies operate NFT marketplaces or provide services related to NFTs and investing in the stocks of such companies can offer exposure to the growing NFT industry.

The NFT industry has taken a massive leap in growth since the pandemic in 2021 when almost the whole world was forced to a work-from-home concept.

Since then, the market value of many NFT marketplace stocks has plummeted because of the consistent amount of trades that are being recorded every day.

The consistency of this structure has made the value of NFTs, marketplaces, and stocks grow very high and also provided a very mouthwatering venture for investors.

Some NFT marketplaces stocks to invest in include Gamestop and Coinbase.

It is important to research the financial health, market position, and growth prospects of these companies before making investment decisions.

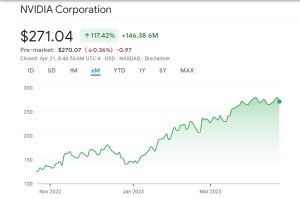

Investing in Blockchain Technology

In addition to NFT marketplace stocks, investors can explore publicly traded blockchains that these NFTs and their marketplaces are being traded on.

Blockchain technology serves as the foundation for NFTs, providing security and transparency to digital assets.

Investing in blockchain technology companies can offer exposure to the broader blockchain industry, which supports NFT development and adoption.

Some of the most popular blockchains to start with are Ethereum, the most notable blockchain in which many NFTs are hosted, Solana, Avalanche, etc.

Identifying companies involved in blockchain infrastructure, development, or solutions can provide investment opportunities in this emerging field.

Here’s a full list of the most popular blockchains to invest in:

- Mastercard (MA)

- Amazon (AMZN)

- NVIDIA Corp (NVDA)

- IBM Corp (IBM)

- Riot Blockchain (RIOT)

See also: Top 4 Avax NFT MarketPlaces to Trade in 2023

Investing in Blockchain Scaling Companies

Another way to invest in NFT companies is by investing in Blockchain Scaling Companies. These companies are the ones in charge of maintaining the immutability and scalability of a blockchain.

They are also there to enhance transaction speeds and reduce costs while addressing critical issues that may hinder the widespread adoption of NFTs.

As the popularity of NFTs and blockchain technology grows, scalability becomes a significant challenge.

Investing in companies that develop or provide solutions for blockchain scalability can be a strategic move.

Here are some of them to get started with:

- Polygon ($MATIC)

- Gnosis (xDAI)

See also: Revealed: How NFT Marketplaces Make Money

Investing in NFTs with Cryptocurrencies

Some NFTs incorporate embedded cryptocurrencies and tokens, adding an extra layer of value and utility.

Investing in these NFTs with Utilities can provide potential exposure to both the NFT market and the cryptocurrency embedded within them.

There are some NFTs in the market right now that are used as a medium of transaction for gaming platforms, as a native currency.

These tokens have now been listed on many exchanges to be traded as crypto. Some of them include the $BAYC token, $MANA used within Decentraland, and Axie Infinity’s $AXZ.

Careful consideration should be given to the underlying cryptocurrency’s fundamentals and the long-term prospects of the associated NFT project.

Investing in NFT Metaverse Land

Another major way to invest in NFT companies is by investing in virtual land or virtual real estate. NFT metaverse land refers to virtual parcels of digital space within decentralized virtual worlds.

These virtual lands are listed on marketplaces as an asset for gamers and users to purchase and use in-game.

They can be traded within the marketplace and ownership of the assets is transferred when the land is exchanged within gamers.

Investing in NFT metaverse land can provide opportunities for long-term value appreciation as these virtual worlds gain popularity.

Analyzing common factors such as community engagement, development roadmap, and partnerships can help identify metaverse projects with promising returns.

Conclusion

Investing in NFT companies presents exciting opportunities for investors seeking exposure to the digital asset revolution.

By understanding the potential of NFTs, researching companies, evaluating teams and technology, analyzing marketplaces, diversifying portfolios, staying informed, and adopting long-term strategies, you can navigate this emerging market successfully.

However, it’s essential to be aware of the risks involved and make informed decisions based on thorough research and analysis