Forex Hedging Strategy for Beginners

Forex Hedging Strategy is probably the most misunderstood method in all of forex trading, but it can be a great way to trade and also reduce trading risk. It’s super flexible, you don’t have to use stop losses, and you can actually wait until you have a win and then pair that up with a smaller loss so that you exit your trade with a profit. So if you’re new to the concept of hedging, this article is for you.

In this article, I will be giving you a great introduction to how you can make money using the forex hedging strategy. One of the constant questions I have always had lots of beginner traders asks about hedging. Questions like how do you finally exit a trade if you decide to use the forex hedging strategy, what forex hedging strategy is the best and how can it be properly implemented, and the most common question of them all.

Is it really possible to make a profit from hedging? This is because they think you can’t make money taking a long and a short at the same time, they’re going to cancel each other out.

But in this article, I’ll show you how you can actually make a profit using the forex hedging strategy. Now, like with any other trading strategy, this is not for everyone. But if you read this article and it resonates with you, stick around to the end, because I’ll show you how to get a free guide that will get you started with hedging.

What is Forex Hedging?

All right, let’s start with some basic definitions. First of all, what is hedging? Hedging is a way to limit risk by taking a trade in the opposite direction in a related asset or the same asset. So let’s say that you bought a stock, you could buy an option on the stock, which would make money if the price went down. So you would be long on the stock, but you would have that downside protection with the option. Or you could sell some of that same stock short in another account, and that would cover some of your downside risks also.

So that’s a way of limiting your risk and at the same time, taking advantage of the direction that you think that asset is going to go in. Now, this risk reduction might not be a total loss you could actually profit from it and that’s what we’ll talk about a lot in this article.

Types of Forex Hedging Strategy

From the above definition, you will deduce that we mentioned two types of forex hedging strategy, the first is buying an option on a stock you are already trading while the second is entering the opposite direction on the same commodity you are trading on. This means that there are mainly two ways or strategies in which a trader can trade using the forex hedging strategy.

The first is using or taking option or futures trade to hedge your financial position, this method is used mainly by large organizations, while the second hedging strategy is simply taking opposite trades on the same currency pair you are trading in.

This means taking a long and short position simultaneously on the same currency pair. This particular strategy is used mainly by retail traders and it’s easier to execute.

You should keep in mind while reading this article that forex hedging can actually be an advantage for you. Now, international companies use hedging to limit their foreign exchange risk. So take BMW, for example, they’re selling cars in different countries, and those currencies can fluctuate over time. So they want to protect themselves in case one currency gets too cheap or too expensive and they have a department that hedges their risk on the currency exchange. So that’s one way that big companies use hedging in their day-to-day operations.

Another area where companies use hedging to limit their risk is if they’re a large corporation that uses a lot of commodities, for example, gas or lumber or things like that, that could go up in price significantly. They’re going to hedge that so, for example, an airline would lose money if their fuel cost is too high. So they could use some futures or options to make some money if the price of fuel goes above their profitable price or even before that. That’s another way that big companies use hedging to limit their risk.

Finally, you may not know this, but hedge funds were founded on the principle that they’re going to be hedging their positions. So they were supposed to be slightly safer investments, but that’s no longer the case anymore. A hedge fund doesn’t have to hedge, but they were founded on that principle, and that’s why they’re called hedge funds. All right, now I’ve shown you how hedging works for big corporations and large hedge funds. But as I know you might already be asking, what about independent traders like us?

Well, retail forex provides an easy way to hedge without expensive options or futures contracts, or complicated transactions. Another great thing about retail forex is that it can be easily traded, long or short. It’s the only market that the small independent trader can easily do this in and that’s why this article is targeted directly at retail forex traders. This is not for futures, not for stocks, not for crypto. This method will only work in the forex market and I believe it’s worth mentioning.

The transaction costs are so low that even if you have a small account, let’s say like $500, you can still do this without incurring a lot of transaction fees and a great benefit of hedging in forex is that you can get an excellent feel for the movements of a particular currency pair. So let’s say that you’re trading the pound dollar (GBPUSD), and since you don’t have to necessarily enter and exit the pound dollar at certain prices or with a certain system, you can kind of take some off here, take some off there, put some more on here.

You’ll get a really good feel for how the pair moves and that can help you with your hedging, but it can also help you in developing other trading systems in the future.

Common Misconception for Forex Hedging Strategy

Now, let’s get into the most common misconception around forex hedging. If somebody doesn’t know about hedging, they’ll email me, they’ll show me a spreadsheet, and they’ll show me why hedging cannot work. And it usually goes something like this.

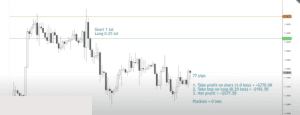

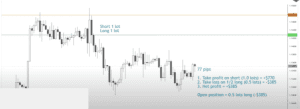

So for example, looking at the diagram above, we’ll take this trade and we’ll take one lot short, and one lot long at the same time, and then let’s say that the price goes down 77 pips. From that green line is where we entered, and the dotted line above 77 pips is the current price. Then they’ll tell me, okay, so the short made $770, the long lost $770, and the net profit is zero. What the heck? How do you make any money from hedging?

See Also: 8 Chart Patterns Every Beginner Trader Must Know to Succeed in Trading

Forex Hedging Strategies

Okay, so I will be giving you some basic ways in which you can use forex hedging to improve your profitability in trading. There are three ways that you can trade using forex hedging strategy and they are:

- Percentage Hedge

- Covered Hedge

- Full Hedge

Percentage Hedge:

First, you can do a percentage hedge. That just means that you are not doing one-for-one. You’re doing a percentage, maybe you’ll have one lot long, but you only have a percentage of that short to cover your downside or the opposite, right? You might have one lot short and you only have a percentage of that long to cover the price going up if you’re looking to go short.

Here is a practical example of how to trade forex hedging using the percentage hedge, as shown in the diagram above, you’re going to go short one full lot, and instead of taking one full lot long, you might take a zero point 25 lot long (0.25), because as you can see, price is hitting a resistance level and it’s probably more likely to go down. If you want to bet that it’s going to go down, you would take one lot short and then only take a little bit long just to cover your upside a little bit.

In this case, you could take one lot short, 0.25 lots long, and when price goes down, 77 pips, you could take a profit on the short. Then you close out the entire 1 lot and you would make $770. Then you would close out the entire long position, the 0.25 lots, and you would lose $192.50 for a net profit of 577 dollars fifty cents ($577.50), and your position would be flat. This means in this case, you would make a profit on the net, but you would also cover your upside without a stop loss.

Covered Hedge:

The covered hedge is Another way that you could do forex hedging. As shown in the diagram above, you could go short one lot at the current market price, that green line, but instead of putting a stop loss in, you could have a pending one lot long if price goes above this double top.

This means if you’re wrong about the direction, you could have a pending long above that and if price starts to go up, you could make money even if you were wrong. Now in this case, if the price went down, 77 pips, obviously you would take that full profit, you would make $770 and you would have zero positions after you close that out.

Full Hedge:

Finally, we’ll go back to the original example where you do a full hedge. Looking at the above diagram, you take one lot short, one lot long at that green line, and then you’ll do what I call a roll-off. If price drops 77 pips, you’re going to take a profit on the full one lot at $770 profit.

Then you’ll only take a partial loss on the long position. So you’ll take, let’s say half of that off, then you’ll close 0.5 lots and you’ll lose $385. The net profit on that transaction will be plus $385. That’s something you bank that goes into your account and then obviously you’ll have a floating loss now because you’ll still have 0.5 lots long, right?

Now you have a floating loss of negative (-$385) and that’s where people stop because they’re not thinking ahead, they’re not thinking creatively, and they haven’t understood this strategy. So from there, what you can do is you can hedge again, right? You could actually put on another maybe one lot short to hedge this long position, or you could put on 0.5 lots short and be one for-one again.

That significantly reduced your initial position of one lot long, one lot short. Now you’re down to half, and then price can move around again, you can take a profit, roll-off part of the loss, and then re-hedge again.

Now that’s how you make money even if you have a full hedge on. So, as you can see, roll-offs are the key to success in this method. A roll-off is when you offset an existing closing position with a gain and you don’t take the entire loss, but you take part of it off so that it nets out to a profit. This allows you to gradually close out losing trades at a net profit instead of taking the entire loss at once.

This can have significant psychological benefits because you’re not taking that big loss and you’re not having this big drawdown of losing trades, but you’re taking off the losing trades gradually at net profit, which can be psychologically easier to handle for some people.

From the above illustration, you should now understand that it really helps to set a percentage that you’re going to roll off, like 50%, so I’ll take 50% of my profits and if there is a losing trade, I’ll take off that money from the losing trade. If there isn’t a losing trade, then I’ll just take the entire profit. All right so that’s how we make money in using a forex hedging strategy.

Read Also: 7 Candlestick Patterns Every Trader Should Know

Benefits of Hedging in Forex

Now, that we have gotten some great strategies that can be used to increase our chances of profitability using the hedging strategy, let’s review the benefits of hedging again because I didn’t mention some of these things at the beginning of the article.

it’s extremely flexible:

You don’t have to be set into certain rules, you don’t have to have a set system, and in fact, you can actually do a random entry and still make money. Now, that’s not ideal because a set entry method can give you some advantages right off the bat, and you could see yourself in profit faster that way. But for people who don’t like to be locked into those types of systems, this can be a great way to trade.

It prevents you from getting stopped out:

As I mentioned, psychologically that can be easier for some people because you’re not having these losses in a row and you’re not having these big drawdowns, whereas you’re removing the losses slowly over time, and you’re netting out a profit on every transaction. This is something I’ll go into more in future articles, but you can use pending orders to semi-automate your trading and since you don’t have set entry and exit rules, you can take advantage of things like support and resistance levels, and you can set pending orders at those points to enter and exit.

Then if you want to do that, you can create a semi-automatic trading strategy. This is one of the biggest benefits. So like I mentioned before, you can make money even if you’re wrong about the direction of the market. This can be a huge psychological benefit for a lot of people, because, you can make money even if you’re wrong about the direction of the market and you don’t even have to have an opinion of which way the market is going to go you can just do a random entry. So that can be a great benefit to some people.

Also, you can roll off losing trade at a net profit instead of taking the loss all at once. I’m sorry if I’m repeating myself here, but I think it’s important for some people to get these concepts multiple times because I get a lot of questions about, okay, you can’t really do that, how do you do this? Anyways, you just need to remember that rolling off is the key to success in Hedging.

Read Also: The Best Forex Brokers in USA 2023

Brokers Protection:

Finally, this is a minor point, but some brokers will slip you if they know where your order is. Let’s say that you have a profitable account some dodgy brokers will shave off maybe half a pip or a pip on your orders because they know where your orders are but with Hedging, you can either do the semi-automatic trading or you can just do manual trading and they don’t know where your orders are, right? Because there’s nothing in the system.

You’re just entering exiting whenever you open the charts and take a look at it. This can be a huge benefit also if you’re worried about your broker slipping.

Read Also: How to Trade Like a Pro Using SMC Trading Strategy

Final Thoughts

There are several schools of thought when it comes to the forex hedging strategy, and most of them are not the most pleasant, therefore, I will like to give a quick piece of personal wisdom to you who have taken out time to read through this article.

Personality traits are very important when it comes to choosing the right strategy, therefore, the hedging strategy is generally not for everyone. You need to understand your personality as a trader, before deciding to use the hedging strategy, because if you are a very cautious person, or rather have a cautious personality, taking trades in opposite directions on the same instrument, without making use of a STOP LOSS might be very difficult for you. Unlike traders with adventurous personalities.

After putting all the above into proper consideration, I will like to say Forex hedging is a great strategy if you master it properly and also have a mentor to properly guide you on how to go about it. Especially when you look at the stats; over 90% of traders fail even when they try the traditional methods and strategies, and also try to get the best entry and at the same time reduce losses on their account by using exit stop loss, they still find themselves failing.

It will be great therefore to have an alternative like Hedging that you can try that will give you some other options and some other ways of thinking about the market. If it works for you, then you have gotten a great way to properly navigate the market and make your profit. As you should know, before using a strategy, you will need to backtest it properly and ensure it has a win rate that is to your expectation.

All right, so that’s the basics of Hedging, if you want to try out this strategy and you feel its for you, you can backtest any or all of the methods I have mentioned in this article using your demo accounts and after finding the most suitable before eventually switching to your live account.

If you like that article, please like and comment and also subscribe to our newsletter to keep getting great educational articles like this. Thanks for taking the time to read this.

You can get this article in pdf format, click the button below to download the Price Action pdf format.

«« Download PDF »»

We Hope you’ve learned a lot from this. We’re glad you did. Join our telegram community to get up-to-date news, educational materials, free online classes, market analysis, and crypto futures trade signals that will help you grow and become profitable