7 Candlestick Patterns Every Trader Should Know

Introduction:

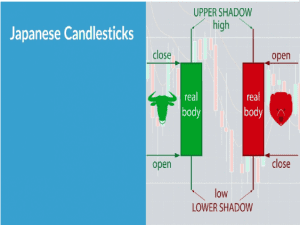

The candlestick chart is arguably the most popular chart among forex traders of all kinds, as it shows an easier pictorial and graphical representation of historical market data and information, it also gives a more detailed illustration of price action.

Candlestick patterns are therefore a vital aspect of forex trading as it makes market interpretation easier, and also assist the forex trader in making trade calls and making some key trade decisions. Candlestick patterns also serve as a form of confirmation for many forex trading strategies.

Therefore, in this article, we would be examining key candlestick patterns that are very useful to every forex trader that deals with technical analysis and their impacts or possible impacts each time they are spotted in a trading chart. Before we proceed, let’s get to understand the meaning of candlesticks and candlestick patterns.

Meaning of Candlesticks in Trading.

Candlestick charts are price indicators used in financial trading to represent price movement of a financial instrument over a period of time. It also shows a clearer picture of price action and what is going on in the market. By representing price movement visually, candlesticks offer traders a more precise depiction of the market’s price action. With their ability to provide a comprehensive view of the current and prevailing market trends, candlesticks have become an indispensable component of technical analysis.

Informed trading decisions can be made by traders by using candlestick charts to identify price patterns.

Meaning of Candlestick Patterns:

Candlestick patterns are formed by candlesticks that display the price action of an asset or instrument over a given period of time, enabling traders to make predictions about future price movements. Furthermore, candlesticks patterns can be utilized to verify or challenge trading signals provided by other technical indicators and trading strategies.

Overall, candlesticks and their candlestick patterns have a crucial role in financial trading, offering traders the ability to attain a profound understanding of the market and make informed decisions. By capitalizing on the insights obtained through candlestick analysis, traders can enhance their chances of achieving success in the fiercely competitive world of financial trading.

We have been able to establish the fact that candlestick patterns are one of the key aspects in financial trading currently, and this is why it is important for technical traders, that is traders who take their trades using technical analysis, to understand some of the basic candlestick patterns that are useful in spotting key entry and exit price levels on the chart.

In this article, I will be listing and explaining seven (7) basic candlestick patterns to take note of, during technical analysis.

Basic Candlestick Patterns in Chart Trading:

The following are the basic candlestick patterns:

- Bullish and Bearish Engulfing Candlestick Pattern

- The Rising Three Method Candlestick Pattern.

- The Falling Three Method Candlestick Pattern.

- The Hanging Man and Hammer Candlestick Pattern.

- The Piercing Line Candlestick Pattern.

- The Morning Star Candlestick Pattern.

- The Doji Candlestick Pattern.

Now that we have listed the basic candlestick patterns, let’s start examining them one by one, and get to know how to spot them and how to use them in our daily trading.

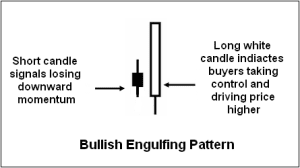

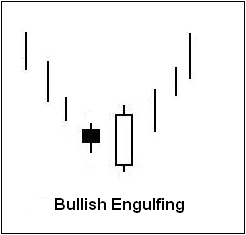

1. Bullish Engulfing Candlestick Pattern:

The first on our list is known as the bullish engulfing candlestick pattern.

The Engulfing pattern is a technical analysis chart pattern that signals a potential reversal in the current trend. This pattern can be either bullish or bearish, depending on its position on the chart. If it appears at the end of a downtrend, it is known as a bullish engulfing pattern, which suggests that the trend may be about to reverse.

The pattern typically begins with a small-bodied candlestick, followed by a larger candlestick whose body completely engulfs the previous candle’s body. This occurs because buyers outnumber sellers, leading to a strong upward momentum in the market. As a result, the chart will show a long white or green real-body candlestick.

Again, this pattern needs confirmation and the long white candle should be followed by a series of white or green candlesticks to confirm a possible bullish reversal or movement.

Traders and investors often look for these engulfing patterns to help them identify potential trend reversals and make informed trading decisions. By understanding how this pattern works, you can better analyze market movements and develop effective trading strategies.

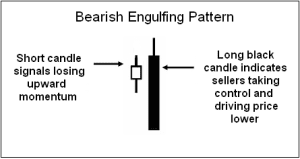

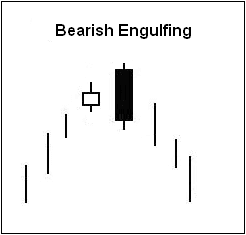

Bearish Engulfing Candlestick Pattern:

The bearish engulfing candlestick pattern is a type of reversal pattern that typically appears at the end of an uptrend or a bullish market. The pattern begins with a small-bodied candlestick, followed by a larger candlestick whose body completely engulfs the previous candle’s body.

This happens because sellers outnumber buyers, resulting in a strong downward momentum in the market. As a result, the chart will show a long black or red real-body candlestick after a small green or white candlestick, indicating the weak presence of the bulls in the market.

Again, just like its other half, this pattern needs confirmation and the long black or red candle should be followed by a series of black or red candlesticks to confirm a possible bullish reversal or movement.

2. The Rising Three Method Candlestick Pattern

In Candlestick charting analysis, most patterns are reversal patterns, bullish or bearish. There are only a few continuation patterns and the rising three method is one of them and is considered quite reliable by traders.

The pattern begins with a long white or green body candlestick, followed by three smaller body candlesticks (usually black or red, but the middle one can be white or green). The three smaller body candlesticks are confined within the range of the first white or green candlestick, which indicates that the market is taking a pause after a strong rise to consolidate due to uncertainty.

The fifth candlestick brings a resumption of the uptrend, with a closing price well above the high of the first white or green candlestick. This pattern is often seen as a strong signal of bullishness, and traders may take it as a sign to go long or hold onto a long position.

It is common to see consolidating patterns play out after a major move in the financial market, as the market takes a pause. At this point, bulls may be building up for new long positions while bears may be making a last attempt to fight back and take control of the market.

In this process, If the price fails to drop below the low of the first bar, as shown in the diagram above, it can be a sign that bulls are taking over once again while bears are giving up. This can lead to a resumption of the uptrend and the creation of new bullish momentum in the market.

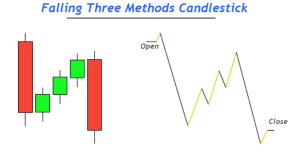

3. The Falling Three Method Candlestick Pattern.

The falling three method candlestick pattern is the opposite of the rising three method and is also used to confirm market or trend continuation rather than reversal as most candlestick patterns do.

The beginning of the pattern is marked by a lengthy black or red body candlestick, followed by three smaller body candlesticks, commonly white or green, with the middle one occasionally black. These small body candlesticks are within the limits of the first black or red candlestick, implying that the market is pausing after a sharp drop to consolidate due to uncertainty.

The beginning of the pattern is marked by a lengthy black or red body candlestick, followed by three smaller body candlesticks, commonly white or green, with the middle one occasionally black. These small body candlesticks are within the limits of the first black or red candlestick, implying that the market is pausing after a sharp drop to consolidate due to uncertainty.

A resumption of the downtrend arrives with the fifth candlestick, with a closing price far below the low of the first black or red candlestick. This particular pattern is frequently perceived as a powerful signal of bearishness, causing traders to potentially consider going short or retaining a short position.

Just like in the rising three methods, The bears, who believe the market will fall, are starting to create new short positions. On the other hand, the bulls, who expect the market to rise, are abandoning their efforts to gain an advantage, once the market fails to surpass the high point of the initial bar as shown in the diagram above, it would mean that the bears are likely to regain control while the bulls are giving up.

Confirmation:

- High of the first black/red candlestick must remain intact

- The break of the closing price of the first black/red candlestick should be treated as the first confirmation. The fifth bar closed well below the bottom of the first bar, becoming the final confirmation.

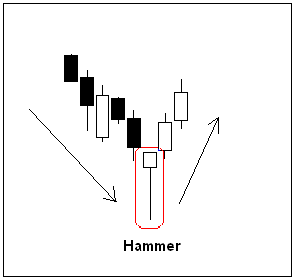

4. The Hammer Candlestick Pattern:

The hammer is a type of single candlestick pattern used for reversal analysis. It consists of a small real body, typically white or green but can also be black or red, with an extended lower shadow and a very short or non-existent upper shadow.

To qualify as a hammer, this candlestick should form after a price decline, with the bottom of the extended lower shadow marking a new low. Following this pattern, white candlesticks should appear.

Because of its formation, the hammer is categorized as a bullish reversal pattern, indicating a potential shift from a bearish trend to a bullish one.

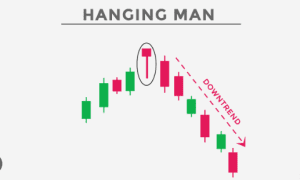

The Hanging Man Candlestick Pattern:

The hanging man candlestick looks like the hammer in shape but appears in a completely different position on the chart as it is encountered during an uptrend as compared to the hammer that is encountered during a downtrend.

It is normally due to a surge of forceful selling pressure (noted by the lengthy lower wick on the candle) in most cases the hanging man candlestick is always not anticipated in an uptrend, making its appearance imply a likely alteration in market sentiment, which may culminate in a reversal to the downside.

The appearance of a hanging man in an uptrend serves also as a warning sign for traders and investors alike. It indicates that the upward momentum of the market may be losing steam and that the bears might soon take over. This is particularly true if the hanging man appears after an extended uptrend.

It is important to also note the context in which the hanging man appears. If it is accompanied by other technical indicators such as high trading volume, a bearish divergence, or a break below a key support level, the probability of a downtrend increases significantly.

Read Also: Supply and Demand Zones: A Profitable Trading Strategy

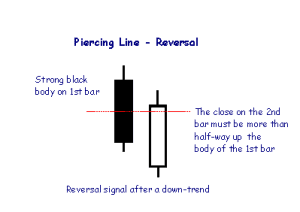

5. The Piercing Line Candlestick Pattern

The piercing line is a double candlestick pattern that can indicate a bullish reversal in a declining market. This pattern is characterized by a black or red candlestick followed by a white or green candlestick that opens below the close or the low of the preceding candlestick, resulting in a gap-down opening. However, the white or green candlestick closes above the midpoint of the previous black or red body candlestick.

This pattern can be a signal of a potential trend reversal, as the bulls have been able to push the price up after a period of decline. It can also indicate a shift in market sentiment, as buyers begin to outnumber sellers and drive the price upwards.

However, like the other candlestick patterns, it is important to note that the piercing line candlestick should not be used in isolation and should be used in conjunction with other technical indicators and fundamental analysis to make informed trading decisions.

Characteristics:

In a falling market;

- A long black/red candlestick preferably closes near the low;

- Followed by a long white/green candlestick that opens lower than the close of the first bar;

- The high of the second white/green candlestick is contained within the first black/red candlestick and it must close higher than the middle of the body of the first candlestick;

- The second bar should not close above the first candlestick body.

Explanation:

The formation basically suggests market participants are reevaluating the underlying security with potential buyers starting to consider it is undervalued and is at a good price to build long positions.

Confirmation:

In order to confirm a low formation or reversal, one needs to see another long white candlestick or a large gap up on the next trading day.

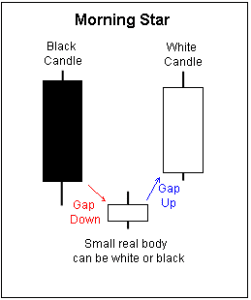

6. The Morning Star Candlestick Pattern:

This is basically a three steps bullish reversal pattern at the bottom of a downtrend consisting of three candlesticks. It starts with a long real body black/red candlestick after an extended downtrend. It’s followed by a small body candlestick (could be white/green or black/red but a white/green body tends to have a stronger indication) that gapped down on the open and closed below the low price of the previous candlestick (which makes that candlestick appears isolated from the prior bar).

Finally, a long real body white/green candle which gapped up on the open and closed near the bar high or at least well above the mid-point of the previous black candle.

In addition, you should also know that if the star itself, (by the star, I mean the small body candlestick) is a hammer or doji, this normally suggests a stronger reversal signal and the subsequent impact is more likely to be bigger.

7. The Doji Candlestick Pattern.

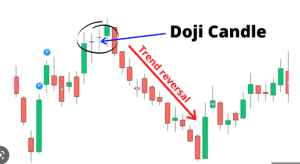

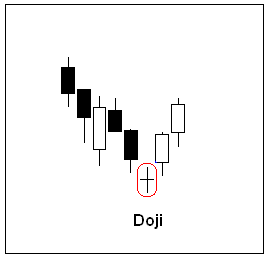

There is another single candlestick reversal pattern which could be either bullish or bearish, depending on the combinations of the preceding and the subsequent candlesticks formations.

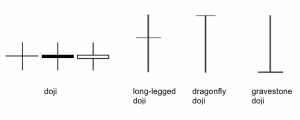

A doji star is formed when the opening price and the closing price are virtually the same level (the word doji is actually a Japanese word ‘同市’ which means same price level) which made no real body.

The length of the upper and lower shadows can vary and the appearance of the candlestick resembles a plus sign, a cross, or an inverted cross. One doji star alone is only a neutral pattern as it indicates a sense of indecision between the bulls and bears, whether it is going to be a bullish or bearish sign mainly depends on the prior and future price developments.

Whenever you see a ‘doji’ candlestick after certain trending moves, you can consider it as a warning sign or a red flag for a possible reversal and one should wait to see if there is a candlestick pointing to the other direction after the doji.

In the above example, once the white candlestick is formed after the doji, this should be treated as a confirmation and one can buy the underlying security in anticipation of a low formation.

There are different types of doji shapes and each one has a slightly different meaning in the market.

Applying doji candlesticks: A good trick is to look out for a doji near the edge of a price channel (i.e., if a doji appears at the top of a channel it could indicate a bearish correction and if it appears at the bottom of a price action it could indicate a bullish correction.)

Read Also: How to Trade Like a Pro Using SMC Trading Strategy

Hello Readers!!! Dipprofit Community is now on Threads, the new Twitter-like app, and we would like for you to follow us there, so we can also interact better and provide you with some educational tips and nuggets. Thanks for the follow!

Conclusion

Understanding Candlestick patterns is a very important instrument that must be in the arsenal of a financial trader, be it a forex trader, crypto trader, CFD trader, etc. Candlestick patterns as stated earlier can also serve as confirmation tools and indicators in various trading strategies.

It is important to note that no matter the trading strategy you are making use of as a trader, be it the SMC trading strategy, supply and demand zone strategy, or the forex scalping strategy, having a deep understanding of candlestick patterns is a necessity as it helps you get a clearer picture of price action and also makes interpretation of the market structure easy to understand.

Kindly support us by sharing this article to those who would find it useful, you can also subscribe to the newsletter to continue to receive constant updates on our educational articles.

You can get this article in pdf format, click the button below to download the Candlestick patterns pdf format.

«« Download PDF »»