Forex Scalping Strategy Guide

Introduction

In my previous article where we talked about a great trading strategy known as the SMC trading strategy, I mentioned that there are various types of trading strategies through which a forex trader can become profitable. What is most important is the traders understanding and mastery of their trading strategy.

One of the major reasons why most forex traders tend to make losses rather than gains/profits in their trading journey is due to the fact that they get distracted by the vast arrays of trading strategies, trying several trading strategies out without truly mastering or understanding the particular strategy they work better with.

Therefore as I break down the forex scalping strategy in this article, I would also like to make you understand the importance of truly mastering a particular trading strategy as that would make you more efficient and profitable as a forex trader.

Forex scalping strategy is a trading strategy for individuals who like thrilling and exciting adventures, you would understand why I said that as we get to understand the meaning of scalping and how to trade using the forex scalping strategy. In this article, I will be giving an in-depth definition of Forex scalping strategy, the techniques used in Forex scalping, and showing a practical example of how to apply the Forex scalping strategy.

So, just as I would always say, sit down, relax your mind, grab a cup of coffee, your notepads, tablets, and MT4/MT5 platforms as we get to understand forex scalping strategy.

Firstly, let’s get to understand what Forex scalping.

What is Forex Scalping?

Forex scalping is a popular day trading technique employed by forex traders to make swift profits by buying or selling currency pairs within a short holding period. A forex scalper seeks to capitalize on the frequent small price fluctuations that occur throughout the day, making numerous trades in the process. Although the gains sought after in scalping are typically small, such as 10 to 20 pips per trade, they can be amplified by increasing the size of the position and also the number of trades taken.

In the world of forex scalping, traders often hold positions for just a few seconds or minutes before exiting and opening new ones, sometimes executing multiple trades in a single day.

Now that we know the primary meaning of forex scalping, let’s get a deeper understanding of forex scalping and forex scalping strategy.

See Also: Supply and Demand Zones: A Profitable Trading Strategy

Understanding Forex Scalping and Forex Scalping Strategy.

Forex scalping strategy is a strategy used by Forex scalpers to make quick and multiple gains from the market in short periods. Forex scalping strategy involves looking for profitable opportunities while using lower time frames like 1mins, 5mins, 15mins, 30mins while executing multiple trades within short time windows, with the aim of raking in some little pips in profit.

It is important to note that there are some basic principles that need to be adhered to while using the Forex scalping strategy some of these principles are:

- Ensure you minimize your risk in order to capture small price movements for your profit. The small price movements can become significant amounts of money when you capitalize on the usage of leverage and large lot sizes.

- While using the Forex scalping strategy, it is advisable to make use of ECN Forex accounts instead of traditional ones, as the latter may put you in a disadvantaged position, due to the large spread, ask, and bid price.

- While using the forex scalping strategy, it is important to control your Leverage, spreads, fees, and slippage as they are risks that forex scalpers need to control, manage, and account for as much as possible.

From the above-stated principles it is clear that while using the Forex scalping strategy, Forex scalpers commonly use leverage, which enables them to take larger positions, resulting in significant profits with even small price changes. For instance, a profit of five pips on a $20,000 position (mini lot) in the GBP/USD currency pair would amount to $10, whereas on a $200,000 position (standard lot), it would equal $100.

Furthermore, Forex scalping strategies can be either manual or automated. A manual system requires a trader to sit in front of the computer screen, identify trading signals, and decide whether to buy or sell. On the other hand, an automated trading system employs programs to instruct the trading software when to execute trades based on pre-set parameters.

Another thing of note is the fact that scalping is particularly popular just after significant news releases, such as the announcement of interest rates or U.S. employment reports. These types of high-impact news releases often result in substantial price movements within a short time, providing an ideal opportunity for scalpers to enter and exit trades quickly.

Due to increased volatility, scalpers may reduce their position sizes to mitigate risk. While a trader may aim to achieve a 10-pip profit on a typical trade, they may be able to capture 20 pips or more in the aftermath of a major news announcement.

Now that we already understand what forex scalping strategy entails, and some of the guiding principles, for forex scalping, let’s look at some forex scalping strategies that forex scalpers use when scalping.

Forex Scalping Strategies:

There are quite a few forex scalping strategies forex traders make use of while engaging in their scalp trading, but we would be talking about a few of them in this article.

Trend Scalping Strategy:

The trend scalping strategy requires identifying the trend direction and executing quick trades in the same direction, aiming to capture little profits as fast as possible while the trend continues.

Counter-trend Scalping Strategy:

In contrast, the countertrend scalping strategy is more complex, requiring the scalper to open positions and make quick trades in the opposite direction of the trend. Those using this approach are betting on a trend reversal or pullback, aiming to profit from these changes.

Range Scalping Strategy:

Traders using the range scalping strategy identify areas of support and resistance and aim to purchase near support and sell near resistance, generating profits from oscillating price movements occurring within the range.

Statistical Scalping Strategy:

Finally, statistical scalping strategies involve identifying patterns or anomalies in the market. This approach looks for specific conditions that result in predictable price movements. For instance, traders can identify chart patterns that appear at particular times of the day or certain days of the week to take advantage of these patterns and generate profits.

In conclusion, traders can utilize various forex scalping strategies to profit in the Forex market. Each approach presents its own unique challenges and advantages, and traders should select the technique that best matches their trading style and risk tolerance.

So far, we have been able to understand the meaning of forex scalping and forex scalping strategy, some basic techniques that are required while scalping, and also some forex scalping strategies that scalpers use while trading. The next step is to examine how to take profitable trades using a forex scalping strategy.

In this illustration, I would be using the trend forex scalping strategy, which is also what I mostly advise traders to use, as it is less risky than the counter-trend scalping strategy.

How to Trade using the Forex Scalping Strategy.

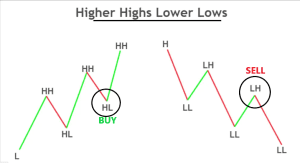

in the above chart, we can see that price is in an uptrend with higher highs and higher lows on the chart. As I stated we are trading with the trend and not against the trend which is a countertrend scalping strategy another scalping strategy in case you missed it earlier.

in an uptrend, you are looking to start your buy scalping when price is making its higher lows which is in favor of the trend, while in a downtrend you are looking to start your sell scalping when price is making its lower highs, as shown in the diagram above.

This strategy is based on the concept of market retracement and consolidation. One golden rule of price action is that when price moves in a particular direction, it would retrace, as price cannot keep moving in a particular direction without having pullbacks and retracements.

What you, therefore, need to do as a trend scalper is to wait for the retracement to finish, wait for the end of the retracement or pullback as some traders call it before you decide to enter your trade and make some quick pips.

This strategy works well with the 5mins timeframe, remember that one of the explanations I gave at the beginning of the article is that the forex scalping strategy is most effective on lower timeframes.

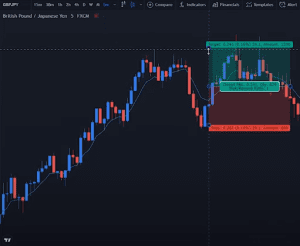

So we would be changing our chart timeframe to 5 mins, to get a better entry and exit opportunity for this scalp trade. Note that before we go to the smaller timeframe, we need to get our trend in the higher timeframe, preferably a 1-hour timeframe which was what I did in the first diagram before entering the trades on the 5 mins timeframe.

So from the chart above we are now on the 5mins timeframe, and we can see the price movement, as price starts pumping up, before the retracement down, now all we need to do, is to be sure that price has finished its retracement, after which we can take some quick and short buys, which is the true essence of scalping.

So from the chart above we are now on the 5mins timeframe, and we can see the price movement, as price starts pumping up, before the retracement down, now all we need to do, is to be sure that price has finished its retracement, after which we can take some quick and short buys, which is the true essence of scalping.

If you are wondering how to know when price is done with its retracement and is ready to continue moving toward its prevailing trend, then there are basically two ways:

Ensure you draw your trendlines to form a diagonal support and resistance line, as soon as price hits the support trend line you have drawn, it is very likely it would continue in its trend direction, but you need to wait for confirmations which are mostly shown through the candlestick formation.

The next candle after the candle that touched the trendline, might be an engulfing candle, a hammer, doji, or a hanging man. Seeing any of this candlestick formation after price has gotten to the support trendline, means a trend continuation and you can take your scalp trades.

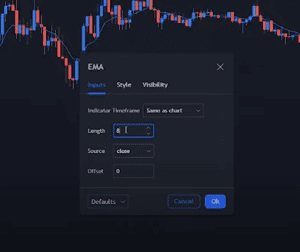

The second way to know when the retracement is over is through the use of the Exponential Moving Average (EMA). In the diagram above, you can see it around the candlesticks, it is the thin blue line that runs through the candlesticks on the chart.

To get it set up on your chart, just go to moving averages and select exponential, change the period to 8 and the source to close just as it is in the diagram above, save it, and then you can also change the color before you close the setting window and you should have the EMA on your chart now.

Now that the EMA is set, the logic behind this EMA is when it is above the candlesticks, price is going down and when it is below the candlestick, the price is going up. You would be able to confirm any retracement in the situation, when the candlestick crosses the EMA line on the chart, then you would know the retracement is over and price is continuing its trend as shown in the above chart.

Always remember that this is mainly for scalping.

Looking at the diagram above, since we are using the forex scalping strategy, we entered a quick trade after the candlestick crossed the EMA line, and made about 20 pips profit as quickly as we could. This was a successful trade also, as illustrated in the diagram.

Another thing of note is what I had talked about earlier, looking for a confirmation, we can see from the chart above that there was a bullish engulfing at the end of the retracement before price continued its trend, crossed the exponential moving average, further confirming our opportunity, and then we rush in as scalpers take some good pips and we are out.

Let us take a look at the next scalping opportunity, still on the same chart and still using the 5 mins timeframe.

So another scalping opportunity appeared just some minutes after the first opportunity, and in this one the retracement ended with a long-legged doji, forming a morning star candlestick formation as shown in the chart above, after seeing this, we wait for the second confirmation which is the candlestick crossing the EMA, then after that is also confirmed, we take our trade and make a quick 20 pips profit from the trade.

Some scalpers may not even wait for the second confirmation, after seeing the morning star candlestick formation, but the candlestick crossing the EMA makes the trade less risky.

From the above illustration, we can see that it is easy to trade using the forex scalping strategy if you are someone who likes scalping, and following the above steps I have highlighted using the trend scalping strategy, would make your scalp trades a lot better hopefully.

Risks in Forex Scalping:

Forex scalping, like any other trading style, comes with its own set of risks. While it’s true that profits can accrue rapidly by taking numerous profitable trades, the possibility of losses escalating just as quickly cannot be ignored. This is particularly true when traders lack the necessary skills or employ a flawed system.

Even when traders limit their risk exposure by staking a small amount per trade, a high volume of trades can result in a substantial drawdown if many of those trades are unsuccessful.

Leverage and position sizes that are scaled up can also be a cause for concern. Consider a trader who has $20,000 in their account but uses a position size of $200,000, equating to a leverage of 10:1. Let’s assume the trader is willing to risk five pips on each trade and seeks to exit the trade when they gain a 10 pip profit.

While this can be a sound strategy, there are instances when the trader may be unable to exit the trade at a five-pip loss. For example, the market may gap through their stop-loss point, resulting in a 20 pip loss, which is four times the expected amount, other times, there might be a sudden spike in price movement in the opposite direction of what the trader had anticipated.

Such an event, known as slippage, is a common occurrence during major news announcements, and repeated incidents can result in significant losses that can deplete a trading account in no time.

Scalping Personality:

In one of my articles, I talked a little about traders’ personality traits, this is because, as a trader, it is important for you to understand your personality and the trading patterns and strategy that suits you, as this would help strengthen your expertise, understanding and profitability.

Scalping is good for traders, who love exciting and thrilling adventures, they can cope with the intensity of the quick-fire trades and still keep a cool head. This set of traders must also be able to sit in front of the chart for an extended period of time, ensuring they closely monitor their trades.

If you are not able to take the heat on instant trade executions and fast-paced trade entries with almost instant exits, then you should know scalping is not for you and look for other less intense strategies.

Conclusion

Scalping has been one of the oldest and most common trading strategies available in forex trading, and a lot of binary and currency traders make use of this strategy from time to time.

Like every other strategy, scalping does not guarantee any fast-paced profit for you as a trader, it takes a lot of patience, practice, planning, and understanding to be able to make use of the forex scalping strategy and benefit from the market.

Therefore, if you are still reading this at the time, I would like to congratulate you, because it means you already have one of the needed traits which is patience and every successful trader has that.