Crypto Market Analysis and Price Prediction. (BTC, ETH, XRP, BNB,)

Crypto market analysis and price prediction for the 2nd quarter of the year Q2. Our crypto market analysis centers on Bitcoin (BTC), Ethereum (ETH), Binance coin (BNB), and Ripple (XRP).

Q2 Summary|TLDR

- The current market situation indicates that the Total Market Cap has reached a point of resistance. To confirm further positive movement, it needs to close above $1.18T on a weekly basis. However, if it fails to do so, a pullback is likely to occur.

- As for BTC, it is also facing a resistance point. To prevent a potential drop, it must close above $28,750 on a weekly basis. Otherwise, we can expect it to drop down to $25,150 initially.

- Ether, on the other hand, has a chance to close this month’s candle above $1740. This would mark the first time in nearly 9 months that such a feat has been achieved. If it does happen, we can anticipate that Ether will hit $2000 in Q2.

- BNB needs to break through the $335 level on the weekly timeframe for its upward momentum to continue. Until this happens, we should expect BNB to trade between the $300 – $335 range.

- XRP, unfortunately, is currently at a resistance point. It’s best to take profits at this time and avoid buying.

- Lastly, LTC is trading in a bullish market structure on the weekly timeframe. We anticipate it will reach the nearest resistance level at $113 during Q2, which is about 26% higher than its current price.

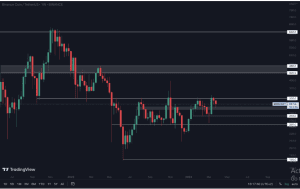

Total Market Cap (Weekly)

The Total Market Cap index provides a comprehensive overview of the cryptocurrency market’s value. We closely monitor this index to gain insights into the market’s current status and make informed predictions about its future trajectory.

Currently, the Total Market Cap is facing a resistance level. While we anticipate a pullback to around $1.03T, we cannot discount the possibility that it may break through the resistance and continue to rise.

However, for the market to avoid a short-term decline, it needs to close a weekly candle above $1.18T. If this occurs, we can expect our wallets to grow as any downside will be invalidated. Despite some obstacles in the way, we remain optimistic that the Total Market Cap index will reach $1.35T in Q2.

See Also: Profitable Cryptocurrency Trading for Beginners

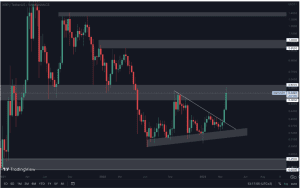

Altcoins Market Cap (Weekly)

The Altcoins Market Cap Index is a metric that represents the overall value of the altcoins market, which includes all digital coins except for Bitcoin. Currently, the Altcoins MCap Index is situated in the mid-range, with a value of approximately $650 billion to $550 billion. Considering the Total MCap Index has reached a point of resistance, it is highly probable that if there is a rejection in the market, it will drag the Altcoins market down with it.

Despite some uncertainty in the short term, we anticipate a promising Q2 for the Altcoins market. We firmly believe that it will reach a value of $700 billion in the upcoming months. Our conviction is based on two key factors. Firstly, we remain above the support level on the higher timeframe of $550 billion. Secondly, we are currently trading in a bullish market structure on the weekly timeframe.

In conclusion, the Altcoins market appears to be on track for a positive growth trajectory in the coming months. However, investors should remain vigilant and cautious given the unpredictable nature of the cryptocurrency market.

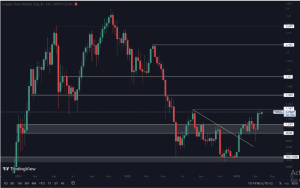

BTC | Bitcoin (Weekly)

As an avid observer of the cryptocurrency market, there is one particular chart that demands your attention at all times, regardless of whether or not you hold Bitcoin. This chart pertains to the current state of Bitcoin and its ongoing trends.

As it stands, Bitcoin is currently encountering resistance at the $28,750 mark. In order for the current upward trend to persist, it is imperative that Bitcoin manages to close a weekly candle above this level. Failing to do so will confirm our prior expectations of a pullback to $25,150.

However, the second quarter of the year is proving to be bullish for Bitcoin from a technical standpoint. Based on our analysis, we predict that Bitcoin will surpass the $32,000 mark and potentially reach even higher targets, such as $35,000 or even $40,000.

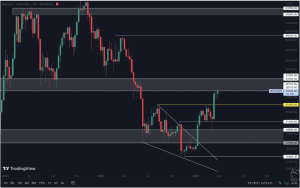

ETH | Ethereum (Weekly)

Ether is on the verge of making history by closing a monthly candle above the $1740 mark, a feat it has not accomplished in almost 9 months. This breakthrough could pave the way for Ether to test and even surpass the $2000 mark during Q2. However, for now, we will focus on the weekly timeframe.

It is crucial to note the significant difference between Bitcoin and Ether’s price actions. While Bitcoin is currently facing resistance, Ether finds support at its current level. Essentially, these two cryptocurrencies are counteracting each other. While one suggests a possible decline, the other signals an uptrend.

Therefore, we do not recommend buying Ether with the sole purpose of capturing a move to $2000, even though it currently enjoys support. A rejection of Bitcoin at the $28,750 mark would cause Ether to lose its support at $1740. Consequently, the risk-to-reward ratio is not very compelling at this stage.

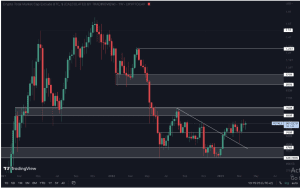

BNB | Binance (Weekly)

With the current weekly bullish market structure, it’s no surprise that we anticipate Binance Coin (BNB) to maintain its bullish run into Q2. The asset has recently tested the grey box as a support level, and it’s now experiencing an uptick in buying pressure, thanks to Bitcoin’s performance.

It’s likely that BNB will remain in a range of $335 – $283, at least until Bitcoin breaks the $28,750 mark. If Bitcoin breaks this resistance level, we can expect BNB to close above $335 on a weekly timeframe. This would signal a clear path for BNB to test the $430 – $460 range in Q2.

If you’re considering investing in BNB, it’s crucial to keep an eye on Bitcoin’s performance, as it has a significant impact on BNB’s price movements. It’s also wise to consider BNB’s historical price patterns before making any investment decisions.

See Also: How to Trade Cryptocurrency and Make Profit: A Comprehensive Guide

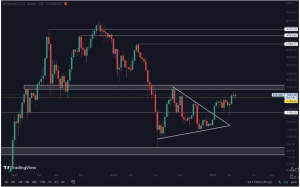

XRP | XRP (Weekly)

Source: cryptonary.

XRP has exhibited an impressive performance over the past fortnight, and it’s possible that you have generated some profits from it, or maybe not. However, what matters most at the moment is the preservation of your earnings or avoiding incurring losses.

Currently, XRP is hovering around the resistance level of $0.60 – $0.50, and therefore, it’s advisable to refrain from purchasing XRP with the intention of gaining short-term profits. The potential risk/reward ratio is so unsettling that it could be a scene out of a horror movie.

Our recommendation is to exercise patience and allow XRP to cool down while waiting for any signs that might give a clue as to its next direction.

Our Experts Take:

Get ready for an action-packed Q2 as the market gears up for an upward trajectory. Brace yourself for a thrilling ride!

However, in the coming weeks, it is anticipated that there may be a temporary decline. This could actually be a positive development as it can help maintain the market’s overall health and prevent it from becoming oversaturated or drained.

Once this pullback has passed, the market is expected to surge to new yearly highs. So, it’s definitely worth the wait!

To stay informed on the latest developments in the cryptocurrency world, please subscribe to our email newsletter through the comment session, just enter your email and tick the box that says you want to receive updates on new posts, and then hit the submit button.

Disclaimer:

Also please note that this analysis is not any form of financial advice as its strictly the opinion of the author, therefore dipprofit would not be held liable for any of your trade decisions.