What is Crypto Yield Farming?

Crypto Yield farming is a term that has recently become popular in the world of blockchain and cryptocurrency. It’s a method of earning rewards by providing liquidity to a decentralized platform, specifically a decentralized lending platform, decentralized exchange (DEX), automated market maker (AMM), or yield aggregator. Yield farming involves investing capital in a platform’s liquidity pools, a process that can be compared to staking.

In simpler terms, it is the process in which an individual lends capital or liquidity to a token project using a decentralized platform such as pancakeswap, uniswap, etc, intending to make returns from the investments. The returns can be in the token the user invests in or in a stablecoin.

In essence, Crypto yield farming protocols offer rewards to liquidity providers (LPs) for depositing their cryptocurrency assets in a smart contract-based liquidity pool. These incentives can take the form of a percentage of transaction fees, interest from lenders, or a governance token (a concept known as liquidity mining). The returns are measured as an annual percentage yield (APY) or annual percentage returns (APR). As the liquidity pool grows with additional investments, the value of the returns offered decreases proportionally. Therefore, earlier liquidity investors tend to earn more before the liquidity pool gets more investments.

Basic Steps in Yield Farming:

- An investor deposits their cryptocurrency into a liquidity pool (LP) on a decentralized exchange (DEX) such as Uniswap or PancakeSwap.

- The deposited cryptocurrency is used as collateral to facilitate the trading of other cryptocurrencies on the exchange.

- The investor earns rewards for providing liquidity in the form of additional tokens. These rewards can be the same cryptocurrency or a different one.

- The investor can then withdraw their original deposit along with the earned rewards at any time, or they can reinvest the earned rewards into the liquidity pool to earn even more rewards.

- The rewards earned from yield farming are usually in the form of governance tokens, which provide the investor with voting rights on platform decisions. These tokens can also be sold on a cryptocurrency exchange.

Liquidity Pools

As we have mentioned liquidity pools in our earlier explanations, let’s take a look at what they mean.

Liquidity pools are funds made up of cryptocurrencies that users deposit into a smart contract on a decentralized platform. These funds are then used to keep the platform’s trading and lending engines running. In return, investors earn rewards in the form of governance tokens, transaction fees, or interest.

Many tokens created today run using smart contracts and unlike Bitcoin where mining needs to take place before more coins/blocks are created, these tokens run on what is known as Proof of Stake protocols (POS) where people can stake their cryptocurrencies in the liquidity pools to earn rewards, through validation.

Therefore, yield farming can be seen as a new way to earn rewards by providing liquidity on a blockchain platform. It’s similar to staking, which is another way to earn rewards by locking up cryptocurrencies for a specified amount of time.

See Also: The Best Crypto Trading Mentorship Programs In 2023

Yield Farming Platforms:

One of the most popular platforms for yield farming is Uniswap, a decentralized exchange that enables users to swap tokens without needing an intermediary. Uniswap’s liquidity pools are used to execute trades between users’ cryptocurrency holdings. Users who provide liquidity to these pools earn a share of the transaction fees, which are paid out in the form of Uniswap’s governance token, UNI.

Other platforms for crypto yield farming include Compound, Aave, Curve, Yearn Finance, SushiSwap, and PancakeSwap among others. Each of these platforms offers a unique set of features, liquidity pools, and reward structures. The following are some examples of yield farming protocols.

Compound

Compound is a decentralized lending platform that enables users to earn interest on their cryptocurrency holdings by providing liquidity to the platform. It operates with a native token called COMP, which is used for governance and rewards users for providing liquidity. Users who deposit cryptocurrency into Compound’s liquidity pools earn interest on their holdings, which is paid out in the form of COMP tokens.

Aave

Aave is a decentralized lending platform that enables users to earn interest on their cryptocurrency holdings by providing liquidity. It operates with a native token called AAVE, which is used for governance and rewards users for providing liquidity. Users who deposit cryptocurrency into Aave’s liquidity pools earn interest on their holdings, which is paid out in the form of AAVE tokens.

Curve

Curve is a decentralized exchange that operates on the Ethereum blockchain. It’s designed to optimize trading between stablecoins by reducing slippage and transaction fees. Curve’s liquidity pools are made up of stablecoins, and users who provide liquidity to these pools earn transaction fees paid in the form of CRV tokens.

Yearn Finance

Yearn Finance is a yield aggregator that relies on automation to optimize returns for investors. It’s designed to automatically move funds between different lending and borrowing protocols to maximize returns. Yearn Finance’s liquidity pools are made up of various cryptocurrencies, and users who provide liquidity to these pools earn interest paid in the form of YFI tokens.

SushiSwap

SushiSwap is a decentralized exchange and liquidity protocol that was created as a fork of Uniswap. It operates with a native token called SUSHI, which is used for governance and rewards users for providing liquidity. Users who deposit cryptocurrency into SushiSwap’s liquidity pools earn transaction fees and SUSHI tokens.

PancakeSwap

PancakeSwap is a decentralized exchange and liquidity protocol that operates on the Binance Smart Chain. It’s designed to offer lower transaction fees and faster transaction times compared to Ethereum-based protocols. PancakeSwap’s liquidity pools are made up of various cryptocurrencies and users who provide liquidity to these pools earn transaction fees and CAKE tokens.

Pancakeswap can be said to be one of the easiest and cheapest platforms to use when carrying out yield farming. Therefore I will be giving a step-by-step guide on how to do yield farming on pancakeswap.

See Also: The 5 Best Crypto Wallet UAE Residents Can Use in 2023

How to do Yield Farming on Pancakeswap

- Get a decentralized wallet.

- Go to the pancakeswap platform through their website.

- Connect your decentralized wallet to pancakeswap.

- Navigate to the earn menu and select the farm option.

- Select the liquidity pool you want to place your liquidity into.

- Ensure you have an equal quantity of the token pair you selected in the liquidity pool.

- Click on the enable button, to go ahead with the transaction, after which the gas fee and the tokens will be deducted from your wallet.

- You can check your yield farming investments and yields from time to time on the pancakeswap platform.

Step 1:

The first step is getting a decentralized wallet (dex), meaning a self-custodial wallet, example of such wallets are meta mask, trust wallet, coinbase wallet, wallet connect, and also Binance wallet.

Step 2:

Go to the pancakeswap platform, where you would see a screen like the one below

Step 3:

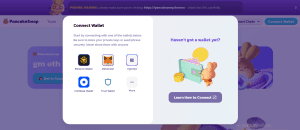

Connect your wallet to the platform. You click the connect wallet button circled red in the above image and it will bring a list of wallets to select from as shown in the diagram below. Since I am using Pancakeswap for my yield farming I would also be using the Binance wallet extension on my PC.

Step 4:

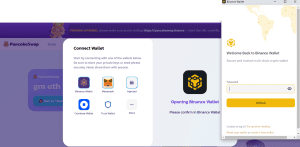

I would select the Binance icon to connect my Binance wallet to pancakeswap as shown in the diagram above. After clicking the icon, you will see a pop-up screen like the one shown in the diagram below. Enter your login details and click the unlock button.

Step 5:

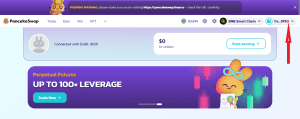

Once you enter the correct login details and click the connect button, it would mean that your wallet is connected to the pancakeswap platform. For you to know if it’s connected, your wallet address would show on the pancakeswap top right corner replacing the button which you used in connecting your wallet. The diagram below shows you what it would look like.

Note that the reason why I can connect my Binance wallet extension to pancakeswap is that it is Binance smart chain compatible. As the Binance wallet is strictly a Bep20 wallet.

Step 6:

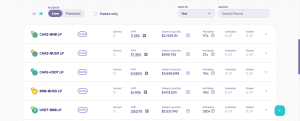

After you connect your wallet, you will navigate further to the Earn menu, where you then select the farms’ option, as shown in the diagram below.

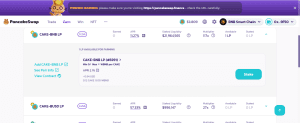

After selecting the farms’ option, you will be taken to the farms’ dashboard as shown in the diagram below. At this point, you would see several liquidity pools from which you can put in your liquidity and start earning.

For this illustration, we would be selecting the first option, which is to farm BNB-CAKE. You need to know that before you choose the liquidity pool to use, you need to make sure you have the tokens required to farm in the liquidity pool.

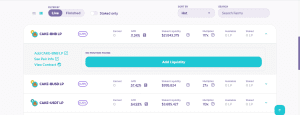

Step 7:

Another thing of note is that when it comes to yield farming, and you are to put your tokens in the liquidity pool. Both tokens must be of equal value before you would be able to enter the liquidity pool.

What I am simply saying is, assuming we are entering the liquidity pool for BNB-CAKE as shown in the diagram above, and we want to put a total liquidity of $100 in the liquidity pool to farm more tokens. We would ensure that we have $50 worth of BNB and also $50 worth of CAKE. If both tokens are not equal in liquidity value, you won’t be able to enter the liquidity pool.

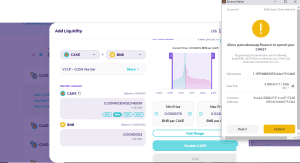

Step 8:

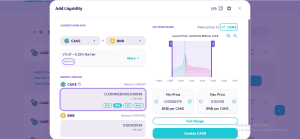

After you have been able to ensure that both tokens are of equal liquidity value, the next thing to do is to click the enable cake button, after you click that it will take you to your wallet where you need to give access to pancakeswap to take the required funds from your wallet as shown in the diagram below.

As soon as you authorize the transaction, you would also be charged a gas fee on the transaction which is not fixed. The cost depends on the amount of liquidity you are investing in the liquidity pool.

Once it is verified and the transaction is successful, you can come back to your farms’ dashboard to see what you have in the liquidity pool, just as you can see in the diagram below. Also, you can check for the annual percentage yield (APY) or the annual percentage returns (APR) for the period you want to leave your token in the liquidity pool.

From the diagram below, we can see the returns we are expecting after 30 days, we can also check how much we are likely to earn as ROI for a year, but we should understand that the APY or APR are not fixed. They fluctuate due to market conditions such as an increase or decrease in token value, and an increase or decrease in the number of investors in the liquidity pool. Therefore Yield farming has its fair share of risk as we would be looking at in the next paragraph.

See Also: The Top 5 Cryptocurrencies to Buy and Hold in 2023

The Risks of Yield Farming

Yield farming can be an attractive investment for cryptocurrency investors due to the high-yield returns that are available. The rewards earned from yield farming are usually in the form of governance tokens, which provide the investor with voting rights on platform decisions. These tokens can also be sold on a cryptocurrency exchange.

As stated earlier, the popularity of yield farming still keeps growing due to the high return on investment (ROI) it offers. However, it’s important to note that yield farming comes with risks, such as impermanent loss (the loss of value that can occur when the price of deposited cryptocurrencies changes).

Yield farming is a complex process that involves significant financial risks for both lenders and borrowers. In addition, it usually incurs high Ethereum gas fees for those who do their liquidity farming on Ethereum-based platforms and this may only be profitable if thousands of dollars are invested.

When market conditions are volatile, users also face the risks of losses and price slippage. Some platforms like CoinMarketCap offers a yield farming ranking page that includes an impermanent loss calculator to assist users in assessing their risks. The website also features a page that monitors the prices of the leading yield farming tokens.

One of the most notable issues with yield farming is its susceptibility to hacks and fraud, which may result from possible vulnerabilities in the protocols’ smart contracts. These coding bugs can arise due to fierce competition between protocols, which often leads to unaudited or copied contracts and features being introduced in a race to stay ahead.

Examples of vulnerabilities that have led to severe financial losses include the Yam protocol, which raised more than $400 million before a critical bug was exposed, and Harvest. Finance, which lost over $20 million in a liquidity hack in October 2020.

DeFi protocols are permissionless and rely on several applications to function seamlessly. If any of these underlying applications are exploited or fail to work as intended, the entire ecosystem of applications may be affected, leading to permanent investor fund losses.

It is also important to note that there has been an increase in risky protocols that offer APY returns in the thousands and issue so-called meme tokens with names based on animals and fruit. However, it is recommended that caution be exercised when dealing with such protocols, as their code is often unaudited and returns are subject to the risks of sudden liquidation due to price volatility.

Many of these liquidity pools are also fraudulent scams that result in “rug pulling,” where developers withdraw all liquidity from the pool and flee with funds. You can read our article on how to spot crypto scams and avoid them, to better equip yourself when deciding to go into yield farming.

Since blockchain technology is immutable, DeFi losses are usually permanent and cannot be undone. Therefore, it is advisable for users to fully understand the risks of yield farming and conduct their research before engaging in it.

See Also: 3 Ways to Spot and Avoid Crypto Scams in 2023

It’s important to note that yield farming comes with risks, such as impermanent loss (the loss of value that can occur when the price of deposited cryptocurrencies changes). It’s also important to understand the risks associated with the platform being used and to do proper research before investing in any platform.

In conclusion, yield farming is a great way for cryptocurrency users to make money off the market without being actively involved with the whole process of buying, selling, and trading, as the cryptocurrency owner just needs to lend their tokens to a liquidity pool and watch it grow all things being equal. But as I have mentioned, market conditions also affect the yields and return on investments (ROI).

Therefore, participating in yield farming does not still completely take away the risk and volatility that influences or affects the market, it is therefore advisable that as any reasonable investor would always do, make proper research before investing in any yield farm project and also ensure you invest wisely using liquidity you can let go of.