Supply and demand zones:

Trading in general, whether it is Forex trading, cryptocurrency trading, CFDs trading, and other forms of trading needs a proper and reliable profitable trading strategy to excel as a trader. Therefore, the importance of mastering a trading strategy and making it into a profitable one cannot be overlooked by any trader aspiring to become successful in their trading journeys.

Price action strategies are arguably one the most commonly used strategy among Forex traders today and this is because they have a more practical approach when it comes to interpreting market data and events on the chart. These strategies also help the trader to easily identify the sentiment of the market and locate or spot great opportunities in the market.

There are several notable price action strategies that traders use to improve their chances of profitable trading, such as trendlines and channel strategy, which we have already talked about in one of our articles here on the platform, another one is the breakout and breakdown strategy, which is also a great strategy, but in this article, we would be looking at one of the best and profitable trading strategy known as supply and demand zones strategy.

Introduction

The economic law of supply and demand has always been a governing law in the market and therefore governs all market prices. This is why the supply and demand zone strategy is a very great trading strategy as it helps the trader identify supply and demand zones on the chart which then interprets to buy and sell positions. The law of demand and supply states that when there is a higher level of demand than supply, the price increases, in this case, we say the price is bullish while when there is a higher level of supply than demand, the price falls leading to a bearish market.

The above explanations should already give you an idea of how the supply and demand zones trading strategy works. Now, let’s move over to understanding what supply and demand zones are.

What are Supply and Demand Zones?

From the above explanation, supply and demand is basically aggressive selling and buying. While supply and demand zones are zones where the price starts making big and massive prices on the chart. When we spot these supply and demand levels, what it tells us is that the big boys like banks and institutions are entering the market and pushing the market in the direction where the major price movement is going and this should be the right time to enter a buy or sell position, depending of the price movement at the time.

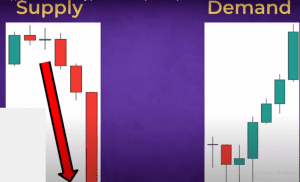

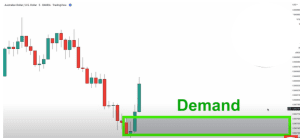

Looking at the chart above we can see at the supply side there is a serious bearish momentum, with the price falling aggressively, while on the demand side, we can see there is a great bullish momentum with the price level rising aggressively.

Putting it in simpler terms, for you to spot a supply zone, we would see it forms before a downtrend, while a demand zone forms before an uptrend. This is how you would be able to spot your demand and supply zones. Furthermore, these momentum candles shown in the diagram above tell us smart money is in the market, but if you see small candles like the one in the diagram below, it is not demand or supply at all, what it means is that we just have the retail traders trying to scrape some funds from the market, as there is no real liquidity in the market yet.

See Also: The Secret to Profitable Forex Trading: Trendlines and Channels

Why Should We Trade Supply And Demand Zones?

Why you should use the supply and demand zones trading strategy in your trading is because it helps you to trade when the big boys like the banks and institutions are trading with smart money, you are reacting with them as they react and you would be able to get enough liquidity from the market as a result. The best way to easily identify when the big boys like the banks and institutions are entering the market is by using the supply and demand zones trading strategy.

You might want to ask why should I want to always trade with the big boys rather than scrape the market, but you should remember that you are a retail trader, and retail traders in most cases always provide liquidity for the big boys. Why? you may ask again, we should not forget, that while you and all your trading colleagues are trying to trade with $1000 to $10,000 these big boys like banks, institutions, and hedge funds deal with hundreds of millions and billions of dollars in the market every day.

what a billion dollar looks like

Now if you are a professional trader you should already know that liquidity drives the market in whatever direction it wishes, so when these big boys come into the market with lots of cash liquidity, they more or less stare the market in a particular direction, if you are able to discover the supply and demand zones which can also be called order blocks where they enter into their trades, it is very likely you would make your profit from the market. This is why I mentioned earlier that it is one of the most profitable trading strategies around.

See Also: How to Trade Like a Pro Using SMC Trading Strategy

Let’s look at it from another angle, If you had insider information about one of the big boys’ buy or sell position, the key level they would move into a trade, would you enter the trade or not? You would be a dumbass if you don’t because that is free money, but we all know that insider trading is illegal so we can’t start sourcing for insider information, which is what makes the supply and demand zones strategy unique.

Now that we have talked about why you should trade the supply and demand zones let’s now talk about how to spot and draw these supply and demand zones.

How to Draw and Identify Supply and Demand Zones

- Look for and identify Momentum Candles.

- Identify consolidation zones/areas

- Identify where there are concentrations of wicks.

1. Momentum Candles:

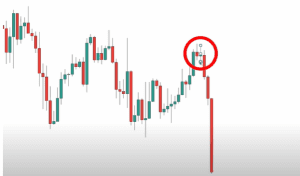

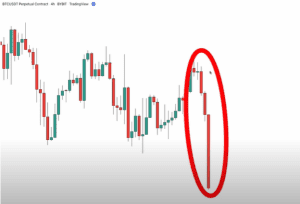

The first step is to look for at least 3 momentum candles in a row, this means it can be more like the circled one in the diagram above but never less than 3 big momentum candles. You can see that in the chart above. Also, remember, you don’t want to see tiny momentum candles like those represented in the diagram below as this does not indicate a supply or demand zone.

To illustrate this, I would use the three momentum candles in the chart below to better explain.

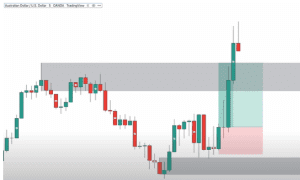

After identifying or spotting the momentum candles, the next step is to find the area where the move started, which is very important. So in the diagram below, we can see that the move started from the previous red candle. Our previous red candled is circled for you to see.

After identifying the previous candle before the momentum candle, the next step is to take your rectangle tool and draw your rectangle taking it from the highest point of the previous candle to the lowest point of the same candle and dragging it to the right across the chart as also illustrated in the diagram below.

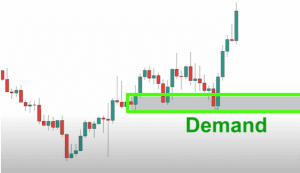

So now the area between these two lines which we have marked out with our rectangle tool can be called the demand zone in the chart below.

One thing of note which is also a very important skill you must have as a trader is waiting for confirmation. If you check the diagram where we identified when the move started, you would see that by the time we were drawing our rectangle tool to identify the demand area in the diagram below the demand zone has been tested one more time, in the area circled red in the diagram below, this retest can serve as a confirmation as the price was unable to break through the demand level.

The third time when the price retested the same demand zone, we could see what happened in the chart below. There was a massive bullish momentum and the great thing about it is you are able to enter the trade right on time.

This is another example right here to illustrate the supply zone and how to identify it since the first illustration was for the demand zone.

From the diagram above, we have three bearish momentum candles, we go through the same process again, by spotting the area the move started, getting the highest and lowest level of the candlestick, then drawing our rectangle across to determine the supply zone, as displayed in the diagrams below.

The next thing we do after identifying our supply zone and drawing our rectangle to establish the supply zone is to wait for the price to retest the supply zone level, and we can see that price managed to retest the supply zone level again from the diagram below.

Now you would see from the diagram below what price does after testing the supply level again. We can see from the diagram again that the bearish momentum was massive, and that price collapsed from the supply zone.

So this is one of the ways you can use to spot your supply and demand zones. Now, let’s move on to the second way you can spot your supply and demand zones.

2. Consolidation:

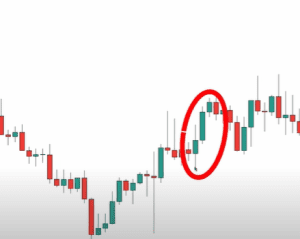

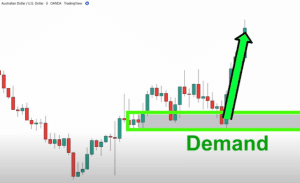

Another way to easily identify supply and demand zones is to look for consolidations. Consolidation simply means when the market is trying to correct itself and gather another momentum for the next major move. Most times the price just moves sideways within a certain range, as you can see from the diagram below.

In other for you to get a good sense of direction in this case, you would need to draw your rectangle across the consolidation zone, so that you can easily identify the zone as shown in the diagram below.

After drawing the rectangle to establish the consolidation zone, we can also see from the diagram below, that price, retested that zone again, before it continued its bearish momentum which is a great indication that the price consolidation method can also be used to spot supply and demand zones while trading, as I mentioned earlier, you just need to make sure there is a confirmation before you take your trade.

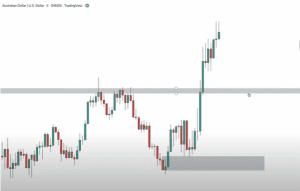

3. Identifying Where There is Concentration of Wicks

The third way to spot supply and demand zones is to identify an area with a lot of wicks. Wicks in a candlestick typically represent price rejection, which is mostly due to the opposing force of the price direction.

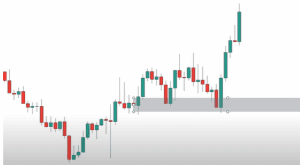

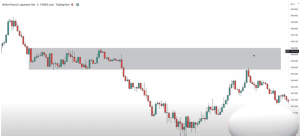

Therefore if you see lots of wicks showing up in a particular cluster of candlesticks, within an area, then you should know that this is a possible demand or supply zone, as the price is rejecting that level or is unable to break through that level mostly due to the massive order blocks or liquidity positioned there. In the diagram below we can see that there were a lot of wicks at a particular price zone.

After identifying the area with a large concentration of wicks, the next thing to do is to try and draw a rectangle across the wicks identified. This would in turn help you easily identify the supply and demand zones as shown in the diagram below.

From the diagram above we can see that price tested and retested the area where the wicks were concentrated, which we were able to spot as a demand zone, after which, it took off on a massive bullish momentum.

From the above illustrations and explanations, I believe we already know how to spot and draw supply and demand zones, now we move on to the next step which is how to trade them.

Trading Supply and Demand Zones

Trading supply and demand zones can be done in different ways depending on the trader’s expertise, experience, and preference, but I would be showing you how I take trades using the supply and demand zones strategy.

So after spotting the momentum candles which should be no less than three as mentioned earlier, and as shown in the diagram below again.

We would carry out the next step highlighted in the how-to spot and draw the supply and demands zone, which is to locate the area where the momentum move started then draw our rectangle to identify our demand zone, as shown in the diagram below.

After identifying the demand zone as shown in the chart above, the next thing you do is to wait for the price to retest the demand zone, so that you can determine if you would go ahead and take the trade. There are basically two ways you can do this, the first is by setting a BUY LIMIT order around the demand zone you have identified, this would enable an automatic buy as soon as the price gets to the demand zone.

The second way to trade is by manual entry, where you manually enter the trade after seeing what price does at the supply and demand zones you have been able to identify. I prefer the manual entry because this would enable me to check properly and confirm before I can eventually take the trade because no matter how strong a demand or supply level is, there is always a chance that the price can break through those levels.

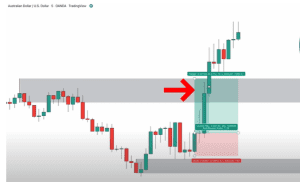

In the diagram below we can see that price got back to our identified demand level, but no matter what happens at this point, do not enter a trade.

I know you might be asking why, as I have also mentioned earlier, it is very important that you wait for confirmation, you have to wait for the price to give you an indication that it would bounce off the demand zone and go up.

Now you can see from the diagram above that after touching the demand zone, the candlesticks are beginning to show long wicks, making up a doji candlestick. What this represents is that there is indecision in the market. Due to this rejection candlesticks, we can’t still take a trade we need to wait for confirmation.

Looking at the diagram above, we would see that after the Doji, a big bullish engulfing candlestick showed up, what this means is the big boys are preparing to make their move in the market and it also validates the demand zone.

After seeing this confirmation, I would go into the trade, setting my STOP LOSS just below the wick of the doji candles which showed rejection. look at the diagram below for more visual understanding.

For my take profit level, I would place it at a key resistance area or a key supply area. To do that, I would look to the left of my chart, and from the diagram below, you would notice a three-momentum candle discovered which confirms to us that there is very likely a supply zone in that area.

Since we have just noticed another supply zone we use the same method, we locate the candlestick that started the momentum and then draw our rectangle to help us easily determine where to place our TAKE PROFIT point. The diagram below shows how this is done, and our take profit is set.

Supply and demand zones

Let us watch how the trade plays out. From the diagram below, we can see that the trade smashed through the supply zone and it hit out take profit point. This means it was a successful trade.

Now I want to draw our attention to something of note in the diagram below, we would notice that when the price got to the supply level which we discovered when trying to set our TAKE PROFIT zone, there was a little rejection on the momentum candle. What this shows us is that there were sellers or bears in that zone, trying to push the price down, but the buyers are way too strong and the bullish momentum continued and smashed the supply zone. So all you need to just do is to rinse and repeat this profitable trading strategy

So after taking our profit, we can see that price has broken through the supply zone we identified in the chart above. What we can just keep doing is keep extending the demand and supply rectangles or zones and keep looking for new demand and supply opportunities to milk more money from the market.

As a side note, you can use other indicators and strategies to complement the supply and demand zone trading strategy, as every trader has a unique way they communicate with the chart and the market.

Hello Readers!!! Dipprofit Community is now on Threads, the new Twitter-like app, and we would like for you to follow us there, so we can also interact better and provide you with some educational tips and nuggets. Thanks for the follow!

Conclusion

In conclusion, we should all understand that there is no trading strategy that is 100 percent foolproof, and becoming profitable as a forex trader goes beyond using a great trading strategy. You need to have great risk management skills and also need to have a trading plan. Getting a mentor can be seen as an added advantage or a bonus point as it would help you avoid the pitfalls must beginner traders fall into.

I hope you have gained value from our article, if you did, kindly leave a like and comment, also subscribe to our newsletter, by leaving your comment, so that each time we drop rich educational articles, you would be one of the first to know.

You can get the supply and demand zones trading strategy in pdf format, click the button below to download the Price Action pdf format.

«« Download PDF »»

Disclaimer

Dipprofit is giving this article as an educational article and does not promise any form of profitability when you use the trading strategy illustrated in this article. Therefore, you take sole responsibility for the profit and losses in your trade.

Thank you so much for this rich content.

Nice article on Supply and Demand Zones.

Thanks a lot for the feedback, I am glad you found it usefull.

Mr,edjala for real u have revamped my sense on supply and demand and i hope to be the next edjala. thumbs up wish u the best at ts best bro

I am glad you found it valuable. Thanks a lot for the feedback. I wish you a very successful trading experience also.

I don’t know how to say it but this article open my eyes know ican easily find levels of support and resistance and supply and demand thank you for your help

Glad you were able to get some value from this article, you can also take time to read more articles on trading.

Can I get a pdf of this please

Would you like for us to mail the pdf to your email address?